A typical homeowner could face unnecessary costs of £278 a month if they forgot to renew their mortgage contract on time, new research has shown.

Nearly a third of homeowners have let their mortgage adjust to their lender’s standard variable rate for at least a month after their fixed-rate deal ended, according to a study by personal finance website Finder. .

The standard variable rate (SVR) is a bank or building society’s more expensive “default” rate that borrowers revert to once their initial fixed agreement ends, if they don’t remortgage immediately.

Don’t be surprised: if homeowners don’t remortgage immediately at the end of the initial fixed term, the interest rate will revert to their lender’s higher standard variable rate.

Many people reaching the end of their five-, three-, or two-year fixed-rate mortgage today will have a rate of 2 percent or less.

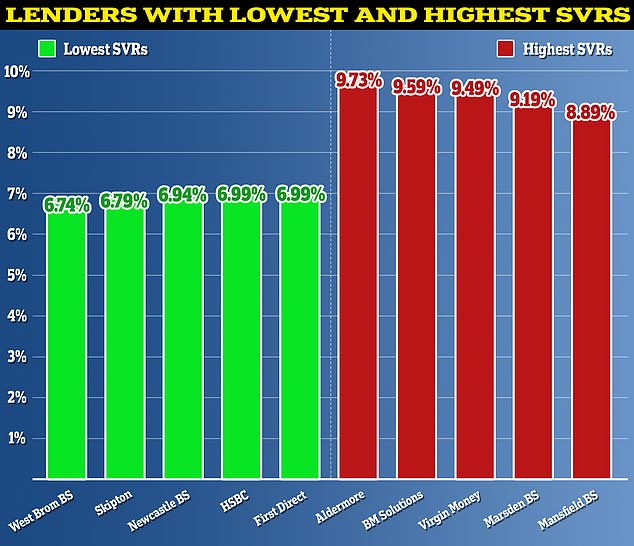

If they fail to remortgage in time and fall into their lender’s SVR, they could fall to a rate as high as 9.73 per cent, depending on the lender.

> Read: Which lenders have increased SVR mortgage rates to almost 10%?

The average fixed rate mortgage amount is currently £164,000, according to data from UK Finance.

Nicholas Mendes, technical mortgage manager at John Charcol, said: ‘For borrowers, it is generally not advisable to continue with or re-use an SVR unless the mortgage amount is very small or the sale of the property is imminent.

‘This is because SVRs are typically 3 to 4 per cent higher than fixed rates. There will likely be alternative arrangements with the existing lender that would be more cost effective.

The best and the worst: The standard variable rate is set at the discretion of each lender and therefore varies greatly

How much could it cost you to upgrade to an SVR?

The average SVR is currently 8.18 percent, according to Moneyfacts. The highest SVR on the market is 9.73 percent.

Someone with a £164,000 mortgage that is repaid over 25 years at a rate of 2 per cent will pay £695 a month.

If they reverted to the average SVR, their monthly payments would increase to £1,285 per month, a jump of £590 per month.

The average five-year settlement is currently 5.5 per cent, according to Moneyfacts.

On a £164,000 mortgage that would be repaid over 25 years, that would cost £1,007 a month. That equates to a monthly saving of £278, if the homeowner had remortgaged in time rather than resorting to the SVR.

If they had 40 percent equity in their home, they could have gotten an even lower five-year rate of 4.5 percent, or about 4.8 percent if they had locked it in for two years.

By switching a £164,000 mortgage at a rate of 4.5 per cent, someone would pay £912 a month, equating to a monthly saving of £373 compared to the average SVR.

> What’s next for mortgage rates in 2024 and how long should they be fixed for?

How much time do people spend with SVRs?

According to Finder’s study, over the course of their mortgage term, the average person will spend 10 months in an SVR.

It found that 11 per cent of mortgage holders have paid a higher SVR for more than a year, and 3 per cent admitted to paying an SVR for more than five years.

Ultimately, borrowers have plenty of time to avoid falling for their lender’s SVR.

Most mortgage deals have a duration of six months, meaning homeowners can close a new mortgage deal six months before the current deal ends.

Sometimes life gets in the way and people end up applying for their new mortgage as the deadline approaches, but it’s worth keeping in mind that the application itself usually takes several weeks.

According to mortgage broker Habito, applying for a mortgage usually takes between four and six weeks.

> Read about a lender that claims to offer most of its mortgages within 24 hours.

Liz Edwards, mortgage expert at personal finance comparison site search engine, said: “It’s easy to let renewals slip for a while and even if you remember to renew your mortgage, if you leave it too late you may have to wait a year or two. months”. for the rate of your new agreement to take effect. In the case of mortgages, this can have a big impact on the amount you pay.

“The extra monthly cost is shocking in itself, but as a point of illustration, if someone were to pay off a 30-year mortgage using the current average reversion rate compared to the current three-year average rate, they would pay an extra £180,000 in unnecessary interest .

“So, set a calendar reminder and make sure you find a new offer in plenty of time before your fixed offer expires.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.