Americans can now earn rewards points when they buy a home, under a new program launched Thursday.

Bilt made a splash on the rewards front in 2021 with its program that allows Americans to earn points for paying their rent on time with no annual fees.

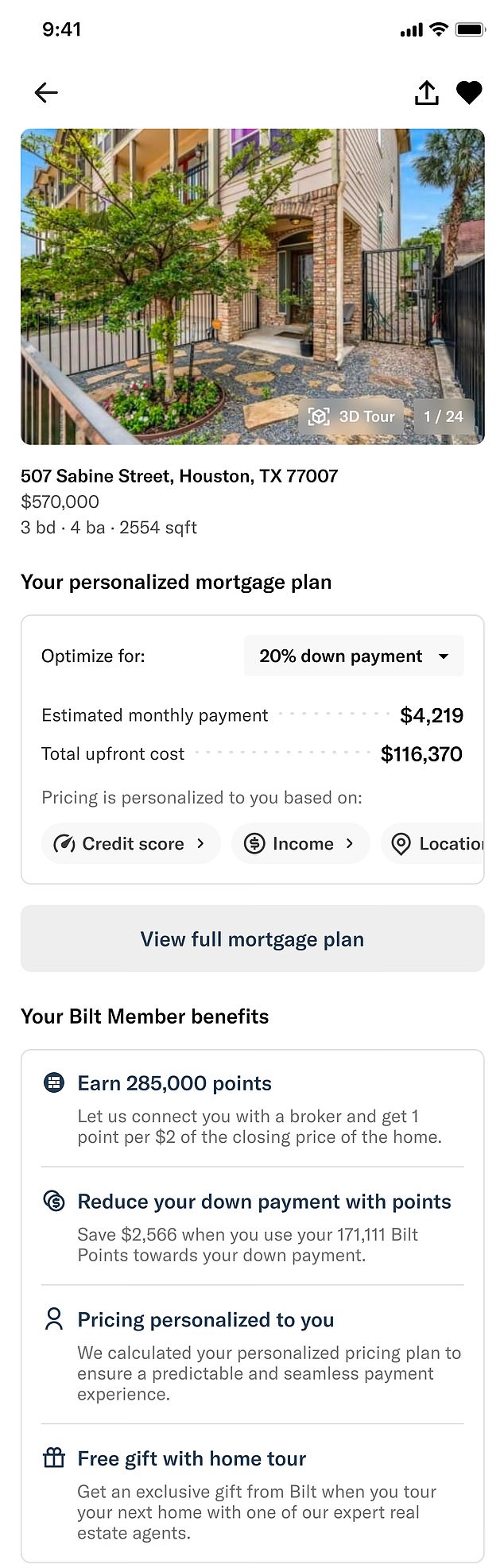

Now it has expanded its reach with a unique program that rewards home buyers one point for every $2 of a home’s purchase price.

For example, a $400,000 real estate purchase can earn up to 200,000 Bilt Points, which can be spent on travel, dining or fitness classes – just like a traditional credit card rewards program.

“Americans receive rewards for everyday purchases, but have never been properly rewarded for the largest purchase they will make in their lives,” said Ankur Jain, founder and CEO of Bilt Rewards.

“This is part of our broader mission to make the path to homeownership more accessible and rewarding for our members.”

It’s coming the The housing market has become increasingly unaffordable for millions of Americans in recent years.

Mortgage rates have soared, leaving many homeowners locked in by cheaper existing loans. This, in turn, has driven up house prices, reflecting a historic shortage of homes for sale.

Property taxes and insurance costs have also risen in much of the US amid worsening climate disasters.

Americans can now earn rewards points when they buy a home, under a new program launched by Bilt on Thursday

“Americans receive rewards for everyday purchases, but have never been properly rewarded for the largest purchase they will make in their lives,” said Ankur Jain, founder and CEO of Bilt Rewards

Anyone can be a Bilt member and registration is free onlinethe company said.

But to earn points by purchasing a home, members must work with an eXp Realty agent.

eXp Realty is the largest independent real estate company in the world with more than 85,000 agents worldwide.

The real estate company will charge the usual brokerage fees and pay Bilt a discount.

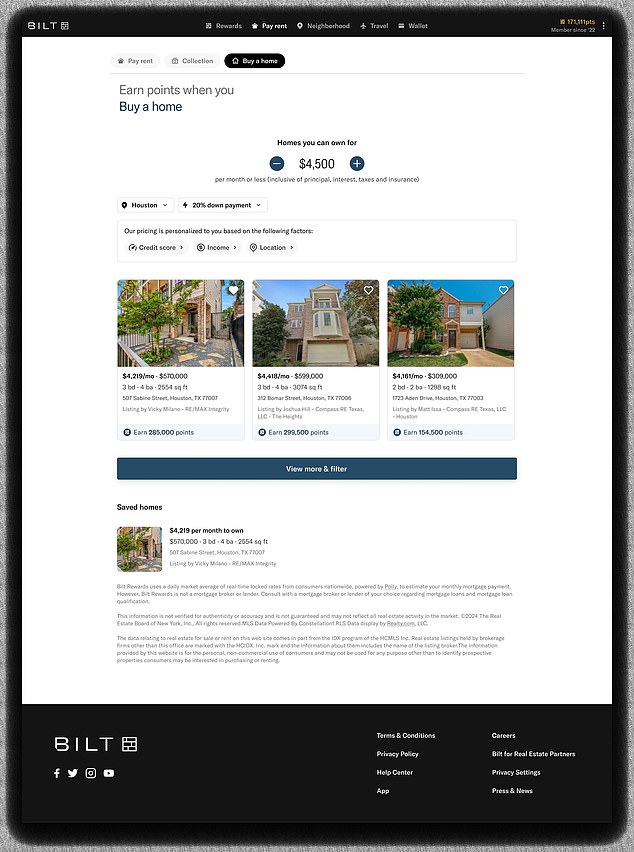

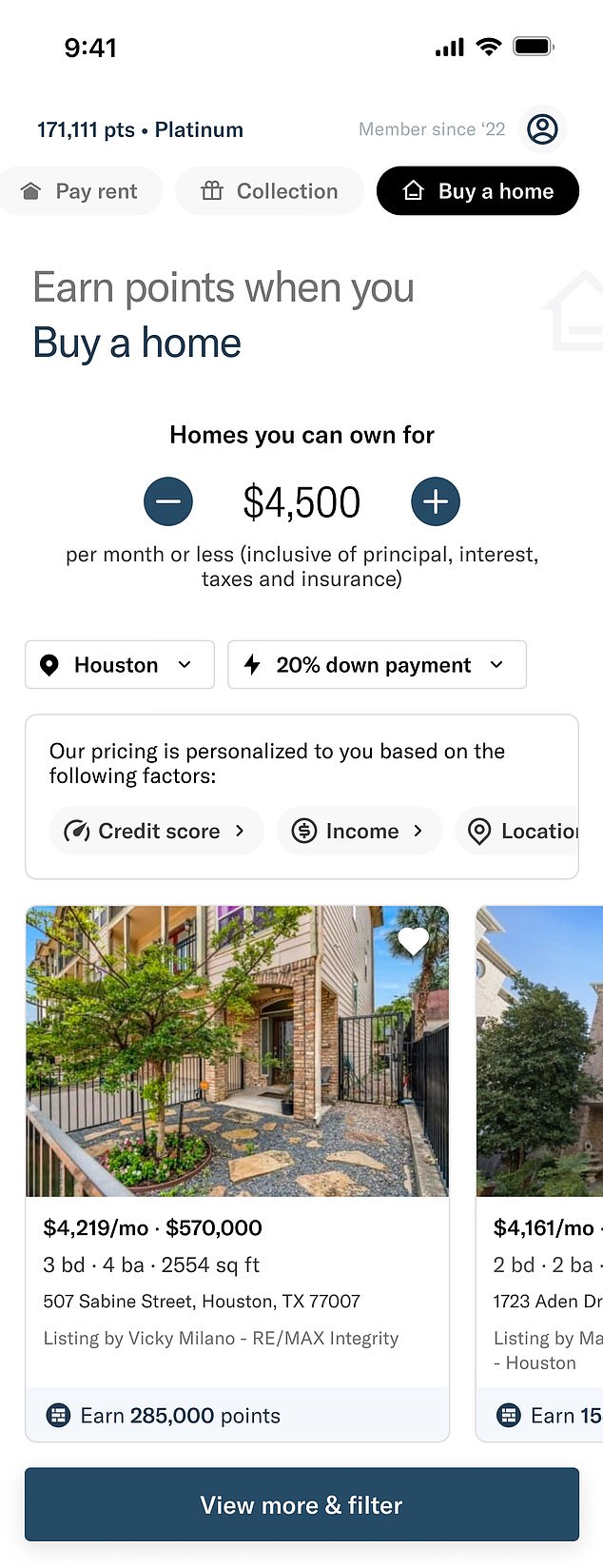

As part of the expansion, Bilt has launched a “buy a house” tool that allows renters to see what kind of home they can afford based on the amount they currently pay per month.

Unlike traditional calculators that require users to enter complex mortgage calculations, the tool shows available homes on an all-in monthly payment basis, including local taxes and insurance costs, the company said.

The tool also shows available properties in different cities.

“There are city-by-city housing shortages across the country,” Jain told DailyMail.com.

“What we’re trying to do is help people make a decision when they’re ready to buy a home and settle about where their dollar goes furthest.”

He added that there are cities where a buyer may think homes are more affordable, but due to high taxes, their purchasing power may actually be lower.

Prospective homeowners can also indicate whether they are buying for the first time, or whether they can make a larger down payment on a home.

“So you can buy the house, find the houses you can afford and qualify for a better rate,” Jain said.

‘You can basically travel around the world for free in the coming years with the points you earn by buying a house.’

Bilt offers members the opportunity to transfer points to its partners, including airlines such as United, or hotel chains such as Hilton or Hyatt.

For Jain, it’s about making the process of buying a home more accessible to Americans, and rewarding them for getting on the property ladder.

“Whether you’re paying rent or finally ready to buy a home, we want to make it possible and make it rewarding,” he said.

“Your biggest purchase is now your most rewarding purchase.”

Jain predicts that interest rates are likely to fall next year under the new presidential administration, presenting an opportunity for first-time buyers.

The company then wants to work on a model that will allow homeowners to earn points on their mortgage.

According to the latest Freddie Mac data as of Nov. 14, the average 30-year mortgage rate is 6.78 percent.

As part of the expansion, Bilt has also launched a “buy a house” tool that allows renters to see what kind of home they can afford based on the amount they currently pay per month.

“What we’re trying to do is help people make a decision when they’re ready to buy a home and wonder if their dollar will go the furthest,” said Ankur Jain, CEO and founder of Bilt.

If Americans don’t live in a Bilt partner home, they can earn points on rent with a co-branded Mastercard credit card

Since its public launch in 2022, Bilt has enjoyed a stratospheric rise – and is now valued at $3.25 billion, according to the New York Post.

The 34-year-old Jain is now estimated to be worth $1.2 billion.

The company now has signed up property owners with 4 million rental properties in thousands of cities across the country, as well as its airline, hotel, gym and restaurant partners.

“Today, 70 percent of the top 100 rental companies all use Bilt to collect all rental payments,” he told DailyMail.com.

By tracking rent payments each month, Bilt also aims to grow its members’ credit history so they can eventually qualify for a mortgage.

According to Zillow, the average monthly rent payment in the US is just over $2,000.

If Americans don’t live in a Bilt partner home, they can earn points on rent with a co-branded Mastercard credit card.

The credit card has no annual fees, but also no sign-up bonus.

According to NerdWallet, users must also commit to using the card five times a month – on top of the rental payment – to get significant value from it.

If tenants do not live in a Bilt-affiliated home and do not have the credit card, they can still pay rent through the Bilt app, but they will only earn 250 points and will still be required to pay the processing fee.