Table of Contents

- Polar Capital Technology Trust has announced proposals for a 10-1 stock split

Investors in FTSE 250-listed Polar Capital Technology Trust are set to vote on proposals for a 10-1 stock split.

PCT said the move “aims to help regular savers and those looking to invest smaller amounts”, with its shares currently trading at more than £30 each.

Shareholders of PCT, which is popular on most DIY trading platforms, will have the opportunity to vote on the stock split at the company’s upcoming annual general meeting on September 11.

News: Polar Capital Technology Trust has announced proposals for a 10-1 stock split

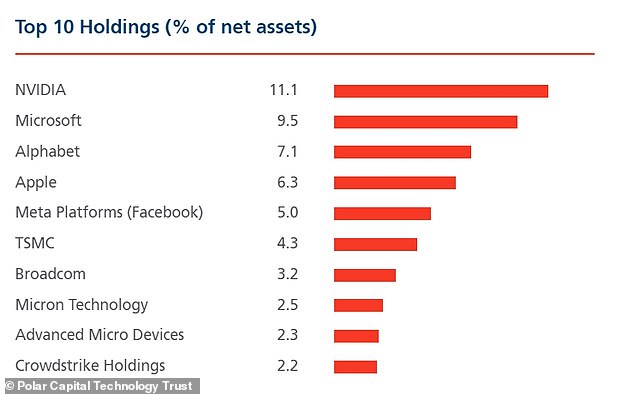

PCT, which has total assets worth more than £4.4bn, has a technology-heavy portfolio that offers UK investors exposure to leading holdings including Nvidia, Microsoft, Apple and Meta.

On Wednesday, it told shareholders: “The reduced market price of each new share of common stock immediately following the stock split is intended to help make each share more affordable for investors.”

This, he says, will encourage “greater participation” and provide “greater flexibility in terms of deal size for investors with different investment profiles.”

PCT shares are currently trading at 3,290 pence, having fallen 3.2 per cent in the wake of the proposals.

If approved by the shareholders, the split will result in shareholders receiving 10 new shares of common stock in exchange for each existing share of common stock on the record date.

What does this mean for shareholders?

Speaking to This is Money, Dan Coatsworth, investment analyst at AJ Bell, said: ‘Stock splits are a great way to make a share more affordable for people who can only afford to invest a small amount of money.

‘They are useful for people who want to grow their wealth but can only afford to allocate a small portion of their salary each month to an ISA or pension.

PCT has high exposure to top-performing tech giants

‘Polar Capital Technology Trust is currently trading at around £33 per share, so someone who can only spend £50 a month would only be able to buy a single share at a time.

‘Replacing one share with 10 new ones will reduce the price to £3.30 per share, meaning an investor could buy 15 shares with a monthly investment of £50.

“It’s a clever technique to make an investment more accessible and we’ve seen big-name stocks like Nvidia, Tesla and Apple use this trick in recent years.”

He added: ‘Polar Capital Technology Trust is currently valued at around £4bn and this valuation is not affected by the timing of the stock split. Only the share price will fall to reflect the increase in shares in issue.

‘Existing investors will find that the value of each share falls at the time of the split, but they will own more shares. It all evens out, so if they owned £500 worth of shares before the split, they will still own £500 worth of shares after the split.

“What could happen after the split is that more investors become interested in the trust because each share is more affordable and the additional demand drives up the price. That’s certainly what happened with Nvidia after its recent stock split.”

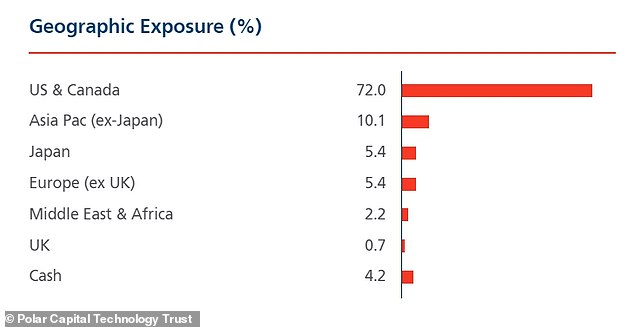

Most of PCT’s exposure is in the United States.

Should you invest when stocks become more affordable?

Polar Capital shares have risen around 50 percent in the past year, and investors are keen to gain exposure to stocks like Nvidia, which have soared so far in 2024.

His net worth has grown more than 40 percent in the past 12 months, according to the Investment Company Association, but his shares still trade at a discount of about 7 percent.

According to analysts at QuotedData, PCT “continues to be committed to the AI investment theme”, having “adjusted the portfolio towards “AI enablers” and “AI beneficiaries” that it believes will outperform the broader sector over the long term”.

In June, PCT was the best-selling ISA investment trust on Fidelity Personal Investing.

Ed Monk, associate director at Fidelity International, said: ‘Polar Capital Technology Trust has climbed the rankings to first place for both ISA and SIPP investors, having not featured in the top 10 since April.

‘The company’s 45 percent position in technology has boosted performance and its top holdings include Nvidia, Microsoft, Meta and Amazon.

‘The recent reduction in the position in Apple reflects concerns about regulatory hurdles, although it still represents 4.31 percent of the portfolio.’

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.