The former head of the Reserve Bank of Australia has called for a rise in the GST and cuts to income tax in a speech that will reignite a war between Baby Boomers and younger generations.

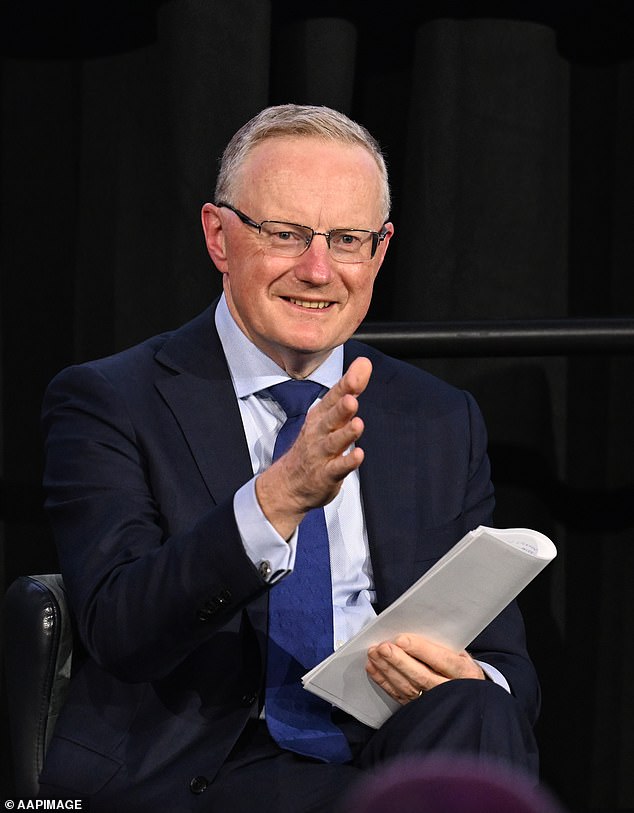

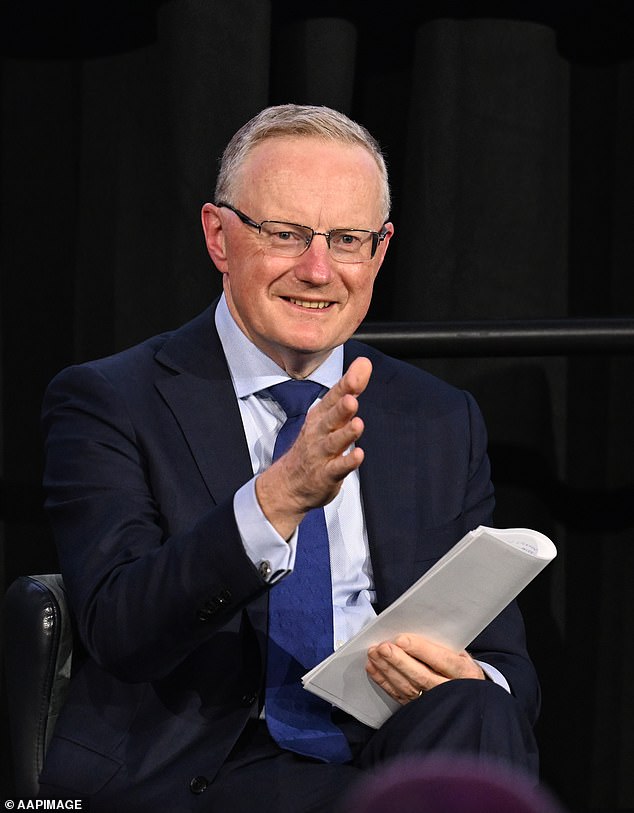

Philip Lowe, whose seven-year term as governor ended in September, is now free to speak about financial policy after years of silence as a government official.

And on Thursday he outlined his tax reform plan in a keynote speech to Future Generation Australia, before becoming its president next month.

“Australia, compared to other countries, taxes wealth generation too much,” he said.

‘In other words, the GST is too low and the income and wealth tax is too high.

“Politicians can’t say that, but that’s the advice.”

An increase in consumption taxes, such as the GST, is likely to affect younger, low-income workers more than older workers with more disposable income, who are also more likely to benefit from income tax cuts. rent at higher rates.

The former head of the Reserve Bank of Australia has called for a rise in the GST and wants capital gains to be applied to the family home, reigniting a war between Baby Boomers and younger generations (pictured, swimmers in Bondi Sydney Beach).

Tax on capital gains on family homes

But in addition to changes to the GST and income tax, Dr Lowe, a 62-year-old Baby Boomer, suggested that capital gains tax should be expanded to cover family housing.

This would especially disadvantage sellers of older homes when selling their main place of residence, because the existing capital gains tax only applies to investment properties and holiday homes.

“Another thing these reports highlight is how favorable the treatment of housing is in the Australian tax system,” Dr Lowe said.

‘The treatment of a family home in the asset tests, in the pensions test, the lack of capital gains tax, negative gearing arrangements.

“There are a lot of things that people have brought to attention that could help.”

Those who bought their family home since the mid-1980s, when prices were much cheaper compared to income, would suddenly be forced to declare a taxable income that would put them in the league of millionaires.

Any profit from selling a home means that someone who bought decades ago would be in the top 45 per cent marginal tax bracket for that financial year, if they earned more than $190,000 on their income and the sale of the property.

With the median house price in Sydney now at $1.4 million, those who bought a home in 1986 when the median price was $98,325 would now face a heavy tax burden if the idea of capital gains tax Dr. Lowe will be applied retrospectively.

Someone selling the family home would pay capital gains tax, but at a 50 percent discount, like a homeowner selling an investment property or a millionaire selling a vacation home.

This means that only half of the capital gain obtained from the sale of the family home would have to be declared in the tax return for that financial year.

This would still leave Baby Boomers with less money to spend in retirement, but their Generation X, Millennial, and Z children would also suffer because this would reduce their inheritance when their parents died.

Dr Lowe has also questioned whether the family home is exempt from the pension assets test, which would particularly affect homeowners aged 67 or over who qualify for the $1,020.60 fortnightly pension for singles.

His call to review negative gearing for property investors suffering rental income losses had also put him at odds with both main parties, which have promised to leave the tax break intact.

Neither side of politics is calling for a capital gains tax on family homes, with the Greens only calling for an end to the 50 per cent capital gains tax discount and negative gearing.

Philip Lowe, whose seven-year term as governor ended in September without being renewed, is now free to advocate for fiscal policy ideas that he could not do as a government official.

Increase GST

Dr Lowe also wants the GST to rise from its current level of 10 per cent, which could allow the revenue to be used to fund further income tax cuts.

Dr. Lowe, who received a total remuneration package of $1.038 billion when he led the RBA, is calling for an increase in a regressive tax that is most likely to hurt the poor and younger people who missed out on a generous income tax cut because they earned less.

Australia’s GST rate has remained unchanged at 10 per cent since its debut in July 2000.

But its introduction 24 years ago caused annual inflation to double from 3.1 percent in the June quarter of 2000, before the consumption tax came into force, to 6.1 percent in the September quarter of 2000, during the Sydney Olympic Games.

It was another year before inflation fell back within the Reserve Bank’s 2 to 3 per cent target.

Dr Lowe, a 62-year-old Baby Boomer, has suggested the capital gains tax, introduced in 1985, should be extended to cover the family home (pictured, a couple in Cronulla, southern Sydney) .

Dr Lowe’s call for a GST increase came after inflation moderated to 4.1 per cent in the December quarter last year, below a 32-year high of 7.8 per cent at the end of 2022.

He suggests the GST be increased, even though the RBA he once led does not expect inflation to fall back within its 2 to 3 percent target until December 2025.

The former Reserve Bank governor’s call to increase the GST comes nine years after then-South Australian Labor premier Jay Weatherill and his New South Wales Liberal counterpart Mike Baird called for an increase of GST.

Former Liberal Prime Minister Tony Abbott backed his call in July 2015, but two months later Malcolm Turnbull appointed him leader.

However, New Zealand raised the GST to 15 percent in 2010, up from 12.5 percent, and former National Party prime minister John Key was re-elected the following year.