Table of Contents

Since mortgage rates began to rise, many of the UK’s nine million mortgaged households and almost two million homeowners have faced the prospect of much higher repayments.

Before that, many had become accustomed to extremely low interest rates for more than a decade.

In this six-part series, we look at how much more people are actually paying when they take out a new mortgage, how households are coping, and whether a mortgage crisis is underway.

Last week we looked at how much more people pay when they want to remortgage. We are now investigating how many people find themselves unable to meet these higher payments, meaning they find themselves facing mortgage arrears or even repossession.

Crisis point: For households with a mortgage, this typically represents by far the largest portion of their overall monthly expenses.

Households spend their savings

A household’s ability to meet higher mortgage repayments depends to some extent on the amount of its savings.

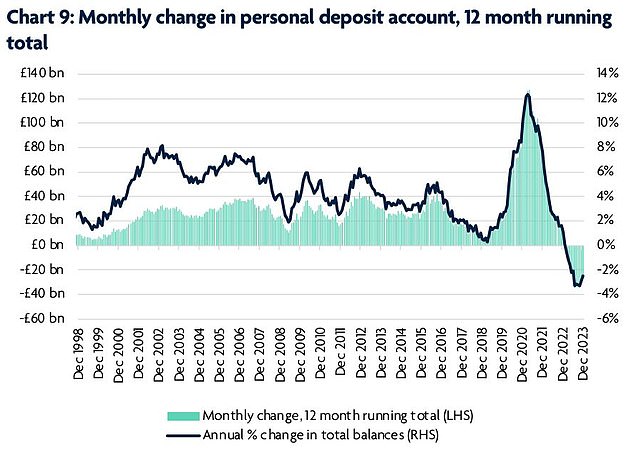

The amount of savings held by households fell every month last year, according to the banking and financial services industry trade association UK Finance.

This trend was last seen 25 years ago and suggests some borrowers may be dipping into their savings to meet higher costs, including higher mortgage repayments.

Savings raid: last year, the total level of savings held by banks saw a sustained decline

Lee Hopley, director of economic research and analysis at UK Finance, said: “This clearly demonstrates the strain that cost of living pressures continue to put on households.

“Following the accumulation of savings during the period of social restrictions linked to the pandemic, savings levels are still well above trend.

“But while it is obviously a good thing that households have this extra savings that they can draw on whenever they need it, this masks the fact that not all households have been able to build up these reserves.”

Households also reduced their unsecured debts. Overdraft levels continued their downward trend and half of all credit card balances were interest-bearing, the lowest proportion since 1995 when UK financial records began.

Personal borrowing also declined in the last three months of last year.

Karen Noye says sharp rise in mortgage rates is starting to hurt some

More and more people are behind on their mortgages

Mortgage arrears occur when people fall behind on their mortgage payments.

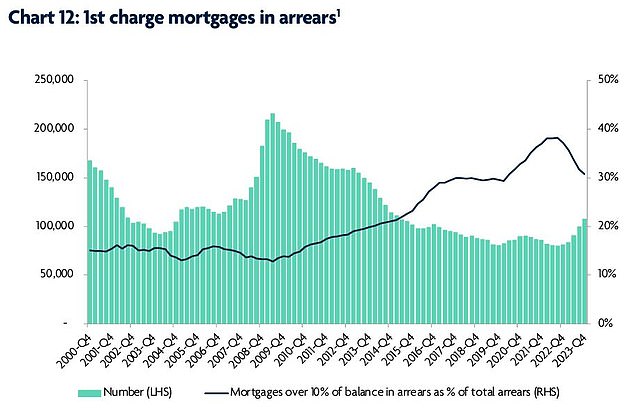

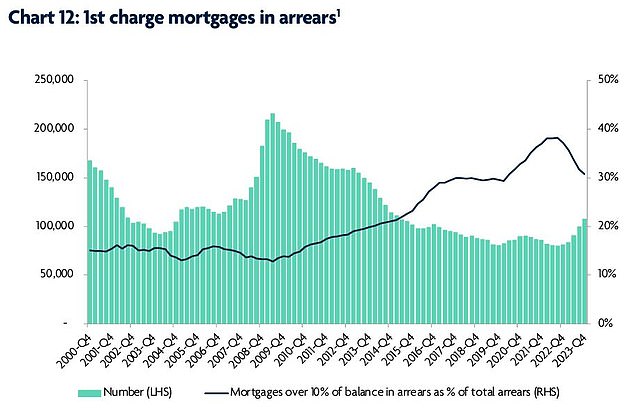

The latest figures from the Bank of England showed that the value of outstanding mortgage balances in arrears increased by 9.2 percent in the three months to December 2023, compared to the previous three month period. .

Arrears reached £20.3 billion, 50.3 percent more than a year earlier.

The proportion of mortgages in default increased to 1.23 per cent, which UK Finance says is the highest proportion since the last three months of 2016.

Karen Noye, mortgage expert at Quilter, said: “The sharp rise in mortgage rates seen over the last two years is really starting to take its toll on some borrowers and this is unfortunately causing them to fall into arrears as they cannot just can’t afford it. to cope with the increase in their payments.

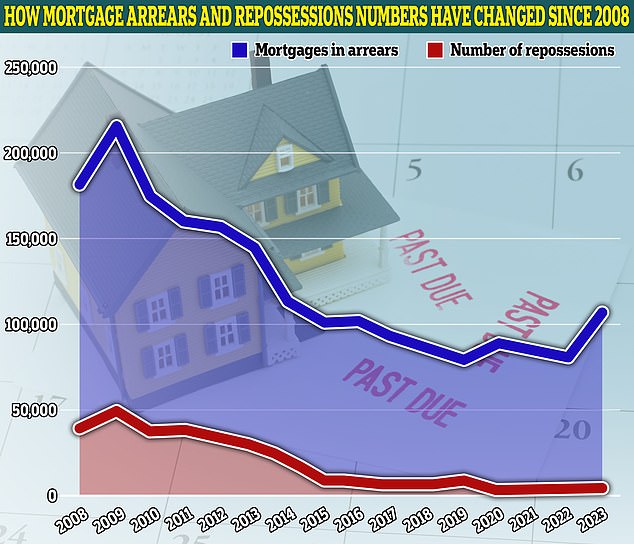

In December, there were 107,250 mortgages in arrears, according to UK Finance. But we are still far from the levels of arrears observed in the aftermath of the financial crisis.

In 2009, the number of mortgage arrears was roughly double what it is today.

The trade association says that while arrears levels remain low by historical standards, it expects the numbers to continue to rise this year.

Rising arrears: As interest rates rise, mortgage borrowers are under increasing pressure, says UK Finance

Are seizures increasing?

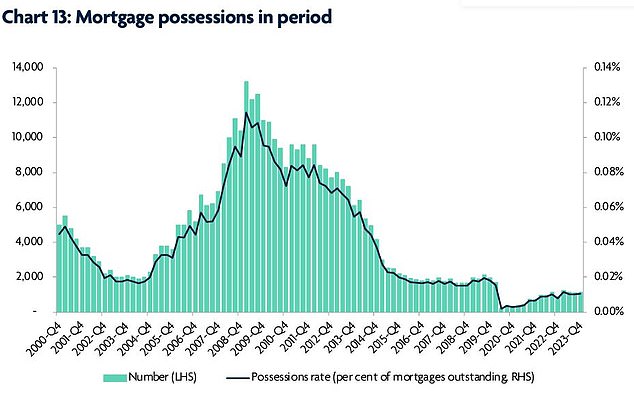

A repossession occurs when a lender takes control of a property after a borrower has defaulted on their mortgage, in order to sell it. This is a last resort after other options have been explored.

Unlike the increase in mortgage delinquencies in recent months, the data does not show a corresponding increase in foreclosures.

In the last three months of last year, 1,150 mortgage repossessions were recorded. This figure has barely changed throughout 2023, according to UK Finance.

Setting aside the pandemic years between 2020 and 2022, the 4,620 foreclosures over the past year are the lowest since 1980, when the housing market was half the size it is today .

During the 2009 financial crisis, there were ten times more foreclosures, a total of 48,900.

Possession foreclosures remain relatively low: unlike the increase in mortgage arrears, there has been no corresponding increase in possession activity, according to UK Finance.

Last year’s foreclosure figures represented an 18% increase over the 2022 figure.

But according to UK Finance’s Hopley, this was due to delays in the repossession process caused by the pandemic.

Hopley says: “2022 saw the number of possessions artificially suppressed, following the moratorium and issues surrounding limited court capacity.

“The increase in these figures last year therefore does not signal a change in market conditions.

“Rather, it is a matter of timing, as possessions that under normal conditions would and should have occurred in previous years have finally been subject to this process.”

Another important point to note, according to Hopley, is that last year’s holdings are not related to mortgage arrears that occurred last year.

Hopley adds: “Given the significant backlog, the cases that have been processed in recent years relate to mortgage arrears accumulated a few years previously.

Borrowers opt for more expensive two-year contracts

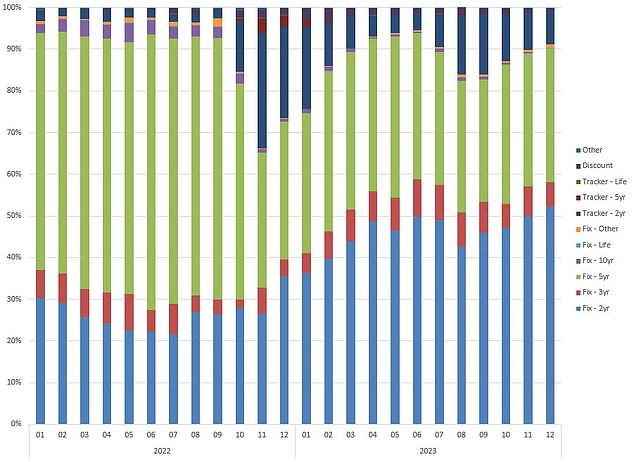

Since rates started rising, two-year corrections tend to be about 0.5 percentage points higher than five-year corrections.

Currently, the two-year average rate is 5.79 percent, compared to the five-year average rate of 5.35 percent. Meanwhile, the two-year average rate (which follows the Bank of England base rate, plus or minus a certain percentage) is 6.15 per cent.

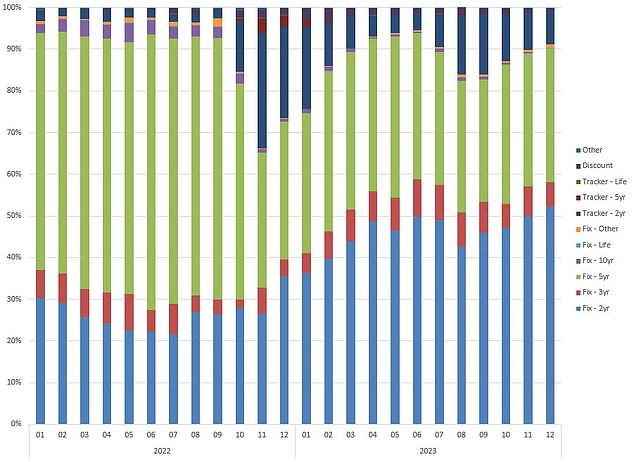

But last year, broker L&C Mortgages said around half of borrowers chose to fix their loans over two years, even though it cost more.

In fact, they were hoping that the rates would drop in two years and that they would be able to get a cheaper rate.

Two-year preference: Around half of Brits have chosen to set their mortgage for two years in 2023, according to broker L&C Mortgages

L&C also said that when rates increased, such as following the 2022 mini-budget, between 20 and 30 percent of borrowers opted for tracking rates.

Many trackers are free of prepayment fees, allowing customers to switch whenever they want without paying a penalty.

David Hollingworth of L&C says: “In general, we tend to see borrowers thinking about how they can manage volatility and keep their options open for a reduction in long-term interest rates.

“This saw more borrowers not using any penalty trackers during the mini-budget period, so they could always move to a fixed rate later if they preferred.

“More recently, borrowers have tended to opt for shorter fixed contracts in the hope that rates would fall and allow them to again mitigate rising payments over a shorter period, if they are right about the evolution of rates.

“Many will have resisted the possibility of extending their mortgage term if they do not increase their borrowing, which also suggests they are able and considering tightening things up and are hoping for better rates to come.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. This helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.