The barefoot investor has insisted that a couple focus on saving for their retirement rather than giving in to their “monster” daughter and paying for her college.

Scott Pape, 46, shared the advice after mom Patty wrote about how she and her partner had already spent hundreds of thousands of dollars on their son.

“Have we created a monster?” read the title of the letter published in a newspaper column. The Telegraph newspaper.

“My teenage daughter has attended a private school. This has cost my husband and I (average working class people) over $40,000 per year,” Patty wrote.

The mother went on to say that the couple had saved “a lot” so they wouldn’t have to pay the mortgage on their “modest” home and were happy to be able to provide a private education for their only child.

The couple were keen for their daughter to finish Year 12 this year so they would not have to pay further “inexorable fees” for education when she attended the local college.

But the couple’s daughter has thrown a spanner in the works of their retirement plans.

“He wants to attend college in another city ($40,000 a year with boarding facilities) to get the ‘full city experience,'” she wrote.

Patty said that although she commutes to the city every day for work, her daughter insists that the university in the same city is “too far” to travel.

A mother asked Scott if it was reasonable not to want to support her daughter in college after she and her husband paid $40,000 a year in tuition at a private school (file photo of a classroom)

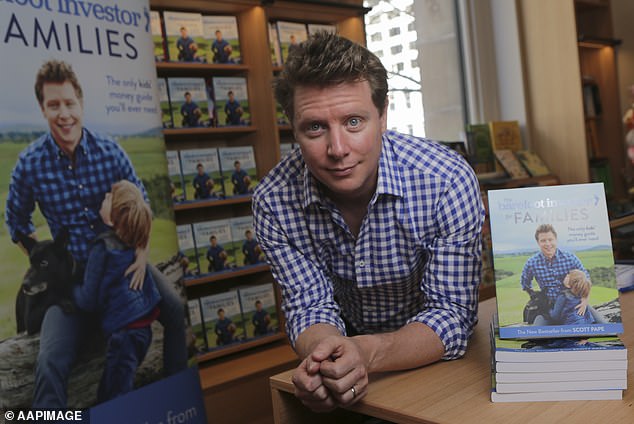

Scott Pape (pictured) did not mince his words, saying his 18-year-old daughter should go to college in the city if she insists, but at her own expense.

“She says she is desperate to leave her home and will move to the city with or without our help,” he wrote.

“She has no idea how to be financially independent! Is this the “normal” behavior of a privileged teenager or have we raised a monster?”

Mr Pape did not mince his words and replied: “You have created a monster.”

The financial guru went on to explain that the couple had already spent a huge amount on their daughter’s education and now was their time.

“Explain to him that he has already spent over $500,000 (before taxes) on his education… and now he needs to focus on saving for retirement,” she wrote.

The barefoot investor thought his daughter should get out of the house and experience life as it would be a great learning opportunity.

“Part of that experience should include working a minimum wage job, occasionally drinking from a plastic bag, and sometimes eating instant noodles for dinner to stretch your money,” he wrote.

The barefoot investor said it was time to save for retirement after spending $500,000 pre-tax on his daughter’s education (Stock photo of middle-aged couple looking at their finances)

The financial guru said it is an opportunity for his daughter to become financially independent, which also comes with the added benefit of making her more stable (file photo of college students on campus)

She urged parents to give their daughter the opportunity to become financially independent and a better person.

“Not only would I encourage her to move to the city, but I would also help her pack her bags,” he joked.

“The education she will receive will make her a much more sensible human being. (And if she doesn’t get over it, she can always go to the local university!)”

Patty’s question comes at a time when private school fees have risen substantially, leaving many parents out of pocket.

In New South Wales, fee increases have outstripped the rate of inflation and Sydney’s top schools now charge up to three times more than they have in the past 25 years.

In 1999, tuition for girls at Kambala School cost just under $10,400 a year, but by 2024 that price had risen by a staggering 352 percent to $46,950.

(tags to translate)dailymail