Table of Contents

People trying to get their mortgage in order find that the best deals don’t last long.

The average shelf life of a mortgage product has plummeted to 15 days, according to Moneyfacts, down from 28 days at the start of last month.

This is the lowest average on record in six months and not far from the 12-day record low in July 2023, when mortgage rates peaked.

Don’t delay: The average lifespan of a mortgage product has plummeted to 15 days, a low of six months and down from 28 days at the start of February.

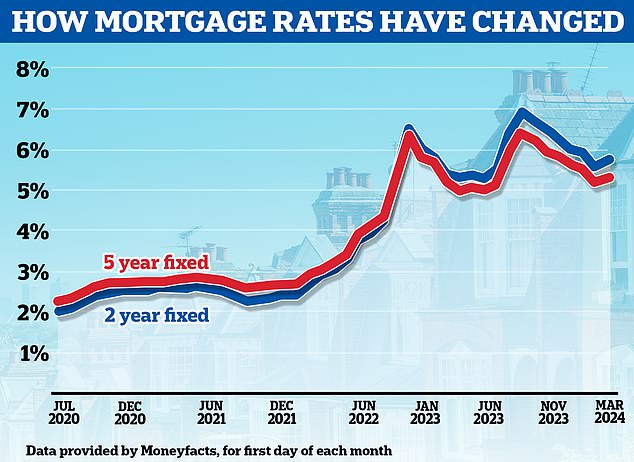

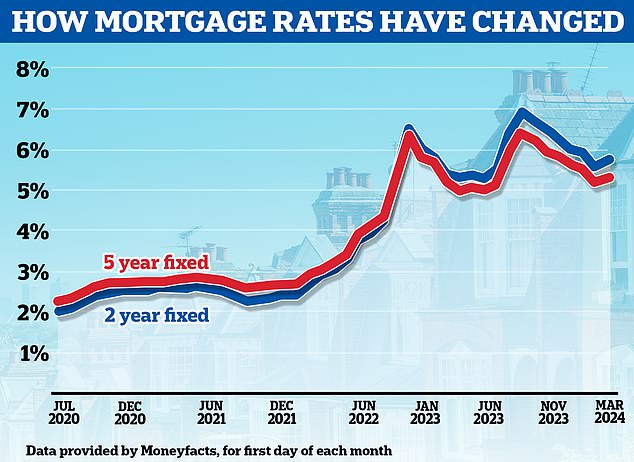

The news may come as a surprise, given that inflation is declining and the Bank of England has kept the base rate at 5.25 percent since August. In theory, the market should be more stable.

However, in recent weeks lenders have been raising rates continuously, some twice in the same week and others doing so at any time.

Yesterday alone, five lenders announced rate hikes, including several of the UK’s largest banks.

Santander, NatWest, Co-op Bank and Principado Building Society all raised rates and Halifax will increase some of its rates from tomorrow.

Nicholas Mendes, mortgage technical manager at broker John Charcol, said: “Mortgage rates are continually changing their prices, even to the point that we have seen lenders change their prices twice in a week, with some lenders giving little or late notice. of a rate change”.

‘Mortgage brokers have called for a 24-hour rate notification commitment to help ensure customers can get the best deal, which includes consumer duty.

“Unfortunately, mainly building societies have agreed that only NatWest is the only major lender that has recently committed to 24 hours notice or as much notice as possible.”

Bad news: Lenders have rushed to reprice their mortgages this week

Why are lenders doing business?

When it comes to fixed mortgage rates, market expectations and prices are reflected in Sonia’s swap rates.

Mortgage lenders enter into these agreements to protect themselves against the interest rate risk involved in making fixed-rate mortgage loans.

More simply put, swap rates show what lenders believe the future will hold regarding interest rates and govern their prices.

As of today, two-year swaps are at 4.46 percent and five-year swaps are at 3.85 percent.

This is up from the start of the year, when two-year swaps were 4.04 percent and five-year swaps were 3.4 percent.

Karen Noye, mortgage expert at Quilter, added: ‘The mortgage market is definitely a difficult place to work in at the moment due to constant changes and updates.

“The biggest influence of product changes by mortgage lenders is obviously swap rates and although we have seen inflation and the base rate stabilize, market forecasts and predictions seem to be changing daily with what will happen to the future interest rates and inflation, which then changes.” impact on market rates.

‘Lenders also adjust their products based on their service levels. If they have a spike in requests and are delayed in processing, they will change their rates to try to slow down requests; however, in the current market that is less likely to be the case as transactions are low.

What does this mean for borrowers and brokers?

The reality is that it makes things difficult for both borrowers and brokers. Those who hesitate or fail to withdraw their application could end up kicking themselves when they are told that the rate they thought they were getting is no longer available.

John Charcol’s Nicholas Mendes says the constant changes are making life more difficult for runners.

‘The impact this has on a broker is rarely talked about, as a mortgage broker is continually busy looking to ensure clients get the best possible deal.

“When a lender gives short notice of interest rates at the end of the day or a couple of hours in advance, brokers must act quickly to ensure clients’ documents are ready and applications submitted, which is why Brokers are often seen working late in the evenings, starting early to ensure submissions are made before the deadline, unable to attend family events or even work until the weekends.

Returning to the rise: Mortgage rates rise again after almost six consecutive months of cuts

To avoid disappointment, people are urged to plan ahead and ensure they have all the documentation on hand to start an application and reserve a rate before it is withdrawn.

“For anyone looking to get a new mortgage, I would recommend getting all your paperwork in order first so there are no unnecessary delays in completing the application and securing the interest rate,” Noye says.

‘Many of the lenders even today give very little; Note that some may take as little as a few hours for rates to drop.

‘Speaking to a mortgage professional can help navigate the current mortgage market and ensure the most appropriate deal based on each individual’s personal circumstances.

‘It is important to mention that borrowers should not panic and simply accept a deal at will without advice, as this could prove costly in the long run. It can also be useful to prepare six months in advance, especially when remortgaging.’

Mortgage choice hits 16-year high

While the best deals may constantly change, the number of deals on the market has reached a 16-year high according to Moneyfacts.

It says overall product choice increased month-over-month, to 6,004 options, its highest level since March 2008.

Rachel Springall, finance expert at Moneyfacts, said: ‘Mortgage options recorded the biggest month-on-month rise in six months, with mortgage options for borrowers totaling over 6,000, the most seen in 16 years.

‘A deeper dive into the loan-to-value sectors reveals good news for borrowers with limited deposits.

‘In fact, the choice of products with a 90 percent loan-to-value ratio increased by 80 offers month on month, now at its highest count in four years (March 2020: 779).

‘This is a positive move as options fell a month earlier (February 2024: 681). Those borrowers with just a 5 per cent deposit will also find an increase in their options, as there are now more than 300 offers on the market with a loan-to-value ratio of 95 per cent, the highest count since June 2022 (347 ).

“However, potential first-time buyers still have affordability challenges to overcome amid volatile house prices and a lack of affordable housing before even considering that average rates on a two-year fixed deal at 90 per cent and 95 percent LTV stand at 5.99 percent.’

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.