The tax on sugary drinks has significantly reduced the amount of sugar people eat and drink, according to a study.

A year after the controversial tax increased the price of sweet drinks, Children consumed 4.8 grams less sugar per day, while adults had a 10.9-gram lower intake.

Most of this drop was due to a lower intake of sugar from soft drinks: children’s daily sugar intake fell by 3 g and adults’ by 5 g.

However, researchers found that people are still consuming too much sugar overall and are not meeting UK or World Health Organisation (WHO) guidelines.

Experts estimate that the sugar tax on soft drinks, introduced in 2018, has reduced the number of under-18s having a tooth extracted due to tooth decay by 12 percent (file image)

Sugary drinks account for about 30 percent of added sugars in the diets of children ages one to three and more than half for older teens (File Photo)

In April 2018, the government introduced a two-tier sugar tax on soft drinks to protect children from excessive sugar consumption and tackle childhood obesity.

It added 24p per litre to drinks with higher sugar content and 18p per litre to those with lower sugar content. Sugar-free and diet drinks were not affected, as was unsweetened juices.

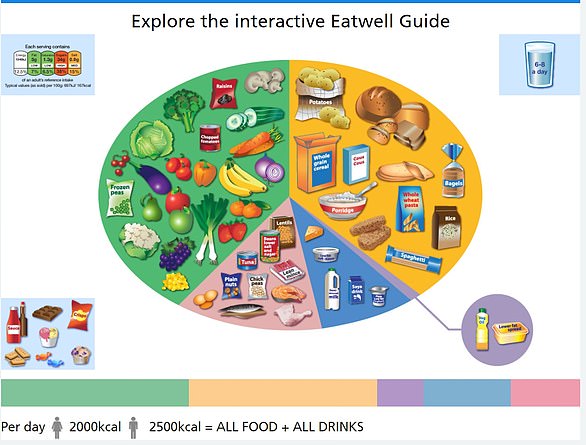

The type of sugars that most adults and children in the UK consume in excess are known as ‘free sugars’.

Soft drinks are a major source, but other foods with added free sugar include biscuits, chocolate, flavoured yoghurts and breakfast cereals.

The sugar present in honey, syrups, fruit juices, vegetable juices and smoothies occurs naturally, but is also considered free sugar.

According to the latest available data from 2018 (shown in the chart), Britons consume an average of four sugary drinks a week, including colas, lemonade, energy drinks and fruit-flavoured drinks. Our total was also much higher than the 2.8 drinks recorded in France, 2.7 in Germany and 3.1 drinks a week in Australia.

Previous research has linked sugary drinks to obesity, type 2 diabetes, heart disease and premature death.

For the new study, published in the Journal of Epidemiology and Community Health, experts from the University of Cambridge and University College London analyzed data from 2008 to 2019 to explore sugar trends over time.

In total, 7,999 adults and 7,656 children were included in the final analysis.

The experts found a drop in sugar consumption following the introduction of the tax and concluded that it “led to significant reductions in the consumption of free sugar in the diets of children and adults”.

They said the energy people got from free sugar as a percentage of total energy did not change, indicating that calories from free sugar were decreasing at the same time as overall caloric intake was decreasing.

They said that in children, a daily reduction of 4.8 g of sugar is equivalent to approximately 19.2 calories out of a daily intake of approximately 2,000 calories, which is equivalent to a reduction of approximately one percent in energy intake.

Although evidence suggested that sugar intake from sweet drinks fell as a result of the controversial UK tax, it was unclear whether people had switched to different, untaxed sources of sugar.

The largest contributor to free sugars in children aged 4 to 10 years are cereals and cereal products, followed by soft drinks and fruit juices.

Among 11- to 18-year-olds, soft drinks are the largest single source (29 percent).

For adults, the largest source of free sugars is sugar, preserves and sweets, followed by non-alcoholic beverages.

The decline in free sugar consumption seen across the diet, rather than just in soft drinks, suggests that free sugar consumption from food was also declining since 2008. The researchers suggest this could be due to public health signals following the announcement.