- Amazon’s billionaire founder bought two properties on Indian Creek Island

- Last week Bezos revealed that he will sell 50 million Amazon shares over the next year.

- By moving to Florida, Bezos has saved at least $610 million in sales taxes.

It has been revealed that Jeff Bezos’ move to Miami will help him save more than $600 million in taxes over the next year.

The billionaire Amazon founder announced he was leaving his former home in Seattle last year to move to Miami, purchasing two properties on the ultra-exclusive Indian Creek Island, nicknamed the “billionaire bunker.”

Bezos said the move was to be closer to his parents and to rocket launches at his Blue Origin space company, but it also carried a significant tax benefit.

Florida has no state income tax or capital gains tax, while Washington introduced a 7 percent capital gains tax on stock or bond sales of more than $250,000 in 2022.

Last week, it was revealed that Bezos had launched a pre-scheduled plan to sell 50 million Amazon shares by January 31, 2025. By moving to Florida, he has saved at least $610 million in taxes on this sale of 8,700 millions of dollars. CNBC reported.

The billionaire Amazon founder (pictured with fiancée Lauren Sánchez) announced he was leaving his former home in Seattle last year to move to Miami.

By 2025, his Florida tax savings would cover the cost of Koru, the $500 million superyacht he bought last year.

The businessman, who is the second-richest person in the world according to the Bloomberg Billionaires Index, filed a statement last week with federal regulators indicating an initial sale of nearly 12 million Amazon shares.

It notified the United States Securities and Exchange Commission (SEC) of the sale of 11,997,698 common shares on February 7 and 8 for a value of more than $2.04 billion.

With this sale alone, Bezos saved $140 million that he would have paid to the state of Washington, according to CNBC calculations.

Indian Creek Island, overlooking Biscayne Bay, is famous as the “Billionaire Bunker” thanks to its mega-rich residents. It has been revealed that Bezos’ move to Florida will help him save more than $600 million in taxes over the next year.

Bezos bought a three-bedroom property in Indian Creek for $68 million in June last year.

The Amazon founder also purchased his neighbor’s mansion for $79 million in October 2023.

The nine-figure sum that Bezos is expected to save by selling his shares over the next year means Amazon’s share price remains stable at its current level.

If the value of the stock continues to rise, your tax savings would also be even greater.

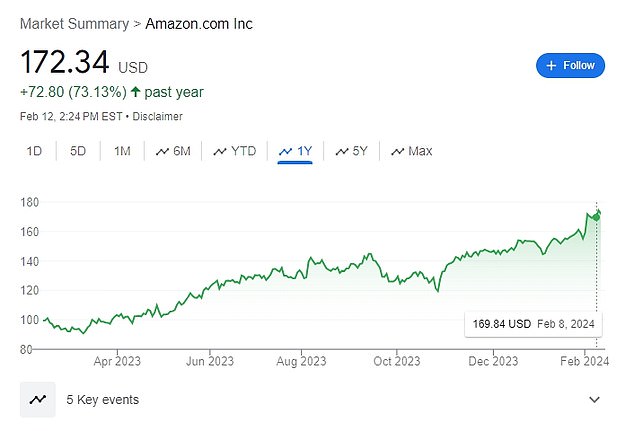

Amazon has seen its stock price rise steadily over the past year.

He the technology stocks called “Magnificent 7” Apple, microsoftAlphabet, Amazon, Nvidia, Goal Platforms and Tesla was responsible for the vast majority of the S&P 500’s 24 percent growth in 2023.

And earlier this month, the retail giant reported that it had raised $170 billion in the final quarter of last year thanks to a surge in holiday shopping.

Amazon’s financial results beat analysts’ expectations and sent the stock soaring more than 8 percent in after-hours trading on Feb. 1.

Amazon, one of the so-called ‘Magnificent 7’ tech stocks, has seen its share price rise steadily over the past year.

By 2025, Bezos’ Florida tax savings would cover the cost of Koru, the $500 million superyacht he purchased last year, according to CNBC.

Fourth-quarter revenue increased 14 percent compared to the same period last year. Analysts on average expected revenue of $166.21 billion, according to LSEG data.

Bezos has been selling billions of dollars worth of Amazon stock since 1998 to fund his philanthropy, his space company and, most recently, his superyacht and a growing number of properties.

He resigned from the position of CEO of Amazon in 2021.

Bezos and his fiancée Lauren Sanchez own several properties on Indian Creek Island, along with retired NFL star Tom Brady and former first daughter Ivanka Trump.

Bezos bought two mansions for $147 million and is reportedly looking to buy three more homes on the island.