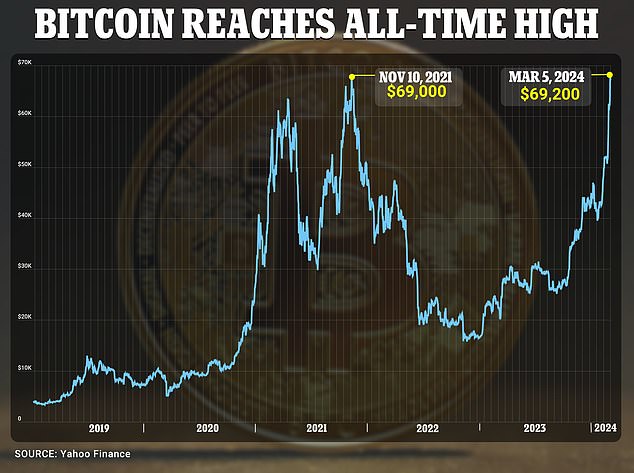

- Bitcoin Hits High of $69,200 in Rally Fueled by BTC ETF Approval

- It comes ahead of the so-called halving in April, which will reduce the supply of new coins by half.

<!–

<!–

<!–

<!–

<!–

<!–

Bitcoin hit a record high on Tuesday, boosted by investors pouring money into newly approved exchange-traded funds (ETFs) that track its value.

The flagship cryptocurrency was trading at $69,200, surpassing the all-time high of $69,000 from November 2021.

The bull run comes after the US securities regulator approved 11 Bitcoin ETFs, which can be bought and sold like stocks.

Its availability in the market dramatically expanded the opportunity for institutional and individual investors to gain exposure to Bitcoin.

Last week, Bitcoin ETFs recorded a net inflow of around $1.7 billion, meaning incoming money has surpassed $7.4 billion since their introduction in January, according to Fineqia.

Bitcoin hit a high of $69,200, surpassing the all-time peak of $69,000 from November 2021

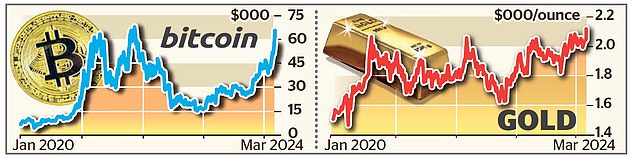

The price of both gold and Bitcoin has risen in recent months as speculation grows that the Federal Reserve will soon cut interest rates.

“Flows are not drying up as investors are feeling more confident the more the price appears to rise,” said Markus Thielen, head of research at crypto analytics house 10x Research in Singapore.

Bitcoin has also received a boost from the prospect that the Federal Reserve will soon cut US interest rates.

That can have the effect of prompting investors to move their capital into assets that have higher yields or are more volatile, such as Bitcoin or gold.

The upcoming halving further fuels Bitcoin’s prospects. The process occurs every four years and halves the speed at which tokens can be mined.

Bitcoin is limited to a supply of 21 million, of which 19 million have already been mined.

However, some experts warn that now may not be the right time to buy Bitcoin and that those considering it should be careful.

Latih Khalaf, head of investment analysis at AJ Bell, said investors should be careful with Bitcoin

“The Bank for International Settlements estimates that around three-quarters of Bitcoin buyers between 2015 and 2022 are likely to have lost money,” said Latih Khalaf, head of investment analysis at AJ Bell.

This is the case even though there was a significant increase in the price of the cryptocurrency during that time period.

Khalaf said those losses occurred because investors “got sucked in at precisely the wrong time,” such as when Bitcoin made headlines.

He also noted that the cryptocurrency still faces significant regulatory hurdles, making its future uncertain.

“As always, retail investors should not bet their shirt unless they are willing to lose it,” he said.