Table of Contents

A heat wave may be on the way, ending a period of discouraging weather. But while Britain is enjoying the sunshine, many of us will still be booking holidays abroad. It’s a preference that investors conducting a mid-summer portfolio review should keep in mind.

The insatiable desire for a break abroad appears to be the most lasting change in consumer behavior after the pandemic, according to airline bosses. Previously, this type of “revenge” spending was considered by some to be a temporary phenomenon.

Luis Gallego, CEO of IAG, owner of British Airways, says that “the high demand for travel is a constant trend”, while the boss of Wizz Air, József Váradi, also believes that spending a fortnight on the beach or in the Pool is a priority.

As a result, the International Air Transport Association (IATA) expects a record number of passengers this year. The recovery is being driven by short-haul flights, packed with tourists.

Corporate travelers are also returning, and tech bosses prefer to meet in person rather than Zoom. Until other executives decide to fly, wealthy people, willing to pay more for comfort, occupy business class seats.

Taking off?: No guarantee of excellent performance, but bargains are on offer

Tom Gilbey of Quilter Cheviot highlights the benefits that come from the new feeling of rationality in the sector.

Post-pandemic consolidation has made the industry more efficient. Meanwhile, problems at plane maker Boeing have limited growth in fleet capacity, putting the brakes on potentially overly ambitious expansion plans. He comments: “This combination of a disciplined supply and a strong demand environment suggests a positive outlook for the future of the airline sector.”

Investors excited about the opportunities on offer must be prepared for global crises wreaking havoc on the airline industry, as illustrated by Covid.

Furthermore, even before the general election announcement, Johan Lundgren of easyJet and Michael O’Leary of Ryanair felt that some customers were becoming more resistant to high ticket prices. Suspicions surrounding the Labor government’s true plans to raise taxes may make more households wary of wasting money.

Meanwhile, in the longer term, there is the possibility of new laws being adopted to limit the environmental impact of flights. IATA forecasts that airlines around the world will use 99 billion gallons of fuel this year, a 3 percent increase over 2019 consumption.

As a result of these factors, there is no guarantee of excellent performance, but bargains are on offer.

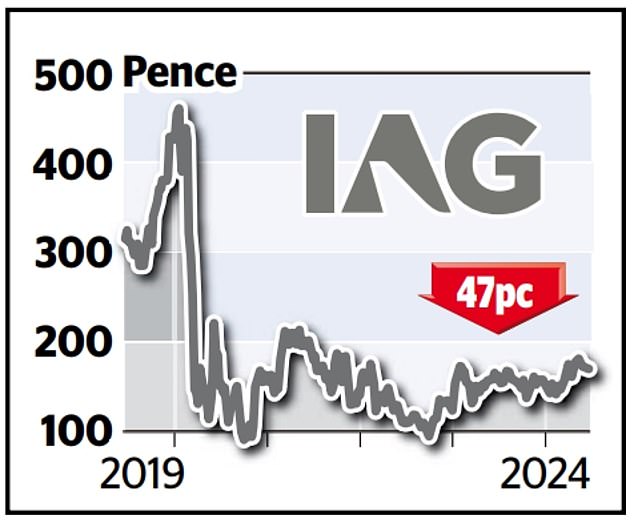

IAG

International Consolidated Airlines has an empire that encompasses not only British Airways, but also Aer Lingus, Iberia and Vueling.

The company’s mountain of debt has been reduced and Gallego is confident that the change will not be reversed.

However, the shares are trading at 164 pence (47 per cent below their level five years ago) and are trading at just four times earnings.

Analysts at BNP Paribas Exane and JP Morgan are among those who believe the stock is undervalued.

This week, for example, RBC’s Ruairi Cullinane reiterated his view that IAG was a “buy” with a price target of 230p. The average price target is 270 pence.

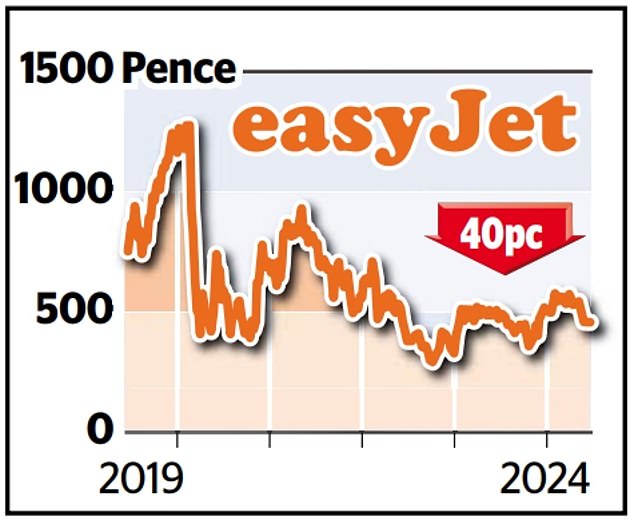

EasyJet

Most analysts consider the low-cost airline a buy despite fears that “revenge” spending on getaways may be declining.

At 449p, the shares are 40 per cent lower than five years ago, but there is hope of a revival as analysts’ average price target is 706p.

Lundgren will step down from his top job next year, having built a profitable vacation packages division and cut borrowing.

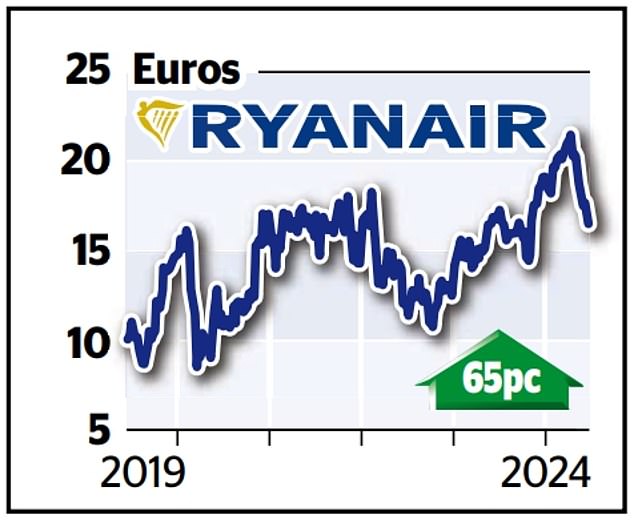

Ryanair

Ryanair, run by the always choleric O’Leary, is now Europe’s largest airline.

But it has been hit hard by Boeing’s problems, which have delayed the arrival of new planes to the fleet.

Shares in the Dublin-listed company have fallen 11 percent since the beginning of the year to €17.

But most analysts still rate Ryanair a “buy”, with an average price target of €24.96.

O’Leary pockets a bonus of €100 million if the share price remains above €21 for 28 days.

In this sector, there is little shame about skyrocketing wages.

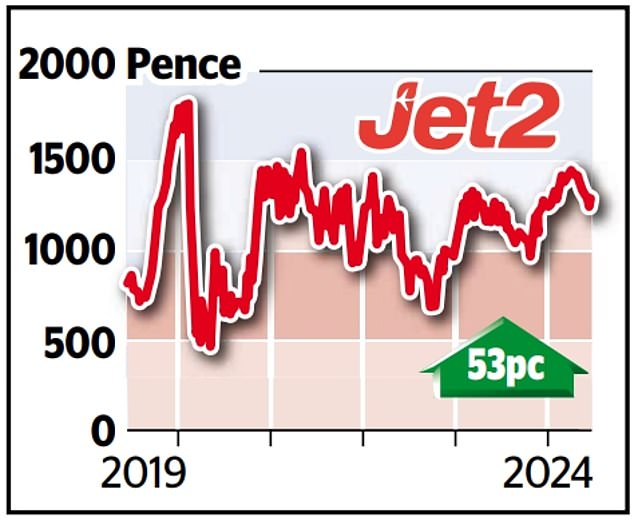

Jet2

This Aim-listed company is not just an airline, it is also Britain’s largest tour operator, an activity that offers higher margins.

The shares have risen 4 per cent this year to 1,298p, having soared 442p over the past decade.

Most analysts rate Jet2 as a “buy”, with an average price target of 1,892p. The pricing power of airlines is about to be put to the test.

But Jet2’s good performance during the pandemic (deposits were refunded on time) could give the company an advantage over its rivals.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.