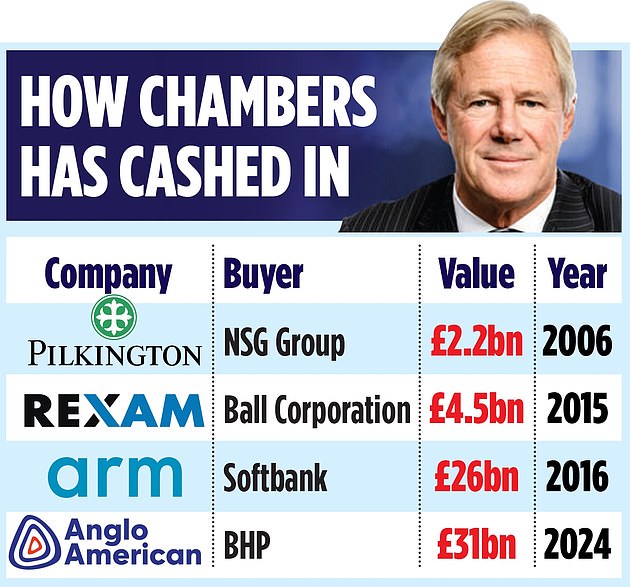

- Another business led by Stuart Chambers is at risk of being sold to a foreign predator

- Mining giant Anglo American forced to defend President Chambers’ record

- He has presided over the sale of a number of blue-chip companies.

Town grandee Stuart Chambers is under fire as another British company he runs risks being sold to a foreign predator.

Mining giant Anglo American was forced this weekend to defend the record of Chambers, its chairman, after receiving a £31bn bid from rival BHP.

Chambers, who has presided over the sale of a number of blue-chip companies, rejected BHP’s full share offer to create the world’s largest copper miner.

He said the offer was “opportunistic” and significantly undervalued the London-listed company.

But critics point out that Chambers, 67, has a history of selling other well-known companies when he was at the helm. He also has close links with Sir Nigel Rudd, nicknamed Sir Sell Off after presiding over the sale of a number of iconic British firms.

Driving force: Stuart Chambers has presided over the sale of a number of blue-chip companies

City insiders say Anglo, which also owns the De Beers diamond group and the Woodsmith mine in north Yorkshire, is firmly “in play” as other rivals could also swoop in with a bid. Most controversially, Chambers oversaw the £26bn sale of local chip designer Arm Holdings to Japanese investment company Softbank in 2016.

Arm snubbed London to list on the New York stock exchange, where it is now valued at more than £80 billion.

Chambers was chairman of FTSE 100 drinks can maker Rexam when it was bought by US rival Ball Corporation in 2015.

He was also chief executive of glass manufacturer Pilkington, one of Britain’s most iconic companies, when it was bought in 2005 by Japan’s Nippon Sheet Glass. He went on to run that company. The chairman of Chambers in Pilkington was Rudd, who oversaw the sale of companies such as retailer Boots, defense giant Meggitt and engineer Invensys to foreign owners.

A senior City adviser told the Mail on Sunday that Chambers still deeply regrets the sale of Arm, which highlighted the growing inability of the London stock market to attract and retain top companies. However, an Anglo-Saxon source insisted that Chambers was “not remotely embarrassed” by the sale of Arm and claimed that his critics were “in the rear-view mirror”.

“The president does not make these decisions alone, it is up to the board and then the shareholders to decide,” the source said.

“It is simply not a reality that one individual controls events.” Analysts say Sydney-based BHP will have to come back with a higher offer to win over Anglo shareholders. Under City takeover rules, BHP has until May 22 to make a firm offer for Anglo or walk away.

The rush by British companies to exit has accelerated this year as Darktrace agreed on Friday to a £4.2bn sale to a US suitor in the latest blow to London.

Jeremy Hunt will hold a summit next month at the Chancellor’s weekend residence, Dorneywood, aimed at stemming the exodus.