Table of Contents

If you’re reading this, chances are you’re doing well financially.

This is Money readers tend to flock to stories about protecting your pension lump sum, avoiding inheritance tax, cutting capital gains bills and finding the best savings rates.

Either they have an altruistic streak and want to help the rich get richer, or they are as self-selecting as readers of a financial website would be expected to be and skew toward the richest in society.

Hit me on Who wants to be a millionaire? and 50-50 the question, and I’ll bet my final answer that it’s the latter.

Who wants to be a millionaire? For a large proportion of Britons, having just £1,000 in a savings account would make a big difference.

This scenario creates a complicated balancing act: we want to write about what you want to read, but we also have a strong commitment to financial education and inclusion, and we want to help everyone get rich.

And in my two decades as a financial journalist, I have come to understand how much help people at the bottom end of Britain’s wealth scale need to get rich.

Simply having a sum of money in a savings account that would be less than a year’s savings interest for many of our wealthy readers would make a colossal difference to the financial security of many Britons.

That’s why I was interested in an idea for a Lifetime Savings Initiative that emerged this week from fund manager Schroders and the Pensions Management Institute.

Simply put, it aims to tap into workplace pension savings, help people build an emergency savings fund, save for a home deposit and invest for a richer retirement.

Parts of this have been tested separately before: the success of automatic pension enrollment; pension freedoms; Lifetime Isa, kind of half-baked, but we’ve never quite combined them.

Doing so to create a Lifetime Savings Plan could create a structure that reflects the struggles of modern financial life and copies better, more flexible savings systems from around the world.

For someone on a starting salary of £25,000, the report claims the concept could increase their wealth by £76,000 over 40 years.

The report identified three key points in people’s finances:

- The lack of a short-term savings cushion for difficult times

- The growing challenge of home ownership

- The growing lack of adequate retirement savings

The solution proposed involves two linked elements: the National Short-Term Savings Plan that is integrated into the National Lifetime Savings Plan.

Rainy day pot: The short-term savings plan would involve workplace contributions aimed at creating a £1,000 emergency fund. Paying 2% of salary, it would take someone on a salary of £25,000 34 months, while it would take someone on a salary of £40,000 21 months.

Create an emergency fund

Under the Short-Term Savings Plan, employees can opt into a workplace savings plan in a push similar to automatic pension enrollment (the default is to join and they can then opt out, but most don’t). it does).

A default contribution would be taken on top of your auto-enrollment pension contribution and used to create an emergency savings fund in an interest-paying account.

If this contribution were set at 2 per cent of salary, it would cost someone on £25,000 about £30 after tax each month. It would take them about 34 months to build up a £1,000 pot from this.

This is considerably below the recommended three to six months of after-tax income that it is recommended to have as an emergency fund. But with FCA figures showing 34 per cent of people have £1,000 or less saved, this would make a real difference to financial resilience.

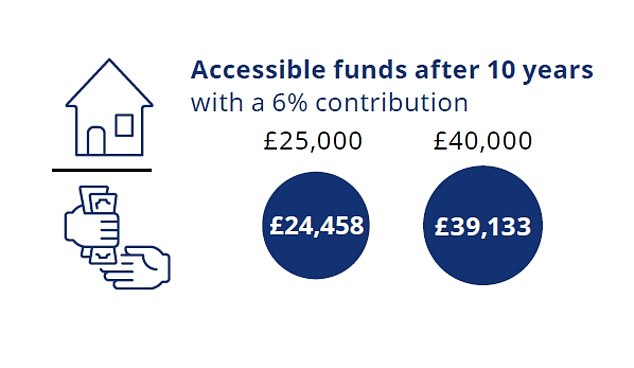

Build wealth – The Lifetime Savings plan would involve additional contributions to a fund that could be accessed for a home deposit or a financial emergency. With 6% of salary paid, after ten years someone starting on £25,000 would have £24,458, while someone on £40,000 would have £39,133.

Getting richer

Once people have reached their £1,000 target, the plan would be to encourage them to contribute to their Lifetime Savings Plan.

This would involve contributions above the minimum 8 per cent total of automatic pension enrollment – 5 per cent from employees and 3 per cent from employers.

Crucially, however, the extra money paid before retirement age could be accessed for either of two things: a home deposit as a first-time buyer or to help address “serious financial problems”.

These early access withdrawals would only be allowed on “the value of retirement savings from contributions in excess of the automatic enrollment minimum.”

Serious financial problems would be defined as someone receiving advice on regulated debt or a legal debt repayment plan.

There would also be the option of diverting contributions above the automatic enrollment minimum to a savings-based scheme rather than investments, reflecting the more short-term basis of saving for a mortgage deposit and a greater risk that falls in the market would eat one.

The report suggests encouraging people to make an additional 6 percent contribution on top of automatic enrollment. That’s a lot and could get us to a level where more people opt out, but divided between employer and employee, it would only be an additional 3 percent for each.

Modeling suggests that even simply joining the short-term scheme and then diverting the extra 2 per cent contributions into lifetime savings would make someone starting with £25,000 around £76,000 richer in 25 years.

I don’t know if I totally agree, but the Lifetime Savings Plan is a very interesting idea. It starts from the position of trying to identify some important real-life financial problems and improve some already successful parts of our financial lives, pension freedom and automatic enrollment.

I would say the additional ingredients needed to make it work would be tax relief, employer matching contributions and the ability to roll existing lifetime Isas into this. A plan for the self-employed is also necessary.

The key to making something like this work would be to keep it simple: it should be easy to understand, navigate and implement.

Would we make it? I think automatic pension enrollment shows that we can achieve this.

SAVE MONEY, MAKE MONEY

Investment boost

Investment boost

5.09% on cash for Isa investors

5.05% solution after one year

5.05% solution after one year

Prosperous momentum for Al Rayan

free share offer

free share offer

No account fee and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible Isa now accepting transfers

Trading Fee Refund

Trading Fee Refund

Get £200 back in trading fees

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.