Nashville’s world-famous music scene took a major hit after one of its most iconic venues filed for bankruptcy last week.

Plaza Mariachi filed for Chapter 11 bankruptcy on July 1 amid an ongoing fraud investigation into its owner and an attempt by a bank to auction off the venue.

First Republic Bank, which is owed about $11 million in loans, foreclosed on the beloved Hispanic retail center and store on June 6.

The bank said it was looking to auction the property on July 2, but the company filed for bankruptcy the day before, halting the sale.

The development comes after Plaza Mariachi owner Mahan Janbakhsh was charged with bank fraud last month. Janbakhsh faces federal charges for falsifying assets.

Plaza Mariachi filed for Chapter 11 bankruptcy on July 1 following a foreclosure

Plaza Mariachi owner Mahan Janbakhsh faces federal charges for falsifying assets

“Mark Janbakhsh has pleaded not guilty and is vigorously defending himself against the charges,” a representative told DailyMail.com on Monday.

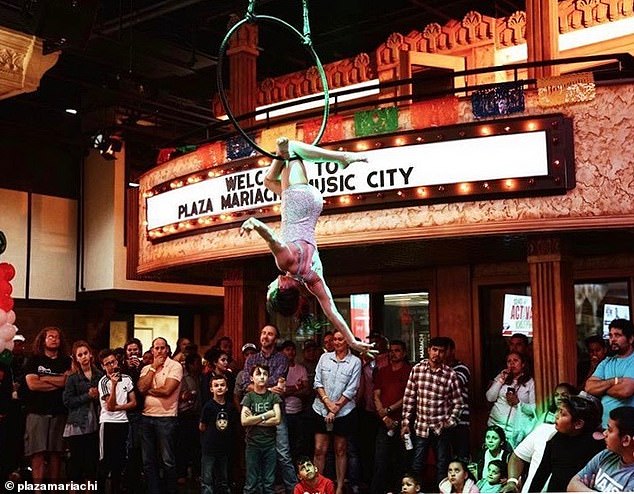

Today, the venue remains open and offers its usual offering of music concerts, salsa nights, Mexican cuisine and shopping.

Janbakhsh insists that Plaza Mariachi is not actually in financial trouble, but simply was unable to pay its loans in full as their terms expired earlier this summer.

A representative of the company He told The Tennessean that the company had been meeting its monthly payments on the loans but could not repay the $8 million principal balance at the end of the term.

“That’s what’s causing the foreclosure and Chapter 11, which we’re confident we’ll emerge from in a stronger position,” Plaza Mariachi representative Randy Hinger said in a statement.

We believe it is crucial for the public to understand that Plaza Mariachi was not behind on loan payments, which is an important aspect of the foreclosure and subsequent Chapter 11 bankruptcy filing.

The company will now attempt to restructure its debts and assets under court supervision.

The sale has been temporarily halted for the next six days, David Anthony, an attorney representing First Financial Bank, told The Tennessean on Tuesday.

The venue is still open today and offers its usual array of music, shopping and dining.

The company will now attempt to restructure its debts and assets under court supervision.

If the company makes interest payments on its debt or files a court-approved reorganization plan, the suspension will likely remain in effect, Anthony added.

“If there is no voluntary dismissal, then in 60 days the automatic stay will still be in effect and there will be no foreclosure,” Plaza Mariachi’s attorney Sean Wlodarczyk also confirmed to the publication.

“The idea behind this is that the bankruptcy code prevents an overly aggressive creditor from selling property to individuals or companies that are reorganizing their debt through the bankruptcy process,” he explained.

Plaza Mariachi plans to “sell the outlying properties surrounding Plaza Mariachi as part of a restructuring and remortgage to continue operating under terms that are attractive to a different lender,” the company said in a statement Monday.