Table of Contents

The Government should organize an inheritance tax raid on unspent pension funds and close other loopholes, says leading think tank the Institute for Fiscal Studies.

Pension funds are outside the inheritance tax net and by including them in it, the Government could raise an extra £200m in revenue, its research claims.

Currently, outstanding defined contribution pensions of loved ones who die before turning 75 can be transferred tax-free, while unused retirement funds transferred by those who die after age 75 are subject to income tax. in retreats.

But the IFS says the Government should end the pension benefit and close other loopholes, imposing IHT on AIM shares and limiting business and farming relief.

Loophole: Pensioners with enough money to avoid using their pension fund can use it as a way to avoid inheritance tax

The amount of money subject to the pension fund’s exemption from inheritance tax will continue to rise, the Institute for Fiscal Studies has warned.

He said the Government would gain £400m in tax revenue between 2029 and 2030 if defined contribution pension funds were included in the estates. And the IFS said the Government could raise between £1bn and £2bn “over the coming decades” if pension funds were taxed.

The inheritance tax “exclusions” were criticized by the IFS, which said they allowed the very rich to pay considerably lower overall rates. While the transfer of unused pension funds contributes to this, a large part comes from aid to businesses and the transfer of tax-free agricultural land.

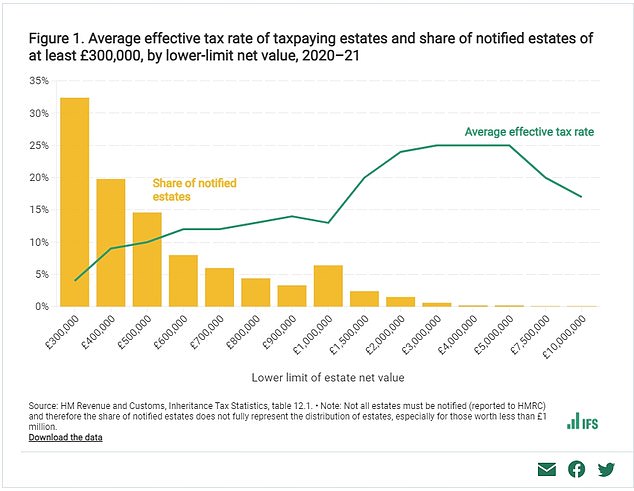

The IFS states: ‘These reliefs are the most used by large assets. As a result, despite a general tax rate of 40 per cent, the effective rate of inheritance tax paid peaks at 25 per cent for estates worth between £3 million and £7.5 million, before decrease to just 17 per cent for properties worth £10. million or more.’

Inheritance tax is charged at 40%, but only above the tax-free thresholds. This means that the average effective tax rate remains below that figure. But while it peaks for properties between £3 and £5 million, it then starts to fall substantially due to tax planning by the very rich.

One criticism of the pension exemption is that it means wealthier people, who do not need to rely on their money to fund their retirement, are advised to use it as a way of passing on their wealth without the impact of inheritance tax.

Mubin Haq, chief executive of abrdn Financial Fairness Trust, said: ‘A key factor undermining support for taxes is the public perception that there are loopholes that a small minority are exploiting.

‘That is the situation facing inheritance tax, with countless reliefs available. Clamping down on some of the main exemptions could increase the amount raised through inheritance tax by more than a fifth.

“That represents more than £2 billion of additional revenue by the end of the decade, which could fund our overstretched public services.”

Unfair benefit or fair exemption? Pension funds and IHT

Currently, defined contribution pension funds (the most common type of workplace pension in the UK) can potentially be transferred tax-free when someone dies.

Pensions are excluded from inheritance tax, which is charged at 40 per cent, but are potentially subject to income tax.

For those who die before turning 75, a pension can be transferred free of charge to income tax for the beneficiaries. Last year the Government abandoned plans to tighten rules on legacy pensions for those under 75.

Those who die after age 75 will see their beneficiaries collect income tax on withdrawals from a pension fund that rolls over, which could be taxed at 20 per cent, 40 per cent or 45 per cent.

Close the loopholes and reduce the tax rate?

The IFS maintains that there are other gaps that should also be filled.

He says this will make the system fairer and also raise money which could then be used to reduce the main inheritance tax rate of 40 per cent.

Among the exemptions highlighted by the group of experts, the ability to transfer agricultural land stood out.

This was created to prevent families from being forced to sell farms, but has led to substantial investments in farmland by very wealthy people, who can then pass it on tax-free.

Instead of closing this loophole, an additional exemption was added in the Spring Budget, allowing uncultivated agricultural land to be transferred tax-free.

This was proposed as a way to support conservation efforts.

Although it only represents a loss of around £5m in income a year, the IFS says the new exemption “illustrates a key economic and political problem with an inheritance tax system that gives special treatment to some assets”.

‘Once a relief is created, there is always an argument for expanding its scope to avoid some injustice at the margin. “The root of the problem is the creation of the special relief in the first place,” the IFS said.

He said the Government loses £400 million every year due to agricultural exemptions.

Loser: IFS says Government could raise billions by cutting inheritance tax loopholes

David Sturrock, senior research economist at IFS, said: ‘Inheritance tax is riddled with special reliefs and exemptions which make the tax unfair. The Spring Budget introduced another relief to this long list.

‘Rather than gradually withdrawing more and more assets from the tax, the government should take steps to reduce or eliminate some of the main exemptions from the system.

“Eliminating the special treatment given to some stocks, limiting relief for business and agricultural assets, and including pension funds in the scope of the tax would make the system fairer and increase revenue.”

Shares on the London Stock Exchange’s AIM market are completely tax-free if they have been held for at least two years before someone dies.

This was designed to support support for smaller, riskier companies, but has also created greater investment in these stocks among wealthy older people to capitalize on them. Removing this could raise £1.1bn this financial year, according to the IFS, and would rise to £1.6bn in 2029-2030.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.