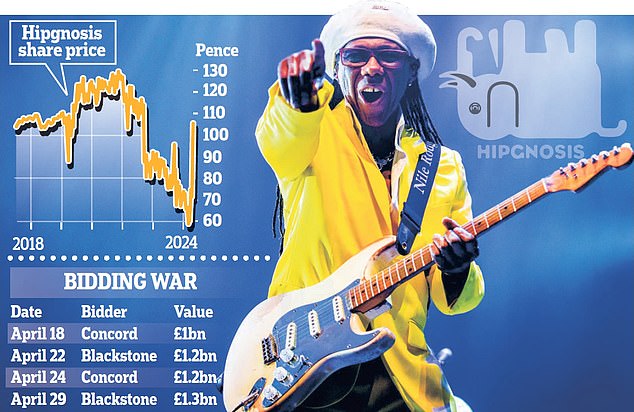

Hipgnosis has backed a £1.3bn bid from US private equity in the latest stage of a protracted bidding war for the embattled music fund.

As the City is gripped by a wave of takeover activity, the FTSE 250 group has accepted a bid of 104 pence per share from Blackstone.

That was more than the 99 pence a share Blackstone proposed last week and eclipsed two rival bids from US music fund Concord.

Hipgnosis, which owns the rights to catalogs of music from artists including Beyoncé and Blondie, looks set to fall into the hands of private equity unless Concord or another bidder comes back with a better offer.

Hipgnosis, founded by Merck Mercuriadis and Chic funk guitarist Nile Rodgers, is the latest London-listed company to be targeted by a foreign buyer.

Hipgnosis, founded by Merck Mercuriadis and Chic funk guitarist Nile Rodgers (pictured), is the latest London-listed company to be targeted by a foreign buyer.

Cyber security group Darktrace last week backed a £4.25bn takeover by US private equity firm Thoma Bravo, Australian mining giant BHP is in talks to buy Anglo American and Czech billionaire Daniel Kretinsky is eyeing to Royal Mail’s owner, International Distributions Services.

Many others have also agreed to be bought out, including FTSE 100 packaging group DS Smith, haulier Wincanton and builder Redrow, meaning they will leave the UK stock market.

The exodus, at a time when very few companies list their shares in London, has raised fears about the health of the stock market and the City.

“There will be fresh lamentations in the City about the extent of the exodus from London,” said Susannah Streeter, an analyst at brokerage Hargreaves Lansdown.

But he added that Blackstone’s offer would be “music to shareholders’ ears.”

The stock is up more than 80 percent since early March, but remains about 20 percent below its late-2021 peak.

Liberum analysts said: “We believe Blackstone’s bid represents an attractive offer for shareholders and should bring an end to what has largely been a painful saga.”

Talks about acquiring Hipgnosis began earlier this month when Nashville-based Concord, which is backed by private equity firm Apollo, offered 93 pence per Hipgnosis share, valuing it at around £1bn sterling.

Concord later increased this offer to around £1.2 billion following interest from Blackstone. Blackstone’s latest push places it in pole position.

Qasim Abbas, senior managing director at Blackstone, said: “The offer is the result of extensive discussions and negotiations with the [Hipgnosis] advice and provides shareholders with the certainty of having cash available today.’

Concord will decide whether to increase its offer or withdraw. Hipgnosis shares rose 0.4 percent.