This morning was a big day for Americans looking to buy a home or check their 401(k) plans.

U.S. stock index futures rose, boosting retirement savings, after consumer price inflation eased more than expected in June. The data also raised the chances that the Federal Reserve will cut interest rates later this year.

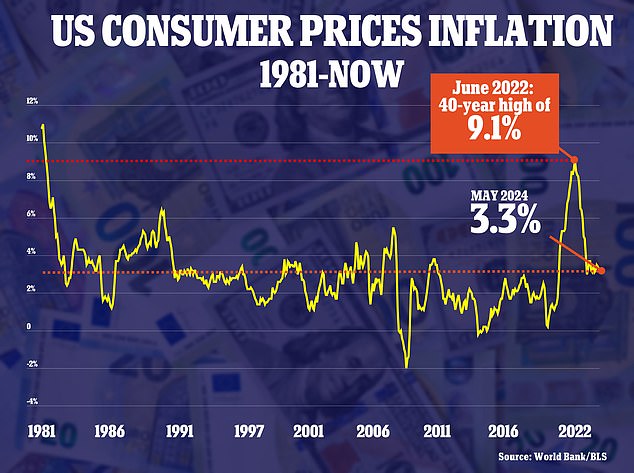

An update to the consumer price index (CPI) showed inflation was slowing. The annual CPI for June was 3 percent, lower than the rate in May.

Monthly inflation, in May-June, fell 0.1 percent, compared with expectations of economists polled by Reuters that it would rise by the same amount.

U.S. stock index futures rose, boosting retirement savings, following the news. The data also raised the chances that the Federal Reserve will cut interest rates later this year.

While prices continue to rise year after year, they are doing so at a much slower pace than expected, which is a boost for the economy. Most experts expected the CPI to rise at 3.1 percent.

The annual inflation rate was 3.3 percent in May, above the Fed’s 2 percent target.

Cooling inflation means more than just falling prices for Americans.

This gives Federal Reserve officials the green light to consider cutting interest rates, thereby reducing borrowing costs for consumers and businesses.

This means mortgage rates are falling, and credit card rates and the cost of car loans are being cut. That frees up money for Americans to spend, which is good for businesses.

Lower rates are also good for businesses in another way: they allow them to borrow more cheaply and grow their business.

All of the above means that Wall Street likes lower rates, and that means stock prices and 401(K)s go up.

Even before the figures came out, global stocks had hit new record highs on Thursday as traders expected the figures to show a decline in inflation and pave the way for the Fed to begin its long-awaited interest rate cutting cycle as early as September.

This came after another surge in Nvidia and other Wall Street heavyweights sent both the Nasdaq and S&P 500 to new highs on Wednesday.

“The main driver is really the prospect of interest rate cuts,” said Shane Oliver, chief economist and head of investment strategy at AMP in Sydney.

“If we get a good reading on inflation, it will tick one of Powell’s boxes.”

U.S. Federal Reserve Chairman Jerome Powell told lawmakers on Capitol Hill on Wednesday that “more positive data” would strengthen the case for the U.S. central bank to cut interest rates. Futures prices imply a roughly 75 percent chance of a cut in September.