There is a popular political economic narrative in the UK that the Conservatives like to impose tax cuts on the rich at the expense of everyone else.

One of the many curiosities of the conservatives’ years of ups and downs in power is that the opposite has happened.

An intriguing look at the Conservatives’ fiscal record over the past 14 years arrived this week from the Institute for Fiscal Studies.

It revealed how income taxes have increased substantially for people with higher incomes, but have been reduced for people with middle and lower incomes.

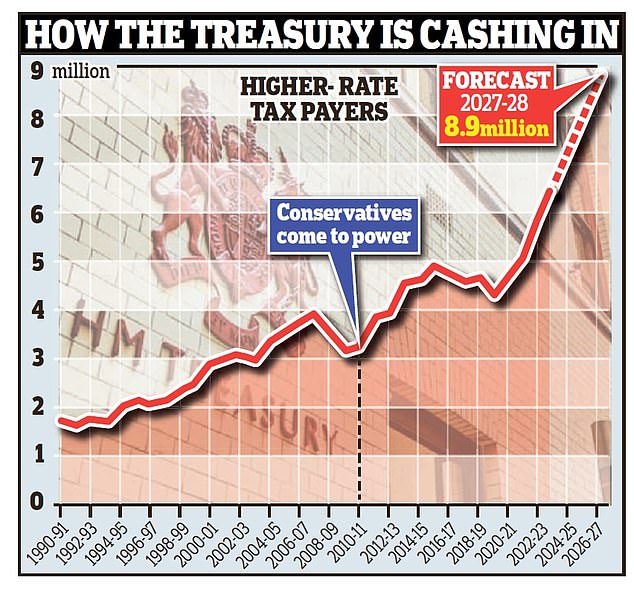

Land grabs: Higher income tax rates applied to 3.3 million people in 2010; now they reach 7.4 million and the figure will continue to increase, says the IFS

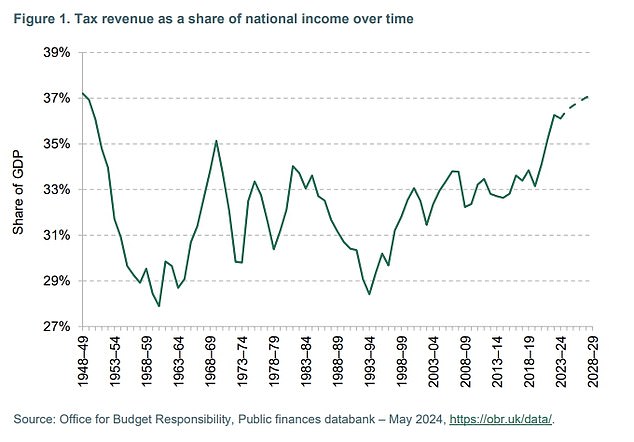

We are used to hearing that Britain has the highest tax burden since 1948. Measured by tax revenues as a proportion of national income, it is currently 36 per cent and rising, inches from the post-war high of 37 per cent.

Yet somehow this has managed to happen at the same time as most of Britain got a tax cut.

This is largely due to the period from 2010 to 2019, when the Conservatives substantially increased the personal allowance from £6,475 to £12,500.

But how do we end up with such a high tax burden at the same time?

The answer is that the number of people paying higher tax rates has more than doubled, from 3.3 million in 2010 to 7.4 million today.

This means we now have 13 per cent of the adult population paying taxes of 40 or 45 pence, compared to 6 per cent when the Conservatives came to power in the Coalition Government.

To put this into perspective, the IFS report points out that if the proportion had remained stable, today we would have 3.6 million taxpayers with higher rates.

This colossal land grab has been achieved in two ways.

The top rate threshold was initially lowered between 2010 and 2014, when David Cameron and George Osborne’s government began substantially increasing the tax-free personal allowance.

His 2014 election manifesto then expressed a desire to raise the tax threshold to £50,000 and it was raised for the rest of the decade by Chancellor Osborne and then his successor Philip Hammond.

If the positive side for the Conservatives on taxes comes from the increase in the personal allowance, the negative side comes from the freezing of the tax threshold since 2019.

Conservatives have radically redefined what it means to have higher incomes and then hit them with taxes.

This colossal, sneaky tax raid has dragged many more people into higher tax rates.

The IFS says the current threshold of £50,270 for a 40 per cent tax is 23 per cent below what it would be if it had risen with inflation since 2010.

Conservatives have radically redefined what it means to have higher incomes and then punished them with taxes. The rise in the cost of living since 2010 indicates that the benchmark should be £65,000; the Conservatives have instead decided that the hurdle is £50,000.

Meanwhile, the tax burden on top earners has risen further, as the quirks at the top end of the tax system become increasingly caught in its web, and the 45p tax threshold has been reduced substantially, from £150,000. at £125,140.

The 60 per cent tax trap when the personal allowance is removed affects those earning much less compared to when the Conservatives took power in 2010, as the £100,000 threshold has not moved. If it had risen with inflation, it would be £160,000.

A higher tax burden on fewer shoulders: Taxes as a proportion of national income have risen near their post-war peak, even though most people saw a tax cut.

The IFS says: “The freezing of thresholds has led to particularly large increases in the number of people facing either the additional rate, currently 45 per cent, or the withdrawal of personal allowance, creating an effective rate of 60 percent”.

The IFS estimates there are now 1.6 million people paying marginal tax rates of 45 per cent or more.

This has led to an increase in the proportion of taxes paid by higher earners.

The share of income tax paid by the top 10 percent of taxpayers has increased from 53.5 percent in 2010 to 60.3 percent today.

Meanwhile, the top 1 per cent of UK adults with incomes over £160,000 paid around a third of all income tax last year, compared to a quarter 20 years ago.

The IFS says: “While taxes have risen substantially for those on higher incomes, income tax and NICs have been cut overall since 2010 for the majority of people who pay them, as a result of increased reliefs tax free and the recent reductions in the main NIC rates.

‘In fact, income tax and employee NICs now absorb a smaller fraction of the income of a full-time, childless average earner than at any time for almost 50 years – a surprising fact when is juxtaposed with the fact that overall tax revenues as a proportion of national income are at their highest level in 75 years.

We also have more pensioners paying more tax, as their income has increased while their personal allowance has become equal to that of workers, and they do not benefit from the national insurance cuts, as they do not pay NI.

Beyond personal taxes, the IFS report dispels another myth: that the Conservatives favor low taxes on businesses and wealth rather than reducing the burden on ordinary workers.

He says: ‘More revenue is also being raised through corporate profits taxes and capital taxes. By 2028-29, capital tax revenue will have almost doubled since 2010-11.

One thing the report does highlight, however, is the yo-yo nature of fiscal policy – with major tax reversals – and the increasing complexity arising from new taxes, reliefs, exclusions and other manipulations.

And this is a major problem we face. The UK tax system is a disaster, as I wrote last week, and by taxing those who earn more by stealth and trickery rather than through deals more, you lose their support and faith in the whole thing.

The danger is that a Labor government that does not want to be seen breaking its promise not to raise income taxes – and has seen all stealth options exhausted – will turn to wealth instead.

Taxing wealth is notoriously complicated and that’s why most countries don’t do it

And that is another tax argument.

However, taxing wealth is notoriously complicated and that’s why most countries don’t do it, and the UK doesn’t do it anymore.

It’s hard to tax wealth that’s just sitting there. While people may have healthy savings or investments, a stake in a company or an expensive house, taxing that means they have to foot the bill with their income or are forced to sell parts of it, which will likely lead to a serious crisis. . reaction.

Instead, wealth can be taxed more subtly at the points where movement occurs, buying and selling investments, withdrawing cash from a pension, buying and selling homes, death, etc.

We already do and the Conservatives have increased taxes here: capital gains tax relief cut, frozen inheritance tax threshold, frozen Isa limit, pension savings limits etc.

There are concerns that Labor will make some kind of attack on wealth, but perhaps they have less room for maneuver and more opportunities to get it wrong than people think.

But perhaps there is a better way forward than arguing over who will raise whose taxes and by how much.

Instead, it would be nice to hear a party come out and talk about other things we can do to keep our taxes down, get the economy starting to grow properly again, and get our incomes up.

We need clear commitments to increase their profits by £10,000 and win the UK back the support of the US, France and Germany.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.