With soaring home prices and rising mortgage rates, Americans who are eager to call a property their own have been locked out of the ability to purchase a home.

But a little-known tactic can help keep costs down and make ownership more affordable.

By shopping for an ‘assumable mortgage,’ buyers can find a home with a low fixed rate and transfer the mortgage into their name, sometimes saving them thousands of dollars a month.

An estimated 23 percent of active mortgages are assumable, according to data firm Intercontinental Exchange, but not all buyers are qualified to purchase one.

Property search companies are starting to label homes as assumable mortgages and many of them have rates as low as two percent, less than half the current average of 7.09 percent for 30-year fixed loans.

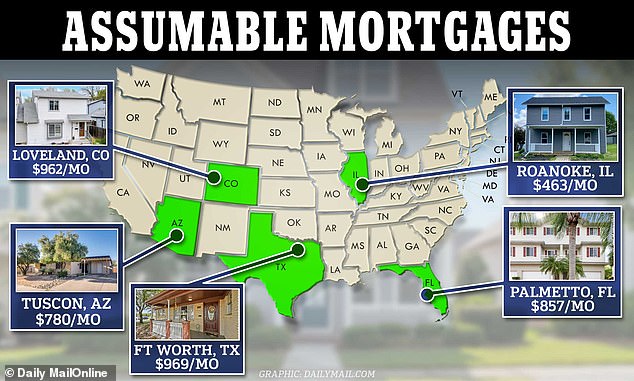

Roam now offers listings in 18 cities in seven states. All listings have affordable mortgage rates below six percent.

By searching for an ‘assumable mortgage,’ buyers can find a home with an existing low rate set

A new company, Roam, works with local real estate agents to identify and list homes with mortgage type.

They have thousands of homes in US cities on their website for a variety of budgets.

Many of the properties have rates as low as two or three percent, meaning buyers could save thousands of dollars in monthly payments.

Software developer Ellen Harper found her new home in Georgia through the site.

He bought a four-bedroom brick Colonial in Fairburn with a mortgage rate of 2.49 percent, equivalent to a monthly payment of $1,400.

She told the New York Times: ‘I didn’t want to have a bad mortgage and be in a chain situation where all I could do is pay the mortgage.

“There were other houses, they were nice and all, but I went for the lowest rate I could find.”

Not everyone is eligible or able to take on a mortgage, as it often requires a large down payment to close the gap between the price of the property when the rate was set and the current value of the home.

It also requires the cooperation of the seller and the lender, who must complete the transfer quickly.

The average rate of a 30-year fixed-rate mortgage has not stopped rising since 2021

Rising rates have cooled demand, with mortgage applications for home purchases falling.

Despite the obstacles, the tactic is gaining popularity and sites like Roam are emerging to make the process easier.

The word is getting out: the number of people taking out mortgages increased 139 percent between 2022 and 2023.

Roam now offers listings in 18 cities in seven states. All listings have affordable mortgage rates below six percent.

Listings indicate price, mortgage rate and down payment amount required.

Raunaq Singh, CEO of Roam, told the New York Times that its site means people “can buy any house and not worry.”

Mortgage lending has surged due to the Federal Reserve’s relentless tightening cycle, which has driven interest rates to their highest level in 23 years.

In real terms, buyers now have to shell out an extra $900 a month for the average home than if they had closed a deal three years ago.

Mortgage lending has surged due to the Federal Reserve’s relentless tightening cycle, which has driven interest rates to their highest level in 23 years.

Higher mortgage rates have effectively frozen the U.S. housing market, as most homeowners struck 30-year deals when interest rates were at record lows.

In April, Freddie Mac chief economist Sam Khater said: ‘The 30-year fixed-rate mortgage surpassed 7 percent for the first time this year.

‘As rates trend higher, potential home buyers are deciding whether to buy before rates rise further or wait in the hope that they will drop later in the year.

The U.S. housing market has benefited from record-low interest rates in recent years, which has helped boost buyer activity.

In the week to April 15, 2021, the average 30-year fixed rate deal was around 3.04 percent.

It means that a buyer who purchases a $400,000 home with a 5 percent down payment faces paying $1,610 a month on their mortgage.

But at the current rate, the same buyer would pay $2,553 a month.