- Social Security beneficiaries could receive a raise of $60 per month

- Benefits increase each year in line with inflation, which has remained stable in 2024

- Analysts estimate payments will rise 3.2 percent by 2025

Social Security beneficiaries will receive an extra $60 a month next year to help with the rising cost of living, new estimates suggest.

The benefits, delivered to 71 million Americans, rise each year in line with inflation, which has remained stubbornly persistent.

Policy analyst Mary Johnson estimated the increase by 2025 would be about 3.2 percent based on recent inflation data.

It would mean the average retirement benefit of $1,907 per month would be boosted by an additional $61 to $1,968.

Beneficiaries already benefited from a 3.2 percent increase in their payments between 2023 and 2024. The year before, they received a record 8.7 percent increase, fueled by rampant inflation.

Beneficiaries have already benefited from a 3.2 percent increase in their payments between 2023 and 2024

Social Security beneficiaries will receive an extra $60 a month next year to help with the rising cost of living, new estimates suggest. Pictured: Martin O’Malley, Commissioner of Social Security

The annual increase, known as the “cost of living adjustment” (COLA), has increased 2.6 percent each year on average over the past 20 years.

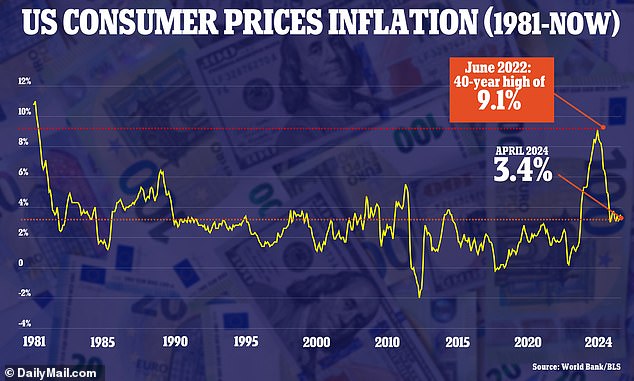

COLA is based on the change in the Consumer Price Index (CPI). Figures released yesterday show the annual inflation rate fell slightly to 3.4 percent in April, down from 3.5 percent in March.

However, it remains well above 2 percent, the target set by the Federal Reserve before it began cutting interest rates.

Johnson said: “Higher inflation indicates that consumers are still experiencing an erosion in their purchasing power.”

Retirees and their dependents represent three-quarters of all Social Security beneficiaries, but millions of other beneficiaries, including disabled workers and low-income people, will also receive the increase.

The payments are considered a lifeline for low- and middle-income retirees, many of whom have never had workplace retirement accounts like a 401(k).

Experts warned that the projected increase in Medicare Part B premiums could significantly reduce the increase.

In an annual report, Medicare administrators estimate that the standard monthly Part B premium could increase 5.9 percent, from $174.70 to $185.

Part B premiums are automatically deducted from Social Security checks and are one of the fastest-growing costs of retirement, Johnson said.

The benefits, awarded to 71 million Americans, increase each year in line with inflation, which has remained stubbornly persistent.

Figures released yesterday show the annual inflation rate fell slightly to 3.4 percent in April, down from 3.5 percent in March.

It comes after a new report warned that the Social Security Administration (SSA) could run out of funds by 2035.

The latest annual report from the Social Security Board of Directors found that the program will only be able to pay full benefits for the next 11 years, one year longer than previous estimates.

While Social Security Commissioner Martin O’Malley said this was “good news” for beneficiaries, he urged Congress to take action to “extend the financial health of the Trust Fund for the foreseeable future.”