The winner of Tuesday night’s historic Mega Millions jackpot will likely walk away with less than a quarter of the $1.13 billion advertised on the billboards.

This is because if they accept their prize as a lump sum, as almost everyone does, they would receive $540 million. After deducting taxes, they would be left with $280 million.

The headline-grabbing jackpot amount advertised in stores, gas stations and highway billboards is not actually the amount lottery organizers have in the prize pool.

Rather, it is the total amount that would be paid to a winner in installments over 30 years if the sum he or she owns were invested in Treasury bonds. That figure is higher when interest rates are higher, as they are now.

It means lottery jackpots are now more inflated than ever and winners will be penalized more than anyone in the last two decades if they choose to accept their winnings as a lump sum.

The winner of Tuesday night’s historic Mega Millions jackpot will likely walk away with less than a quarter of the $1.13 billion advertised on billboards.

Tuesday’s $1.13 billion Mega Millions jackpot was the fifth largest in the game’s history.

This week’s jackpot was the fifth largest in Mega Millions history and had been growing since early December after going three months without a winner.

After a series of 30 drawings without a jackpot winner, a ticket matching all five numbers plus the Mega Ball was finally sold this week in Bayonne, New Jersey.

To make matters worse for the winner, New Jersey has one of the highest state taxes in the country, forcing winners to part with nearly 11 percent of their prize.

Even if the ticket purchaser was not from New Jersey, winnings must initially be claimed in the state where the ticket was purchased.

“You have to pay Uncle Sam, you have to pay the federal government, but you also have to pay state taxes,” said Andrew Stoltmann, a Chicago-based attorney who has advised lottery winners in the past.

However, he warned that if the winner opted for the 30-year annuity they could avoid paying state income tax for the next 29 years by taking up residence in a place like Texas, Florida, Nevada or Alaska.

Stoltmann argued that while many winners may be tempted by financial advisors to take the lump sum and invest it themselves, despite the tax disadvantage, they should almost always resist.

“The money manager will tell them that they have to accept the lump sum distribution because the financial advisors want to get their hands on the entire money right away with their greedy little hands,” he said.

However, regardless of where the winner claims the money, federal taxes will always be due, which represents a whopping 37 percent of the prize amount.

Profits are taxed at 24 percent up front. But the total amount taken when applying will end up being 37 percent, since the winners will likely be in the highest tax bracket.

Under New Jersey law, the winner has one year from the date of the drawing to come forward to claim the prize and also reserves the right to remain anonymous.

This week’s winning ticket was sold at ShopRite Liquor, 2200 Route 66.

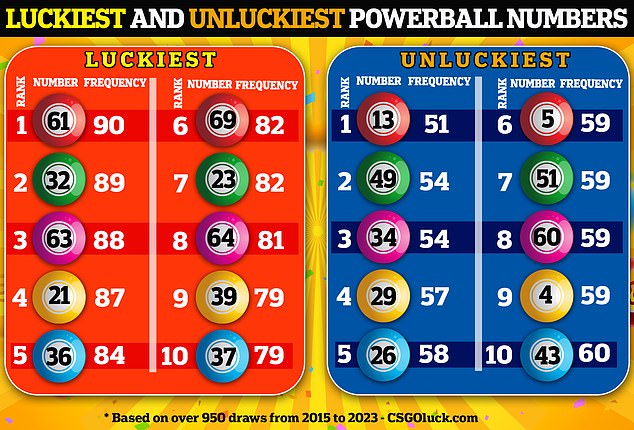

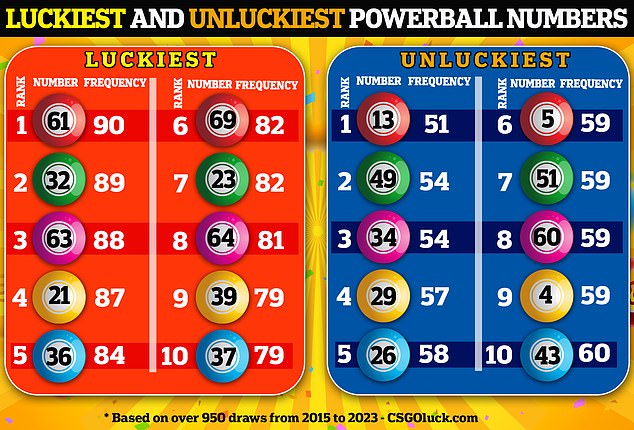

A fascinating study from betting site CSGO analyzed the most frequently drawn numbers in more than 950 draws between 2015 and 2023.

This week’s winning ticket was sold at ShopRite Liquor, 2200 Route 66. After winning the jackpot, it was reset to its default value of $20 million.

In Mega Millions, the odds of matching all six numbers are 1 in 302.6 million.

A fascinating study conducted in November revealed the unluckiest and luckiest numbers that have generated jackpots in the past.

CSGO betting site experts analyzed the most frequently drawn numbers in more than 950 draws between 2015 and 2023.

The number 13 is the least common: it has been drawn only 51 times in the last eight years, according to the research.

However, the number 61 was found to be the “luckiest” number, as it was chosen 90 times during the period.