Table of Contents

One of the big benefits of electric vehicles (which helps keep running costs down) is that they are exempt from many taxes, including road tax.

That will change next year, however, as zero- and low-emission vehicles will have to start paying vehicle excise duty (also known as road tax) in the same way as internal combustion engine vehicles. (ICE).

To make sure you don’t get caught out, here’s our guide for current and future electric vehicle owners – everything you need to know about the road tax changes…

From April 1, 2025, zero-emission and low-emission vehicles will have to start paying VED in the same way as vehicles with internal combustion engines.

The ONS predicts the contribution of electric vehicles to the economy each year and, with half of all new vehicles sold in 2025 expected to be electric, the government wants to start earning tax revenue from them to meet the targets.

Why are VED rates for electric vehicles and low-emission vehicles changing?

The Government announced changes to the VED in its spring budget in April. It was proposed as a way to ensure that all drivers start paying a fairer tax contribution.

Chancellor Jeremy Hunt justified the decision with Office for Budget Responsibility forecasts that half of all new vehicles sold in 2025 will be electric, so the change would “therefore create a fairer motor tax system.” “.

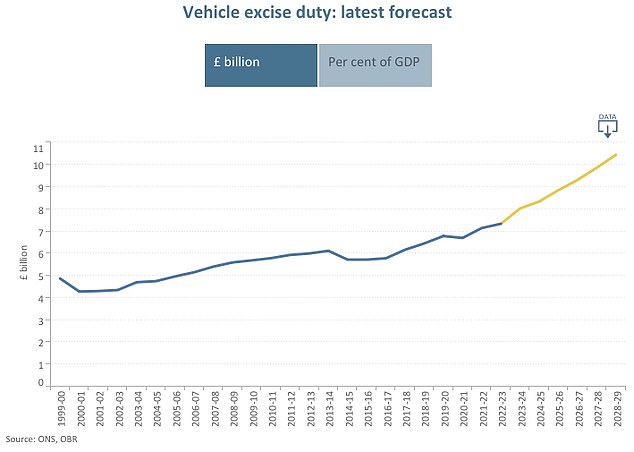

VED generated £7.4bn of tax revenue for the Government in 2022/23, according to the House of Commons library. This figure is forecast to rise to £9.4 billion by 2027/28.

When do the changes come in?

April 1, 2025

How much VED will I have to pay?

This depends on when the low-emission car (hybrid and plug-in hybrid) or zero-emission car is registered.

New electric and low-emission cars registered from April 1, 2025:

For the first year, these cars will pay just £10. This will increase to the standard VED rate (paid by all other cars), which is currently £190, from the second year.

Electric vehicles and low-emission cars registered between April 1, 2017 and March 31, 2025:

You will have to pay the full VED fee (currently set at £190) from the start.

The VED standard rate is subject to change by 2025, but no revision has been made.

Electric and low-emission cars registered between March 1, 2001 and March 31, 2017:

You will move into the first band that has a VED value (as defined by the Department for Transport), which is currently £20.

Again, this rate is subject to change for 2025, but no revision has been made.

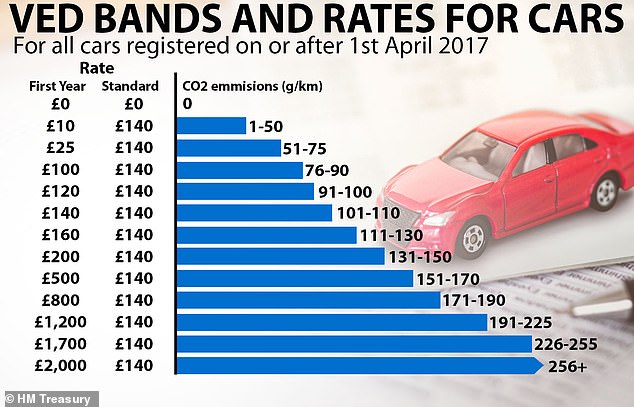

VED band rates for cars registered on or after April 1, 2017 will now apply to electric vehicles and low-emission cars registered before March 31, 2025.

How do you know if your car is low emissions?

If you don’t drive a fully electric vehicle (battery electric or BEV) but your car has low emissions, you may not be sure which VED band your engine is in.

The easiest way to check is to check the gov.uk website, where the bands are laid out, and then check your car’s CO2 emissions.

You can do this using the Government tool. CO2 emissions verification tool. It is not necessary that you have already purchased the car; You can also check new unregistered cars.

The Ford Kuga is one of the UK’s best-selling plug-in hybrids and is rated as low emissions under the government’s VED bands.

0g/km applies to all zero-emission electric vehicles, while most plug-in hybrids (PHEVs), such as the UK’s best-selling Ford Kuga PHEV, will be in the second CO2 emissions band of 1 to 50 g/km of CO2.

For example, the 2024 Ford Kuga emits 25g/km of CO2, so a new Kuga PHEV registered from 1 April 2025 will only have to pay £10 for the first year.

The second tax payment onwards will be £190 (or whatever the rate is set for 2026).

Ford Kuga PHEVs registered before April 1, 2025 will have to pay £190 from the first year.

What about alternative fuel vehicles (AFVs)?

The government defines alternative fuels as “fuel or energy sources that serve, at least in part, as substitutes for fossil petroleum sources in providing energy for transportation.”

These include hydrogen, liquid or gaseous biofuels, synthetic fuels, compressed natural gas (CNG) and liquefied petroleum gas (LPG).

They offer a cleaner (and sometimes cheaper) substitute for gasoline and diesel.

Until now, AFVs received a £10 annual discount on VED, but this discount will be removed from 1 April 2025.

The fee you will pay for an AFV will depend on when the vehicle was first registered.

Registered before April 1, 2017: This rate will depend on the vehicle’s CO2 emissions (use the same government tool to verify).

Registered as of April 1, 2017: You will pay the standard VED rate (currently £190, but subject to change by 2025).

Are motorcycles and vans subject to change?

From 1 April 2025, low and zero emission vans will move into the same flat rate VED tier as petrol and diesel vans, which currently costs £290 a year.

Motorcycles and tricycles will be subject to the annual tax corresponding to the size of the smallest engine, which is currently £22 a year. These can be found on the vehicle tax rates page.

What other changes are happening? The expensive car supplement

The Mercedes EQS is the German brand’s flagship electric vehicle and costs from more than £112,000

From April 1, 2025, electric vehicles will no longer be exempt from the ‘Expensive Car Supplement’.

New petrol and diesel cars with a list price over £40,000 are subject to a surcharge of £355 for the first five years of registration.

From April next year, this will apply to electric vehicles and low-emission cars: you will have to pay the surcharge.

Are tax rates for company cars also changing?

With private EV sales stagnating but commercial and fleet sales moving forward, tax breaks for company vehicles are very important.

Most companies choose electric vehicles because of the attractive benefit-in-kind rates for these models. And the good news is that these incentives will continue after April 2025 and will not be applied in the same way as VED.

BiK rates for cars emitting 75g/km or less will increase by one per cent annually from 2025-26.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.