Table of Contents

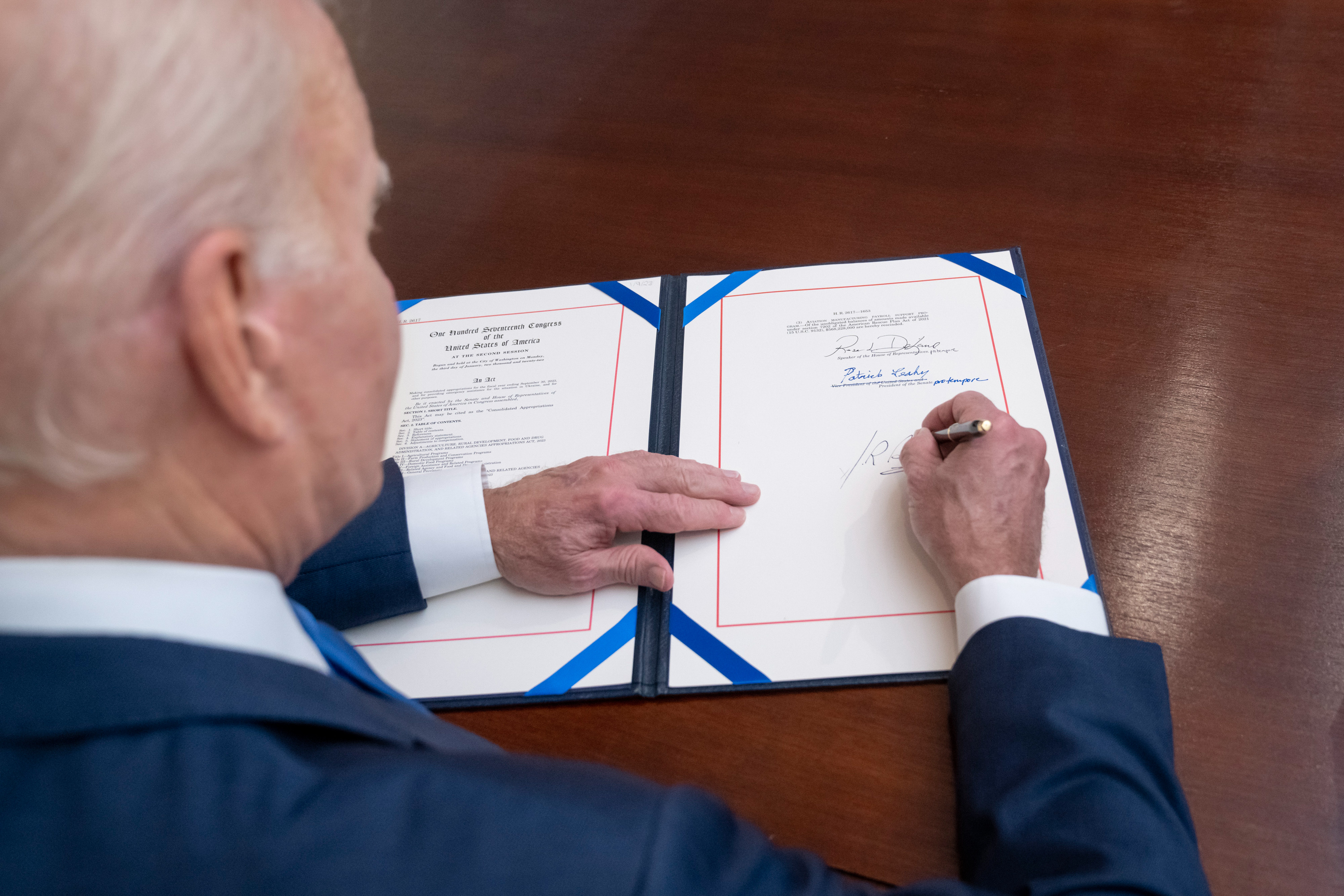

Five months before Congress faced a near-catastrophic standoff over the debt ceiling, with Republicans demanding restrictions to food and Medicaid programs to rein in spending, a bill that raised the cost of private retirement savings accounts to $282 billion per year was quietly signed into law.

In this era of deeply divided politics, the 2022 bill known as Secure 2.0 was hailed as a bipartisan success — a victory for average Americans. It had sailed through the House by a whopping 414-5 vote. It followed four other major bills passed between 1996 and 2019 that dramatically expanded taxpayer savings – all equally lauded as bipartisan victories.

But that rare issue that brought a divided Washington together also increased wealth disparities and the federal deficit. And the victory was most strongly applauded by the burgeoning financial services industry, for whom tax-advantaged retirement savings has transformed a $7 trillion retirement market in 1995 to a $38.4 trillion behemoth in 2023.

Tax-advantaged savings has become a staple of the American retirement system, with 60 million savers squirreling away $6.6 trillion in their 401(k)s, alone. But a yearlong POLITICO investigation found that Secure 2.0 and its predecessor bills have expanded the system well beyond its goal of helping the middle class. Today, wealthy taxpayers can protect up to $452,500 per year in tax-advantaged accounts in a single year, saving up to $203,600 on their taxes. And they can keep their money in tax-advantaged accounts far longer.

More striking is how these victories were achieved: A quarter-century partnership between two senators — Democrat Ben Cardin of Maryland and Republican Rob Portman of Ohio — joined more recently by the former House Ways and Means Committee Chair Richard Neal (D-Mass.). Backed by one of the most highly skilled and lavishly funded industry lobbying teams, and greased by campaign contributions, Portman, Cardin and Neal turned what could have been a deeply controversial giveback to higher-income taxpayers into a staple of the American Dream.

Their success offers an intriguing roadmap for how even the most divided Congresses can coalesce around a single issue. It includes the passionate advocacy of two quietly well-liked senators and a representative whose life story — having grown up orphaned, on Social Security — refuted any suggestion of bias toward the wealthy. They appealed to core beliefs in both parties — free enterprise for Republicans, economic security for Democrats – to enact what is arguably the most costly series of non-Defense bills in recent decades.

Indeed, that success now vexes many retirement experts, alarmed by how easily Congress acquiesces to tax breaks for retirement savings that disproportionately help the wealthy while treating the benefits relied upon by most retirees — Social Security and Medicare — as budget-busters ripe for reform.

“The 401(k) industry owns Congress,” said Daniel Hemel, a professor and tax law scholar based at NYU School of Law. “Either lawmakers were trying to pull a fast one on the American people or lobbyists were trying to pull a fast one on Congress. I don’t know which story is better. I don’t know which one I should want to believe.”

As assets in retirement accounts have exploded since the mid-1990s, so has the amount of money spent by the retirement industry on lobbying and campaign contributions to key members of both parties. A POLITICO data analysis shows that top retirement industry lobbying groups have increased their PAC spending to lawmakers between six to eight times since the early 2000s, with the PACs and executives of member companies of one industry juggernaut providing $98.6 million to lawmakers in the 2022 election cycle leading up to Secure 2.0.

Meanwhile, former administration officials, Capitol Hill aides and other people who work on retirement legislation, some of whom were granted anonymity to discuss the legislative process, told POLITICO that the industry initiated many, if not most, of the policies that became law. They described a closed-door system in which congressional aides — many of whom would later go on to work in the industry — collaborated openly and regularly sought advice from former colleagues employed by financial service companies and groups.

Secure 2.0 and its 2019 predecessor, Secure 1.0, were prime examples. Retirement trade associations succeeded in enacting multiple proposals they claimed to originate and had pushed for years.

The legislation increased the amount of money the top 16 percent of retirement account contributors could use to grow their capital tax free. And it enabled wealthy Americans to shield all their savings in tax-advantaged accounts well into their 70s, providing a boon for asset managers and insurance companies that collect fees based on the money growing in those accounts.

Tax-advantaged savings sounds “like motherhood and apple pie,” said Steve Rosenthal of the left-leaning Tax Policy Center, but in fact is “corrosive to our tax base and to equity across wealth, income, and racial grounds.”

Defenders of the system argue that 401(k)s provide middle-class Americans with a critical additional layer of financial security, when coupled with Social Security. Secure 2.0 also included a new kind of government match program, called the saver’s credit, for the lowest-income savers — which provides a retirement savings match of up to $1,000 for people with very low incomes.

However, a slew of other data, from retirement research centers, consulting firms, the Federal Reserve and other government entities, has called into question the fundamental effectiveness of the 401(k) system for large segments of the population.

In particular, Federal Reserve data shows that the median account balance of the lowest-income savers has in fact dropped since the beginning of the retirement reform project in 1996. And according to the Organization for Economic Cooperation and Development, a global economic think tank, the U.S. has some of the highest rates of elder poverty, far behind 30 similarly developed countries and better off only than Costa Rica, Croatia, Lithuania, Bulgaria, Latvia, South Korea and Estonia.

“It does not work for a wide variety of people,” David John of AARP, who previously worked as a senior researcher at the conservative Heritage Foundation, said of the current retirement system.

Underscoring the need to make retirement plans available to more people, John pointed to AARP studies indicating that 57 million private sector workers don’t have access to any retirement program at work, while only 47 percent of Black employees and 36 percent of Hispanic employees have access to an employer-provided retirement plan.

Meanwhile, according to one estimate by the Joint Committee on Taxation — which is used by lawmakers to evaluate tax proposals and assesses the immediate loss to the government’s bottom line — the cost of retirement tax expenditures to the government is expected to nearly double in just four years from $369 billion in 2023 to $659 billion in 2027.

The statistics fly in the face of rhetoric from advocates in both parties. Republicans celebrate the private-sector nature of tax-advantaged savings, in which workers make their own investment decisions, while Democrats hail the economic boost and enhanced retirement security for American families.

“We made it easier for Main Street businesses to offer retirement plans to their workers by easing administrative burdens, cutting down on unnecessary and often costly paperwork,” said former GOP tax writer and Texas Rep. Kevin Brady .

Neal, who is now ranking member for Ways and Means, put it this way: “I think it is important to highlight that U.S. defined contribution plans have created a unique reservoir of capital in the innovation economy. That means that workers’ retirement assets are directly tying middle class workers to our national innovation economy. That certainly is a win-win for all of us.”

But Alicia Munnell, a former Federal Reserve economist who now directs the Center for Retirement Research at Boston College, says flatly, “I am persuaded that these are bills designed for the high-earners and stuff for middle- and low-earners gets put in along the way to make the legislation less shameful.”

The latest expansion of private retirement savings comes at a time when Social Security, which the majority of American seniors rely on to cover basic living expenses, faces insolvency in 2034. Secure 2.0 sailed through Congress shortly before lawmakers convened working groups to try to fix Social Security’s $119 billion cash shortfall, which amounted to less than half of a single year’s worth of tax benefits for retirement savings that mostly go to higher earners.

Neal says the expansion of tax-advantaged savings is essential at a time when Social Security is facing calls for reform and companies have pulled back from defined-benefit pension plans. He himself relied on Social Security after losing both of his parents and moving in with other relatives.

“I get the critique, but legislating’s really hard. And I am not aware of anything other than sort of an academic exercise that says that, all of a sudden, we can go back to a defined benefit. Because if there were, I’d be the first one to champion it,” Neal said.

“This idea that this was a legislative effort to reward wealthy people is simply not founded and untrue,” Neal added.

Cardin acknowledged that more must be done to help lower-income retirees.

“Sen. Portman and I, along with many of our colleagues, worked to find reasonable solutions to help increase access, encourage increased savings, and expand access to retirement plans for working families,” Cardin said in a statement. “Importantly, we must do more to address the existing wealth disparities in our country to be able to adequately ensure … that all Americans have the opportunity for a secure and stable retirement.”

Portman cited how he learned from his father’s small business the importance of incentives for starting retirement plans.

“There are guys who I’ve known my whole life and over my age, who have built up a nice nest egg for retirement because of these defined contribution plans,” Portman said. “And so I’ve seen it work and I know how it works. And so my goal was when I got to Congress to try to expand it.”

However, a Portman-Cardin bill from 2021 is illustrative of how highly technical changes, receiving little scrutiny, can influence federal tax collection.

Lobbyists for a coalition of six groups succeeded in getting changes into a 2021 Portman-Cardin bill governing IRS oversight of private retirement plans. Fact sheets provided to POLITICO — which a Hill staffer said the lobbyists distributed to advocate for their proposal — sold the changes as fixes that would help elderly Americans, such as retired government and factory workers, who had inadvertently put too much in their retirement accounts and could face penalties from the IRS.

But the lobbyists were also targeting benefits for a different demographic. The head of the coalition, according to his biography, specializes in tax planning for “ultra-high-net-worth clients.” The coalition also included an advocacy group that has previously been tied to the Koch network — and which engaged in a massive lobbying campaign against efforts to restructure Puerto Rico’s debt that was owned by hedge fund managers in 2015.

Tax lawyers who reviewed the statutory changes said they would in fact make it far more difficult for the IRS to penalize supersized retirement accounts where owners avoided millions of dollars in taxes.

“The lobby power of these groups is tremendous,” said Rep. Lloyd Doggett (D-Texas), a member of the tax-writing House Ways and Means Committee. “There has been little lobby effort for [low-income taxpayers] and plenty of lobbying from those people in the financial services industry that benefit from those retirement plans.”

‘Common sense from the Heartland’

It wasn’t always that way.

In the two decades following the Employee Retirement Income Security Act of 1974 — the landmark legislation that introduced the standards that govern private sector retirement plans — both Republicans and Democrats were keenly sensitive to how tax-advantaged retirement accounts could erode the nation’s tax base and provide a windfall for wealthy people.

The Tax Reform Act of 1986 — a key part of President Ronald Reagan’s fiscal legacy — slashed tax rates and eliminated income taxes completely for an estimated six million low-income Americans. It did so, in part, by substantially lowering the amount of contributions that could be made to 401(k)s and placing greater restrictions on deductions for individual retirement accounts.

In remarks on the Senate floor in June of 1986, then-Republican Majority Leader Bob Dole (R-Kan.) touted the “revolutionary legislation” and implored colleagues to consider “common sense from the heartland” propounded by a Kansas newspaper that rejected the notion that limiting deductions for private savings would hurt the middle class.

The passage of the law, as memorialized in the book Showdown at Gucci Gulch, was an unlikely triumph over special interests that had had a stranglehold over the tax committees — and especially so in the case of retirement accounts, since the restrictions came in spite of lawmakers knowing that top beneficiaries were a source of campaign contributions.

The current retirement system, in which taxpayers can put hundreds of thousands of dollars a year into tax-advantaged accounts, started to develop in the 1990s, as the stock market boomed and the workforce became more mobile.

Investors were excited to see money accumulate in retirement plans they controlled, Munnell recalled. Meanwhile, employers with defined-benefit plans — which guarantee a monthly payment to retirees — were eager to get them off their books.

“It was a subject of cocktail-party conversation,” Munnell remembered. “Everybody thought they were a brilliant investor and doing so much better than the sponsors of defined benefits could do.”

The 1994 elections, which saw Republicans sweep the House with a promise of tax cuts, cleared the way for two junior members of the Ways and Means Committee, Cardin and Portman, to propose legislation to let taxpayers put away more income. At the time, the U.S. had the lowest savings rate in the industrialized world and advocates claimed that simplifying the pension system would encourage small businesses to provide more benefits.

“I think we need to do all we can to encourage private savings in this country for retirement,” Portman said in May of 1996. The American people “understand that Social Security is at risk and we need to encourage private savings so it will be there, particularly when the Baby Boom generation begins to retire.”

Besides creating a new kind of retirement plan geared toward small businesses, the first Portman-Cardin package repealed a rule coordinating how much individuals could put into both defined-benefit plans and 401(k)s — a change of enormous consequence that allowed wealthy taxpayers to max out both plans at once.

Suddenly, as a result of the repeal, a person who had fully funded their 401(k)s could also put over $79,000 into their defined benefit plans — up from less than $20,000.

The bill was a tremendous success for the junior lawmakers, and one year later the chair of the Senate Finance Committee, William Roth (R-Del.), proposed legislation creating an additional option. The so-called Roth IRA would reverse the structure of the traditional individual retirement account, from one that made the taxpayer pay taxes on their savings when they withdrew from their accounts to one that made them pay up front but withdraw from their accounts tax-free.

A big appeal of the Roth IRA was that it looked like it would raise revenue, since Congress only scores items in a 10-year window.

Lawmakers likewise proclaimed that they paid for the bulk of Secure 2.0 by “Rothifying” accounts, requiring that certain contributions be made on a Roth basis. According to a Democratic Hill aide who was intimately involved in the 1997 Roth bill and was granted anonymity to speak about legislative processes, the well-honed Washington budget gimmick originated on K Street as a “way to play budget games and make the numbers work.”

By the start of George W. Bush’s presidency, retirement account savings were starting to explode, with IRAs growing 79 percent to $2.6 trillion, and defined contribution plans growing 40 percent to $2.8 trillion between 1996 and 2001. But Portman and Cardin followed up by proposing a further package that would eventually be merged into the Bush tax cuts.

The legislation was a nexus between the demands of business owners, asset managers and unions. Among them was a so-called catch-up contribution, which allowed taxpayers over 50 to put $5,000 more into their employer plans every year.

The legislation increased contribution limits for 401(k)s and more than doubled the amount individuals could put in IRAs. It also relaxed something called the “top-heavy rules,” which prevented retirement plans from primarily benefiting small business owners at the expense of employees. Meanwhile, in a concession to union leaders, the legislation exempted retirement plans under collective bargaining agreements from rules that bar annual benefits from exceeding a worker’s salary.

“Only about half of American workers have any kind of pension at all,” said Portman on the House floor in July of 1999. “How can people save more for retirement? We have got a plan to do that.”

Portman said the $5,000 catch-up contribution “will be particularly good for women who have been out of the workforce raising kids and then come back into the workforce and want to build up a nest egg for their retirement.”

Cardin backed him up: “It is a well-balanced approach. Sure, one might want to pick at one provision and say, does this not help one special group? All of the provisions help all of our workers.”

The bill also saw the birth of a tax credit for low-income savers. The so-called saver’s credit was maxed out at a government match of $1,000 but research found that few ended up claiming the credit because those who qualified owed little to no tax to begin with.

After these changes, assets in IRAs and defined contribution plans accelerated sharply, growing by 72 percent in just six years. But Federal Reserve data was showing that the bottom quintile of earners was getting close to nothing of the action.

Between 1995 and 2007, the percentage of the lowest-income savers with retirement accounts grew only slightly from 8.9 percent to 10.7 percent. Meanwhile, the median account balances for the lowest-income savers dropped from $19,350 to $9,300. By contrast, the median balances for highest-income savers more than doubled.

Some lawmakers began expressing skepticism about whether tax-advantaged retirement accounts were helping average Americans.

Former Rep. Robert Matsui of California, a senior Democrat on the House Ways and Means committee, read a letter by a retirement-law professor on the House floor in June of 2002: “Many of the bill’s provisions were so technically complex that their unlikely impact could only be determined by pension experts. Thus, many in Congress uncritically accepted the lofty expectations of Representatives Portman and Cardin (and industry lobbyists).”

But that did not stop Portman and Cardin from, in 2006, passing provisions that made permanent the higher contribution limits. The law also removed legal impediments to “cash balance plans,” which allow wealthy taxpayers to shield hundreds of thousands of dollars a year.

Still, it would be more than a decade, until the start of the Trump administration, that Portman, Cardin and Neal would be able to advance retirement packages with the same kind of sprawling tax breaks.

Secure 1.0, passed in 2019, eliminated the age limit to contribute to IRAs — a provision that added to the government’s red ink but had little impact on lower-income Americans who need to begin withdrawing from their accounts as soon as they reach retirement age.

Then came Secure 2.0, passed under the Biden administration. It provided some tax incentives for small businesses to start retirement plans, expanded the government matching program for low-income savers and made student loan payments eligible for retirement “matches” by an employer. But the cost of the tax breaks for low-earners was still smaller than the provisions that benefited higher-earners, according to Munnell’s analysis.

Secure 2.0 dramatically raised the catch-up contribution people in their early 60s could put into their retirement accounts — an increase available only to taxpayers already maxing out the limits on their plans, which in 2023 was $30,000 a year, or $73,500 with a generous employer match. Together with Secure 1.0, it also increased the age at which taxpayers have to begin withdrawing from their accounts from 70 and a half to 75, allowing wealthy people to shield their savings from taxation for longer.

Portman, Cardin and Neal presented the bill as a way of helping the average American. “It is estimated that up to 50 percent of the individuals in America who go to work every single day do not have enrollment in a qualified retirement plan,” Neal said upon the introduction of Secure 2.0.

It was a variant of the same statistic lawmakers had been citing to promote sweeping retirement packages for a quarter century.

‘A David versus Goliath situation’

The rise of tax-advantaged savings is intertwined with that of powerful industry associations which spend tens of millions of dollars on campaign contributions and lobbying every year.

“The influence on retirement legislation of public interest and worker representatives versus industry’s influence is typically a David versus Goliath situation — but here Goliath generally wins,” said one person involved in retirement legislation who was granted anonymity to speak about the process.

Part of the reason the industry wins is its lobbyists’ technical expertise. Two of the most successful lobbyists are graduates of the Joint Committee on Taxation: Kent Mason, whose firm Davis & Harman lobbies for the American Benefits Council, an association of financial institutions and large companies offering retirement plans; and Brian Graff, who is CEO of the American Retirement Association. It represents more than 30,000 pension professionals, including actuaries, financial advisers and attorneys.

Both groups expanded along with tax-advantaged savings: In 1999, the American Benefits Council reported spending $120,000 on lobbying. By 2022 it was up to $1.3 million. Likewise, according to documents Graff shared on LinkedIn, revenues of the American Retirement Association grew from $1.7 million in 1996 to $23.8 million in 2022.

Together, Mason and Graff’s institutional knowledge of retirement policy dwarfs that of many staffers who craft and write the legislation. People involved with multiple bills say staffers regularly relied on Mason’s advice. They would reach out to him during the writing process to solicit edits on bill drafts and use his language as the starting point for provisions that would eventually become law — notwithstanding that his clients had billions of dollars on the line.

“They hear what the members [of the American Benefits Council] want and they’re able to translate it into statutory language, and then they’re able to take it up to the Hill and explain it to Hill staff, explain why this is good for the American retirement system, good for the American worker,” Michael Doran, who served two stints at the Office of Tax Policy at the Treasury Department, said of Mason and another prominent partner at Davis & Harman.

While at Treasury during the George W. Bush administration, Doran interacted with Mason and said he was deeply involved in crafting legislation.

“They would put it in the fax machine and send it over to Kent, and then Kent would edit it and send it back to them,” Doran recalls of the tax and labor committee staff members who wrote the bills. “Someone from the Democratic side would say to somebody on the Republican side, ‘Oh, you just got that from Kent Mason. You just stuck it in without even reading it.’”

Mason, who declined to be interviewed, said in a statement: “Like countless others, we provide input to Members of Congress and their staffs. The Members and staffs collect input from many sources and make policy decisions on the legislation and then draft it.”

Graff’s spokesperson said of his own involvement: “Brian’s nonpartisan Hill experience and 25-plus years as the CEO of a national organization of retirement plan professionals makes him a knowledgeable resource for members and staff in both parties who are advancing legislation to expand retirement savings options for all Americans.”

Lobbyists and industry officials don’t downplay their influence: Many have openly taken credit for provisions benefiting their clients.

At a 1998 House Ways and Means hearing, the head of the American Benefits Council said that provisions developed by the council had formed the basis of the first Portman-Cardin collaboration and that its ideas were in the bill that would be incorporated into the Bush tax cuts: “We are gratified that many of our more recent proposals for improving the retirement system were embraced by Representatives Portman and Cardin,” the lobbyist said.

They included the “catch-up” provision and allowing taxpayers to roll over retirement savings into different types of plans to prolong their benefits. In 2000, Mason’s firm received $140,000 from the American Benefits Council and $100,000 from the Edward Jones Company for his lobbying on catch-up and other issues.

Bill Sweetnam, who was head retirement counsel on the Senate Finance Committee at the time, noted that the different lobbying groups sometimes worked together but also complemented each other: The American Benefits Council concentrated on 401(k)s — its bailiwick — while banking groups pushed for expansion of IRAs.

“The IRA stuff would be much more the investment companies and the banks because those were the guys who sold the IRAs, so they were pushing to get the IRA limits up,” Sweetnam said.

Both lobbies were highly successful: The legislation ended up increasing limits on annual 401(k) contributions from 25 percent to 100 percent of a taxpayer’s salary, at a maximum of $40,000, while also more than doubling the amount taxpayers could put in their IRAs.

For its part, Graff’s American Retirement Association also pushed to raise limits on 401(k) contributions. The 2001 legislation increased the limits and enacted many other changes advocated by Graff’s group.

Graff and Mason continued to be key players in the latest iterations of the retirement packages, Secure 1.0 and Secure 2.0.

But there were other players in the mix: They included the Insured Retirement Institute, which represents the insurance supply chain from brokers to marketing firms; the American Council of Life Insurers, an approximately 280 member association of life insurance companies; and the Investment Company Institute, a sprawling association representing investment funds.

All saw their priorities reflected in the bills.

The American Council of Life Insurers gained a proposal it had long spearheaded to exempt companies from doing independent reviews of many insurers offering retirement products in employer plans.

Similarly, 14 provisions that the Insured Retirement Institute had been advocating for made it into Secure 2.0 — including, according to the institute’s lobbyist Paul Richman, two insurance-related provisions that the association conceived and developed. Richman said other retirement industry groups had put forward the other provisions.

But, Richman said, “All 14 were ones we had a hand in.”

The Investment Company Institute scored a provision allowing retirement plan providers to pool different plans together, which industry groups said would enable providers to slash administrative costs.

Another major priority for the institute was the provision allowing taxpayers to shield their savings until 75. The institute shared an email with POLITICO showing a staff member for Portman congratulating the group on Secure 2.0’s passage and thanking the group’s lobbyist for their assistance.

“Thank you again for all your help when we first put this together!” the staffer wrote.

Meanwhile, retirement lawyers who saw themselves as battling for the low-income saver said they were continually outgunned.

Phyllis Borzi, a former top employee benefits official at the Labor Department, said she and other former Labor officials operated as a “think tank in exile” on Secure 2.0, where they provided advice to staffers on reforms to help low-income savers.

However, Borzi said she was informed by a congressional staffer and several consumer advocates that provisions the group was proposing had been vetoed by the business community through Democrats on the House Ways and Means Committee.

Neal, the committee’s then-chair, said he knew nothing about any industry vetoes.

“It’s a separate conversation from me. Nobody said anything to me,” Neal said when asked about Borzi’s experience. “I gave the staff, in this instance here, considerable latitude. They’re really smart people.”

Spreading around campaign cash

In the recent years, as opportunities for increased campaign contributions became enshrined in law, the American Benefits Council, the Insured Retirement Institute and the Investment Company Institute significantly ramped up their donations to the campaign coffers of lawmakers who proved receptive to their agendas.

In March of 2014, when the American Benefits Council convened at the Sandpearl Resort in Clearwater, Florida, it staged a PAC fundraising breakfast for Georgia Sen. Johnny Isakson, then a senior member of the Senate Finance Committee and Committee on Health, Education and Pensions.

According to an invitation for the fundraiser, representatives of the council’s member companies’ PACs were suggested to contribute $1,000 to attend or $2,000 to co-host. A POLITICO data analysis shows that Isakson received at least $294,966 in contributions from PACs and executives of current member companies of the council for the 2016 campaign cycle, Isakson’s last reelection bid.

One of the main topics that weekend was a fiduciary rule — which would later be promulgated by the Labor Department and fiercely contested by industry groups — that would require investment advisers to give advice in the best interest of their clients and not their firms, according to Borzi, who also attended as a guest of the council. Isakson, as a member of the HELP committee, would have purview over fiduciary standards set by the Labor department and spoke about them in his speech to the council, Borzi recalled.

Fast forward to June 2017 and Isakson spearheaded legislation to block the Labor Department’s fiduciary rule on the eve of its implementation.

In the accompanying memo for members, the American Benefits Council laid out how it had made significant strides in promoting its policy priorities, hosting and attending more PAC events for lawmakers — 25 since the beginning of 2013 — than ever before.

“The Council’s PAC also substantially leveraged its ability to help elect or reelect candidates who support the employer-sponsored benefits system, by co-hosting and recruiting attendees for numerous additional fundraising events at which, in the aggregate, hundreds of thousands of dollars were raised,” the memo reads.

Davis & Harman — Mason’s firm, which represents the council — also holds fundraisers for lawmakers at its office, according to campaign finance records.

FEC records show that Portman’s campaign made 10 separate disbursements for room rental and reception expenses to Davis & Harman between 2009 and 2019. Neal’s campaign similarly made six disbursements, and Cardin’s campaign made two.

The industry also holds parties for lawmakers and Hill staff, such as a reception hosted by the Insured Retirement Institute before the 2022 Congressional Baseball Game attended by Neal and award ceremonies for lawmakers who are dubbed champions of retirement security.

Meanwhile, the number of campaign contributions to lawmakers has exploded, according to a POLITICO data analysis.

PACs and employees of companies belonging to the American Benefits Council gave $98.6 million for the 2022 cycle to lawmakers’ campaign and leadership PACs, right before Secure 2.0 was enacted.

PAC spending by those companies increased 7.8 times compared to the 2002 cycle, according to POLITICO’s analysis.

IRI, representing insurance firms, and ICI, representing asset managers, similarly multiplied their donations. During the 2022 cycle, the associations forked over through company PACs and employee contributions $16.5 million and $13.9 million, respectively. PAC contributions of IRI and ICI’s current member companies increased 7.6 times and 6.3 times as compared to 2002.

Other PACs belonging to associations that advocated for provisions in Secure 2.0 — such as the Securities Industry and Financial Markets Association — also lavished hundreds of thousands of dollars on lawmakers’ campaigns in the 2022 cycle.

Many times the industry dollars arrived at critical junctures.

During the 2019-20 cycle, Neal’s campaign received $760,350 from member company PACs and executives of the American Benefits Council, when the powerful tax writer was fending off a primary challenge from the left. That accounted for around 17 percent of his total campaign contributions, according to a POLITICO analysis of FEC records.

During that cycle, Neal’s campaign received $173,250 from PACs and employees of companies of the ICI and $223,450 from members of the IRI. Fidelity in Boston and MassMutual in Neal’s hometown of Springfield have been significant contributors, with Fidelity chair Abigail Johnson providing $5,800 to Neal’s campaign in 2022.

Portman similarly found the support of the retirement industry to be critical during a pivotal Senate election in 2016 against former Ohio Democratic Gov. Ted Strickland.

Member companies of the American Benefits Council through employees and their PACs rustled up $433,725 for Portman’s campaign, according to a POLITICO analysis. $198,650 from ICI members and $152,350 from IRI members helped shore up Portman’s war chest.

Portman crushed Strickland by double digits.

An open secret

Some members of Congress’ tax writing committees readily acknowledge the dominance of industry groups.

“I don’t think we were all aboard on the Democratic side,” Rep. Bill Pascrell (D-N.J.), a member of the committee who voted for Secure 2.0, told Tax Notes, suggesting lawmakers let asset managers have too much say.

“The people are close to the financial institutions in New York, from Schumer down,” he said, referring to Senate Majority Leader Chuck Schumer.

Senate Finance Committee member Elizabeth Warren (D-Mass.) said, “This story is all about money and power. And then money begets power. And then power begets more money.”

She also voted for the bill.

One reason for the lack of pushback is that retirement bills become sprawling legislative packages. Lawmakers focus on their favored policies and not the big picture. Warren, for instance, lauded the inclusion in Secure 2.0 of her own bill creating a database where people could find retirement accounts they had forgotten about.

Michele Varnhagen, who was labor policy director for the House Committee on Education and Labor, put it this way: “[Secure 2.0] had so many provisions. A provision often had to be seriously heinous to be able to say, ‘No, I’m going to walk away from bill support if you don’t take that out of the bill.’”

Borzi, however, said she advised retirement groups not to sign onto a package if “there are 99 things that are horrible and one thing that you like.”

But members of Congress made that difficult.

They “make it clear, although in a subtle manner, that the legislative process is always fluid and if you don’t write a general letter of support, your provision may not ultimately make it into the final package,” Borzi said.

Another challenge is the onslaught of data from industry players that paint a far sunnier picture than the Federal Reserve data.

“The retirement system has been very successful in our view, and as these policies come up, ICI leverages our research folks and our legal folks to talk to policy makers,” said Peter Gunas, a lobbyist for ICI.

For those writing the bills, an ex-Hill staffer armed with both compelling data and technical expertise is hard to turn away.

“You would get a lot of calls from people on the Hill,” said Sweetnam, who after working for Roth’s office and a stint at Treasury became a retirement lobbyist for Groom Law Group. “A lot of times, you have an understanding of how the legislation was crafted before. That’s really helpful. It’s helpful for a staffer to be able to talk to somebody who was involved in drafting the original bill.”

Varnhagen recalls that, as a junior Democratic staffer, she found it difficult to determine whether an ex-staffer turned lobbyist was offering friendly advice or doing their clients’ bidding. Newer staff don’t always research the lobbyists’ conflicts, she said.

“Investment firms don’t say that they’re lobbying for the firm. They say they’re lobbying for their account holders, for the millions of people that have money invested,” Varnhagen said.

The power of industry marketing may be most apparent in how catch-up contributions have been sold. Portman, Cardin and industry groups have insisted that catch-ups are geared for women who reenter the workforce. But a Hill staffer who wrote the catch-up language in the 2001 bill, granted anonymity to speak about the process, said that was merely a “talking point” to bring Republican women on board.

According to a 2023 report, men are 42 percent more likely than women to make catch-up contributions, with only those making $150,000 or more making significant use of the provision. Nevertheless, lawmakers have pushed those catch-up provisions for decades as ways to, in the words of the original bill, “enhance fairness for women.”

Haves and Have Nots

The success of the retirement industry and its advocates in Congress has put a sinkhole in the federal budget at a time when entitlements are under threat. While the cost to the Treasury for tax-advantaged retirement savings was $81 billion in 1995, it has since swelled to over $369 billion in 2023 and, in the wake of Secure 1.0 and 2.0, is expected to nearly double to $659 billion in 2027.

Defenders point out that Secure 2.0 expanded auto-enrollment of employees in new retirement plans, which studies show should boost participation by minority groups in 401(k)s.

Neal’s spokesperson, Dylan Peachey, noted that Neal has been working for decades to expand automatic enrollment and that Democrats scored an expansion of the saver’s credit, which would effectively operate as a direct government matching contribution, up to $1,000, for low-income taxpayers.

Congress shouldn’t “let perfect be the enemy of the good,” Peachey said.

For many advocates, the saver’s credit is what made Secure 2.0 worth enacting at all. However, a Senate Finance Committee spokesperson said that the credit in Secure 2.0 was reduced from $30 billion to $9 billion, because that was all Democrats could get in bipartisan negotiations.

The lack of proportionality in retirement bills — combined with relatively low uptake of the savers credit — has caused some experts to question the fundamental efficacy of the 401(k) system. Notably, Munnell and Andrew Biggs, a retirement scholar at the conservative American Enterprise Institute, have proposed repealing the entire system of tax-advantaged savings accounts to shore up the Social Security system.

“I don’t think they increase savings in a meaningful way,” Munnell said. “In my view, in terms of getting the 401(k) system to work, we’ve kind of done everything that can be done in terms of making it work better.”

Other tax policy experts have suggested simply cutting the contribution limits to levels reasonably attained by the vast majority of Americans.

However, any changes would have to get past the gauntlet of industry groups, who have shown they’ll spend huge sums to block policies detrimental to their interests.

“We’re encouraging [lawmakers] to not touch the current law,” said the IRI’s Richman. “In all our discussions with members of Congress, we remind them about how [tax-deferred treatment of retirement savings] helps people save and encourages people to save.”

Meanwhile, a bipartisan group of lawmakers is proposing a new government savings system run by the Treasury Department for workers who don’t have access to private plans. The bill would also offer a government match of up to 4 percent to low-income workers who put savings in such accounts.

House Ways and Means committee member Lloyd Smucker (R-Pa.), who sponsored the bill alongside six Republicans and three Democrats, acknowledged that provisions from Secure 2.0 like catch-ups do not reach low-income taxpayers at all.

“Definitely not,” Smucker said. “Most of them have no retirement savings at all.”

Finance committee member Thom Tillis (R-N.C.), who is a co-sponsor of the Senate version of the bill, said such provisions are “not something that the vast majority of the American people are even blessed to be able to contemplate.”

Lobbyists are fiercely working to oppose the legislation, which they see as an existential threat to the private system of tax-advantaged plans — with the ARA and the ICI spending $1.6 million and $5.1 million respectively in 2023 on provisions that prominently list the bill. Davis & Harman was likewise paid $210,000 by the American Benefits Council in 2023 to lobby on bills that include the proposal.

At an April, 2023, retirement industry “summit” in San Diego, the ARA’s Graff alerted the large audience to the threat of a new government alternative to private plans. According to an article by an ARA subsidiary on the event, Graff said one of the arguments driving the proposal was the ongoing coverage gap where 60 million people have no retirement savings at all.

Indeed, after more than a quarter-century of expansion of private retirement legislation aimed specifically at solving this problem, the number has barely budged.

“At some point, people in Washington, D.C. are going to grow tired of this systemic coverage gap and they’re going to start pushing for some type of federal intervention,” Graff said. “We need to make clear that a federally run retirement system will never be acceptable.”