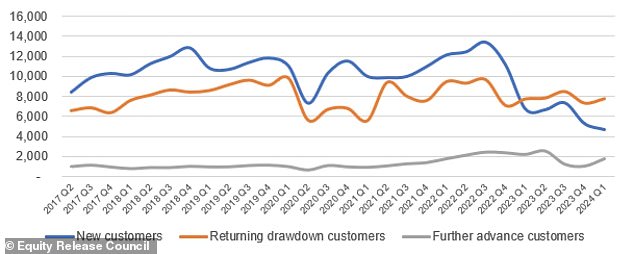

The number of new customers taking out equity release products has fallen as potential borrowers wait for interest rates to fall.

There were 4,698 new customers in the first three months of this year, according to industry body Equity Release Council.

It is 11 percent lower than in the last quarter of 2023 and 31 percent lower than in the first quarter of last year.

The drop has been attributed to speculation about an interest rate cut in the coming months, prompting potential clients to adopt a “wait and see” attitude to see if potential rate cuts translate into Cheapest stock release products.

‘Wait and see’: The number of new customers taking out equity release products has fallen in the first quarter of this year, as potential borrowers wait to see if rates will fall.

The average share release rate, as of April 1, was 6.47 percent, according to Moneyfacts, which tracks rates on the first day of the month.

Rates will differ depending on clients’ specific circumstances as they are calculated based on a variety of factors, including their age.

Data from the Equity Release Council revealed that a total of 14,216 new and returning customers used equity release products between January and March, up 4 per cent on the fourth quarter of 2023. That figure includes those who remortgaged existing plans.

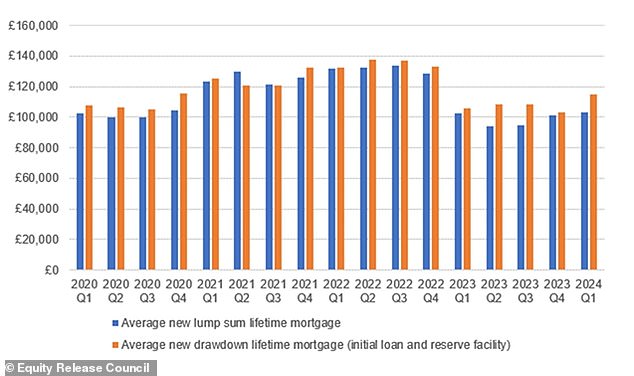

However, there was a 6 per cent drop in total equity release loans, from £535 million in the fourth quarter of last year to £504 million in the first quarter of this year.

Stock Posting Client Numbers Per Quarter by Client Type Revealed

Released equity has had a bad reputation in the past after some clients suffered financially.

The sector has been criticized for encouraging people to take on debt, especially later in life.

There have also been other concerns about equity release, such as clients falling into negative equity where the value of a property is less than the loan taken out when house prices fall.

More recently, the Equity Release Council has introduced a “non-negative equity guarantee”, meaning its member lenders must ensure that the amount repaid is capped at the value of the home.

However, not all equity release lenders are members of the Board.

Total borrowing: The Equity Release Council has revealed the average size of new loans among equity release clients.

Reports on the sector in the past have identified several issues that need to be looked at, including early repayment charges for equity release products if the borrower wants to repay them before death or entering long-term care.

While most providers apply a simple sliding scale of charges (for example, from 10 percent annually to 1 percent in year 10), some providers apply an early redemption charge based on the gilt rates in effect at that time. moment, which puts customers at an unfair disadvantage.

This is because the fees are not transparent, as there is no way for a customer to know in advance whether they will be responsible for a charge and, if so, how much.

Questions have also been raised in the past about the interest rates on equity release products.

These focus on the need for providers to be consistent with their lending criteria and not change targets after clients have taken out a loan, as this may make it difficult for them to access a top-up loan in the future, which could force them to remortgage.

Older borrowers are taking a cautious approach ahead of expected interest rate cuts

The Equity Release Council said the number of new customers had fallen amid a more cautious approach among older borrowers ahead of planned interest rate cuts.

David Burrowes, of the Equity Release Council, explained: “The data for the first quarter of 2024 highlights the current challenges facing the residential property market in the UK as the nation waits to see what happens next with interest rates and the health of the economy.

‘In our market, consumer confidence holds well among people with existing plans, who have no qualms about availing reduction facilities or exploring new developments.

‘The number of new customers is lower than last year and market information suggests that older homeowners are taking a more cautious approach to taking on debt as there are hopes of interest rate reductions in a near future.

‘The flexibilities offered by modern credit products are becoming increasingly popular as customers use them to manage their loans in a way that best suits their individual circumstances.

‘New customers are choosing retirement plans with smaller initial down payments, while existing customers are being more modest in their loans compared to the beginning of last year.

‘Looking ahead to the rest of 2024, we are confident that the green shoots we are starting to see will germinate and the market will grow again.

“The structural drivers of the senior lending sector will intensify in the coming years and Council members are keen to support customers as they make long-term sustainable decisions about their finances.”