Table of Contents

- Nearly Half of Baby Boomers Plan to Leave Their Home in Their Will, Study Finds

- More than two thirds of these properties are already mortgage-free

- Farewill also analyzed trends in charitable giving, prized possessions, and more.

<!–

<!–

<!– <!–

<!–

<!–

<!–

Many millennials are in line to inherit a fully paid-for estate from older generations, research into recently written wills reveals.

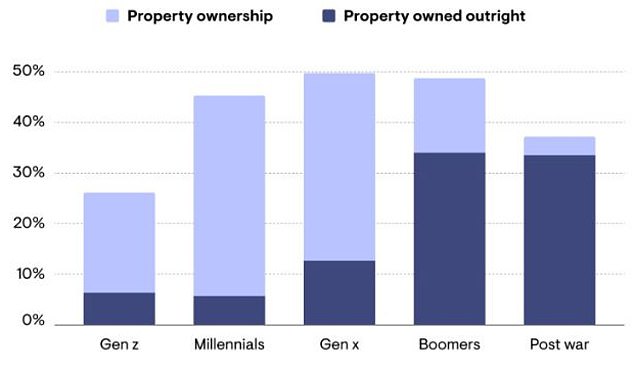

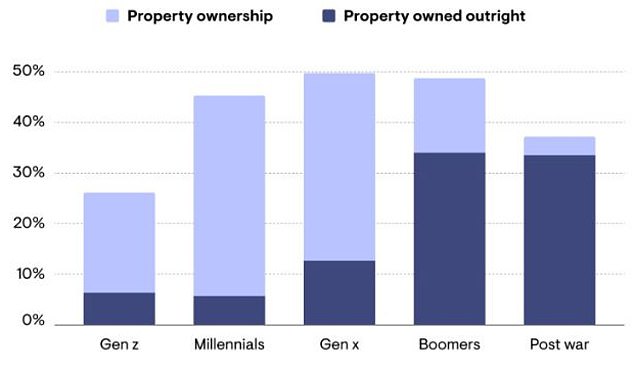

Almost half of baby boomers, born between 1946 and 1964, plan to leave a home in their will and two-thirds of these properties are already mortgage-free, according to an analysis of thousands of wills made last year with Farewill.

Only a third of baby boomers born before 1945 have property to bequeath, although 90 per cent of those who can do so own their home outright, according to the will-writing service.

Property ownership: Many millennials are in line to inherit mortgage-free homes from baby boomers, wills study finds

The figures reveal that millennials are likely to strike gold with their inheritance, which will be a welcome gift, says Farewill.

While 45 percent of millennials, born between 1981 and 1996, included property in their will last year, only 13 percent owned it directly, the firm found.

Home ownership is more common among Generation X, born between 1965 and 1980, but the vast majority also continue to carry a mortgage.

“In a year when financial restrictions became tighter for many, bricks and mortar remained popular with Brits,” says Farewill.

“Baby boomers are by far the most generous when it comes to leaving property behind.”

Farewill analyzed anonymous wills made through its service to determine ownership trends across generations: Generation X is more likely to own a home, but is still in debt to lenders.

“Despite the cost of living crisis, people can still leave property to their loved ones in their wills,” says CEO Dan Garrett.

“With nearly half of Baby Boomers leaving property in their wills, this gesture could significantly impact millennials, a generation struggling to own a home due to financial constraints.”

He adds that his firm’s analysis of wills highlights generational differences in property ownership, but also the potential for wills to address some aspects of the housing affordability crisis and socio-economic changes between generations.

The company’s study also found:

– Charitable donations were as high in 2023 as in previous years, despite the rising cost of living.

– More than one in four will writers left a donation to charity in their will.

– Generation Z, born between 1997 and 2012, was the most likely to leave a gift to charity.

– Around 31 per cent did, although Farewill suggests this is because they are less likely to have young dependents.

– The financial restriction affected the number of shares and participations in wills that remained, 14 percent less than in 2022.

– More than 37 percent left a plan for a pet in their will, up 7 percent from the previous year.

– Jewelry was the most common treasure left in a will.

– Generation Z was less likely to leave jewelry behind, but was much more likely to leave clothing, shoes, and other miscellaneous items than previous generations.

– Generation X was 50 percent more likely to give up a watch than any other generation.

Write a will? How to start

Farewill offers the following advice.

Start by asking yourself these questions and writing them down on paper.

Who do I want to inherit my money and property?

What do I want each of my loved ones to get?

Do I want to leave money to charity?

Is there a specific gift I would like to leave people?

Make a list of people you trust, since your will allows you to name legal guardians for your children, who must take care of your pets, and your executors who will take care of everything when you are away.

This could include your partner, children, parents, siblings, and your best friend.