Millions of homebuyers could soon receive a $10,000 tax credit under sweeping housing market reforms proposed by President Biden during his State of the Union address.

The move aims to improve housing affordability after mortgage rates effectively doubled over the past two years while property prices remain artificially high.

According to the White House, Biden’s plan, which would require congressional action before taking effect, will help 6.5 million Americans. The credit would be distributed over two years.

In addition to that, the president reaffirmed his commitment to other housing initiatives, such as reducing closing costs, offering down payment assistance and incentivizing the construction of new homes.

Here DailyMail.com breaks down what the advert said (and didn’t say)…

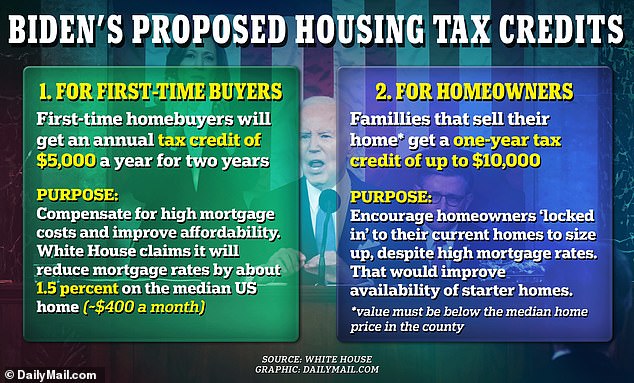

At the center of the housing initiatives were two tax credits. The first would help mitigate the current cost of a mortgage, the other would aim to increase the supply of housing.

Biden arrives on the House floor of the US Capitol for his third State of the Union address on Thursday, during which he announced initiatives to address the housing affordability crisis.

Support for first-time buyers

So-called “middle class” first-time homebuyers will be entitled to a tax credit of $5,000 a year spread over two years.

The White House says the payments, which amount to $416 a month, effectively reduce a buyer’s mortgage by 1.5 percentage points over two years for a median home.

The statement states that the aid will be offered to “middle-class, first-time homebuyers” but does not specify what requirements would need to be met or how “middle class” is defined.

Authorities estimate that 3 million buyers will benefit from the credit.

DailyMail.com asked the White House for clarification on what would constitute a middle-class buyer, but received no response.

Support for homeowners

Biden is also calling on Congress to provide a one-year tax credit of up to $10,000 to families who sell their so-called “starter home.”

This is defined as a property that is valued below the median home price for its area in the county.

The White House also did not provide further details on what is meant by “up to $10,000.”

For example, in Fulton County, Georgia, the median home price is $469,670, according to the National Association of Realtors. In Fresno County, California, the median price is $387,710.

The proposal will help 3 million families, according to the White House.

It aims to overcome the so-called “lockdown effect” that deters many Americans from moving home.

The average rate on a 30-year fixed-rate mortgage is now 6.88 percent, according to government-backed lender Freddie Mac. That’s nearly double what it was two years ago.

This means that a homeowner today faces paying around $1,000 more per month for a typical US property than if they had purchased in 2021.

A buyer of a $400,000 home who makes a 5 percent down payment will now pay about $2,800 in monthly mortgage payments.

In March 2021, when rates were around 3.05 per cent, buying a home at the same price and with the same deposit would have cost just $1,940 a month.

In a normal market, this would be enough to curb demand for housing and therefore crush prices. However, several experts have noted that a widespread property shortage in the United States has kept home values artificially high.

Biden also discussed reducing the cost of refinancing a mortgage by eliminating lender title insurance on some refinances.

Many Americans who bought their homes when mortgage rates were low are now reluctant to sell because a mortgage on a new home would be much more expensive. The second tax credit would encourage them to vacate their homes and improve them independently

Housing Policy Council Chairman Ed DeMarco said the proposed tax credits may have the effect of increasing demand without significantly improving supply.

“Simply put, demand continues to outpace supply and subsidizing increased demand inflates housing prices,” he said.

“The proposed supply-side tax credits appropriately target that goal, but do not address the regulatory environment that constrains builders.”

Redfin data shows that the typical U.S. homeowner now spends twice as much time in their properties as they did in 2005.

Today, a homeowner can expect to spend 11.9 years on the same property, compared to 6.5 years two decades ago.

What else did Biden announce? Were other housing initiatives reintroduced?

In addition to the two tax credits, Biden detailed a number of other initiatives that would help with housing supply and reduce costs for new home buyers.

Notably, the White House said the President would ask Congress to provide up to $25,000 in down payment assistance to first-generation homebuyers.

This proposal was contained in the Down Payment toward Equity Act of 2021 and is currently in Congress awaiting approval.

Another issue that Biden has returned to this week has to do with reducing the cost of refinancing a mortgage.

According to the White House, waiving the lender’s title insurance requirement on some refinances could save homeowners an average of $750 and up to $1,500.

Government-backed mortgage lender Fannie Mae confirmed in January that it will now allow buyers to replace expensive title insurance with a lower-cost alternative.

Insurance is a one-time fee that protects lenders and buyers from losses incurred if there is an error in the title to a property.

In the future, they may use an ‘Attorney Opinion Letter’ (AOL) which allows a real estate attorney to confirm that there are no issues with the property title. An AOL is on average $1,000 cheaper than title insurance, according to Fannie Mae.

This week, the president also called on Congress to pass legislation that he said could result in the construction and renovation of more than 2 million homes. In theory, that would reduce the gap between supply and demand and ultimately reduce housing costs.