The country is holding its breath in hope today as the Three Lions play Spain in the Euro 2024 final.

Although England have not missed a penalty in this tournament, many of their players are likely to score own goals at home. At least as far as their money is concerned.

Despite Premier League players earning an average of £70,000 a week, footballers are notoriously bad at managing their finances. Sports charity Xpro claims that 40% of footballers declare bankruptcy within five years of retiring.

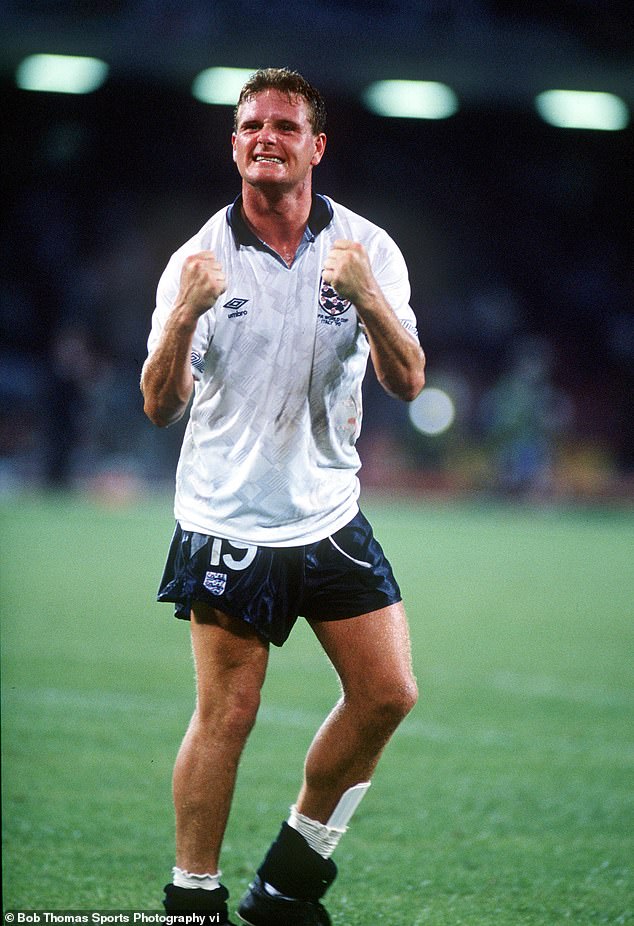

Former England internationals Emile Heskey and Wes Brown have reportedly been declared bankrupt recently. In 2009, Heskey had an estimated fortune of £12m. And former stars David James and Paul Gascoigne have also struggled to stay afloat financially.

What lessons can we learn from their mistakes? We asked financial advisors.

Former England international Emile Heskey was worth an estimated £12m in 2009 but was reportedly recently served with a bankruptcy order.

Former soccer star David James has struggled to stay afloat financially.

Unrestricted spending and a lack of a savings plan is his main financial vice. Chris Reed, of Stonehill Financial, which looks after the finances of eight Premier League stars, says: “Most footballers come from fairly simple backgrounds, with working parents.

“They are often caught at a young age, so going from living a normal life to earning five figures a week is a lot of money for any of us, but for someone in their teens with no financial experience it’s a lot to take in.”

Footballers are known for their extravagant lifestyles, but their spending can quickly spiral out of control. With their short-lived careers, reckless spending could mean they run out of money by the age of 35, unless they set aside some savings.

Reed says: “It’s complicated because they get tens of thousands every month, so if they spend it all, they know they’ll have the money again next month.”

“It’s only natural that they want everything they’ve seen on social media: the boat parties, the big vacations and the luxury cars.”

He advises his clients to set aside 10 per cent of their gross income for savings, investments and pensions. “The cumulative effect of saving 10 to 12 per cent of your income builds up steadily and should leave you with enough,” he says.

If the average Premier League player stuck to this formula from the age of 19, he would have £7-8m by the age of 35, assuming annual returns of 4-5 per cent, the adviser says.

Former England player Paul Gascoigne has also had problems with his finances.

‘This money will help them survive, retrain or start a business.’

While you may not be able to retire at 35, this golden rule of saving can apply to everyone, Reed adds. Setting aside 10 percent of your pre-tax income can help you meet your personal financial goals. Adam Osper of Evelyn Partners, who also works with football players, says he even recommends saving 50 percent of net income.

The next mistake is in retirement planning. Most of us don’t save enough for our later years, but we have over 40 years to plan for them.

Many footballers are guilty of trying to hoard cash in their savings when it is already too late, in the last five years of their careers, says Reed.

This is a lot like when a 60-year-old realises they need to top up their pension. “By then it’s too late,” he says. “You won’t benefit from the cumulative effect of investing that money over time through compounding returns. Plus, you’ll be limited by allocations.”

You can contribute up to £60,000 to your pension each year, or £10,000 if you earn more than £260,000 a year. Similarly, you can put up to £20,000 a year into individual savings accounts (ISAs), which are a tax-efficient way to invest in stocks and shares.

Footballers are also prone to engaging in flashy but high-risk investments, which often end in disaster and investors lose much of the capital they invested in the project.

Reed says: “They should not invest money in attractive and exotic investments that involve high risk and high return. Instead, we opt for conventional investments that generate a return of 4-5 percent per year.”

The financial advisor prefers Vanguard’s range of market-tracking funds, which are inexpensive and offer plenty of diversity.

“Boredom is a good thing when it comes to investing,” he says. Osper agrees: “We create simple investment portfolios and don’t do anything too complicated.”

Footballers are also prone to falling for fads promoted by financial influencers on social media, such as cryptocurrencies. But these can turn out to be disastrous decisions if taken wrongly.

Reed says: “If you want to take risks, you have to take them from your spending budget, not your savings. You wouldn’t take your pension money and bet it on the horse races. We’re not trying to make a quick buck, we’re looking for long-term growth.”