The 401(K) retirement plan is designed to help workers build savings by saving money from their paycheck each month.

In addition to this, they can receive extra money from their employer through a counterparty.

But new research suggests that these employer contributions primarily benefit higher earners.

Employers contributed $212 billion to retirement plans (about 58 cents for every dollar participants saved), according to the latest 2021 data.

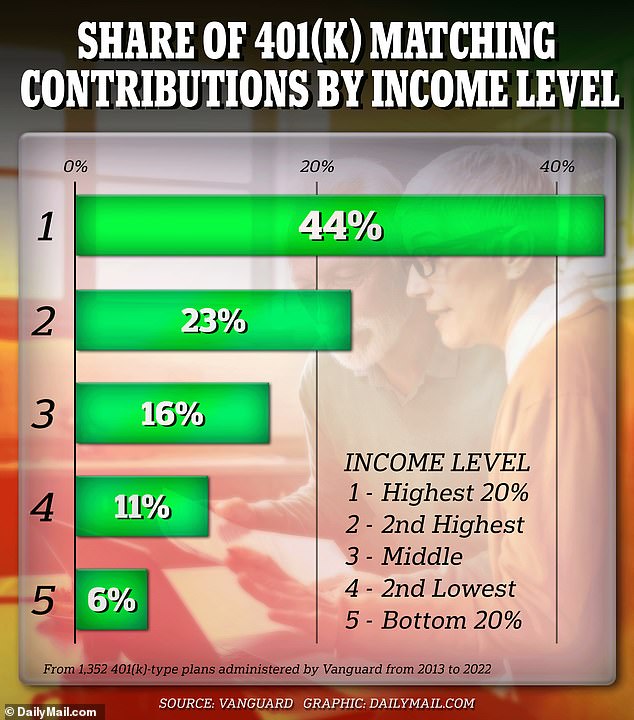

But about 44 percent of these funds went to the top 20 percent of earners, according to analysis of the Vanguardia Group.

Meanwhile, those earning the least received only 6 percent of the “free money” from company contributions, he found.

Vanguard Group Research Suggests Employer 401(K) Contributions Mostly Benefit Higher Earners

It is not surprising that a greater proportion of employers’ matching dollars go to those who are paid more, according to the study, given that matching contributions are generally awarded as a proportion of salary.

But it suggests that higher earners receive a larger share of contributions than their share of income.

The matching formulas that companies use vary.

Some companies contribute a fixed amount each year, for example, 3 percent of salary, regardless of whether the worker contributes or not.

A small number of companies contribute up to a dollar limit; For example, they offer a 10 percent match on 6 percent of salary, subject to a limit of $6,000.

But the most common matching formula, according to Vanguard, is a percentage match.

Typically, this will be half of a worker’s contributions up to 6 percent of their salary.

When the employer contribution is based on a percentage of salary, those with higher incomes typically receive more.

But higher earners also receive a larger share of 401(K) matching dollars than their share of income, the study showed.

On average, those in the top 20 percent income group received 39 percent of income but 44 percent of 401(K) contributions from their employers.

Meanwhile, those in the bottom 20 percent of earners receive 29 percent fewer equivalent dollars than income, Vanguard found through analysis of more than 1,000 plans between 2013 and 2022.

Dollar equalization often exacerbates pay inequality, said Fiona Greig, global head of investor research and policy at Vanguard Group.

Dollar equalization often exacerbates pay inequality, said Fiona Greig, global head of investor research and policy at Vanguard Group. The Wall Street Journal.

One of the reasons higher earners receive a larger amount of employer contributions is because they are more likely to participate in 401(K) plans and earn enough to receive a full matching contribution.

Of the 10 most popular matching formulas, all but one disproportionately rewarded the top 20 percent of earners with a higher proportion of matching dollars than income.

The study suggests that those who earn more receive a higher proportion of contributions than their income proportion

Vanguard found that the best formula to more equitably distribute employer contributions is when funds are capped at a dollar amount.

Using a dollar cap formula, the top 20 percent of earners received about 33 percent of matching contributions, compared to 35 percent of income.

Costco, for example, matches 50 percent of workers’ annual 401(K) savings up to a limit of $500.

The most workers can save in a 401(K) for 2024 is $23,000 – according to guidelines set by the IRS – and $69,000 for combined employee and employer contributions.

Those 50 and older can also add an additional $7,500 in catch-up contributions.

Vanguard research lays bare the central division of retirement in America.

Research from Fidelity Investments earlier this month revealed that a strong stock market means there are now more 401(K) millionaires than ever.

The number of seven-figure 401(K) accounts rose to 485,000 in the first quarter of this year, up 15 percent from the previous quarter.

A year ago there were 340,000, according to the investment firm.

Meanwhile, separate research earlier this year found that a record number of Americans withdrew money from their 401(K) plan in 2023 for a financial emergency, as high inflation continues to eat into the savings of many.