Restaurants from McDaonald’s to the Cheesecake Factory are under pressure to cut prices as the cost of food falls at a faster rate than that of eating out, data shows.

A slew of fast-food restaurant CEOs have admitted that customers are tired of relentless menu price increases on earnings calls this month.

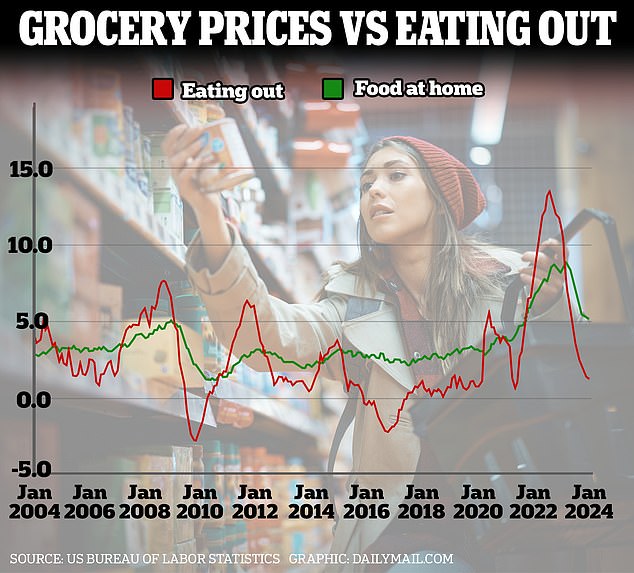

And a new analysis of figures from the U.S. Bureau of Labor Statistics reveals that the country’s annual food inflation rate fell to 1.2 percent in January. In comparison, eating out increased 5.1 percent.

Experts said restaurants are likely focused on lowering prices, or at least avoiding further increases.

Companies such as McDonald’s and Chipotle have acknowledged that price increases helped boost their profits last year.

And a new analysis of figures from the U.S. Bureau of Labor Statistics reveals that the country’s annual food inflation rate fell to 1.2 percent in January. In comparison, eating out increased 5.1 percent.

During an earnings conference call earlier this month, McDonald’s CEO Chris Kempczinski admitted that consumers making less than $45,000 a year were spending less at restaurants.

‘The problem is that places like McDonald’s were once cheap delights but are now becoming expensive luxuries. And customers are tired of continued price increases,” Neil Saunders, managing director of consultancy GlobalData Retail, told DailyMail.com.

‘In comparison, we’ve seen grocery stores like Walmart and Kroger try harder to keep prices low.

“Restaurants will have to curb price increases, otherwise people will choose to eat there more and more.”

During an earnings call earlier this month, McDonald’s boss Chris Kempczinski admitted that consumers making less than $45,000 a year were spending less at restaurants.

“Eating at home has become more affordable,” he said.

‘The battlefield is, without a doubt, the low-income consumer. “I think what we’ll see as we get into 2024 is probably more attention to what I would describe as affordability.”

McDonald’s raised menu prices by about 10 percent in the U.S. in 2023 and implemented similar increases the year before.

The chain came under fire last year after one of its restaurants in Connecticut was caught for selling a Big Mac meal for $17.59.

The problem is not unique to McDonald’s. This week, Yum Brands, parent of KFC, Pizza Hut and Taco Bell, reported similarly disappointing results.

Pizza Hut sales fell 4 percent and KFC sales were flat.

Cheesecake Factory reports its latest results for the final quarter of last year this afternoon, where bosses will reveal sales and are also expected to outline the effect of price increases.

For its pre-Wall Street update, for the three months through Oct. 3, the company said prices were 9.5 percent higher but the number of customers fell 1 percent.

Laura Murphy, CEO of public relations firm Bolt, which specializes in food and beverage marketing, told NBC News that people just want cheap food.

“People are really saying to fast food industry leaders, ‘This is what we’re looking for, this is what we want. We want efficiency. “We want affordability,” she said.

“Let’s get back to really making sure that we’re providing simple foods in a way that’s affordable, efficient, quick and really gives people the basics of what they’re looking for.”

“Let’s get back to really making sure that we’re providing simple foods in a way that’s affordable, efficient, quick and really gives people the basics of what they’re looking for.”

Companies that supply supermarkets like Target, Walmart, Costco and Kroger are now helping them lower prices.

For example, Ramon Laguart, CEO of Pepsi, which makes Lay’s soda and potato chips, commented on its recent earnings call that the company would not raise prices beyond “normal price levels.”

Walmart boss Doug McMillon said food prices in the store were only “slightly” higher than last year.

By comparison, Walmart boss Doug McMillon said food prices in the store were only “slightly” higher than last year.

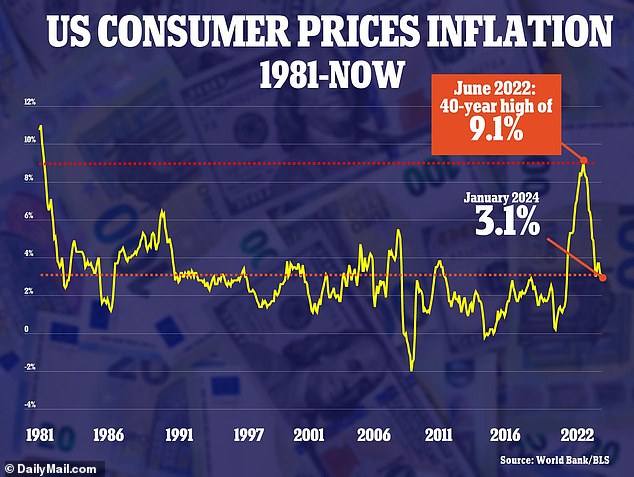

Annual inflation was 3.1 percent in January, which was down from 3.4 percent in December but still 0.2 percent higher than expected.

Your browser does not support iframes.

“Prices are lower than a year ago for prices like eggs, apples and deli snacks, but higher elsewhere, like asparagus and blackberries.”

It comes after a separate study by HelpAdvisor looked at how the cost of grocery shopping varies from state to state.

The data showed that the average household now spends $1,080 on their monthly purchases.

California households spent the most money, spending $297.72 per week on average, or $1,190 per month.

They were followed by Nevada, Mississippi and Washington, where weekly spending amounts to $294.76, $290.64 and $287.67 respectively.