Table of Contents

US investment giant BlackRock’s proprietary research business has backed UK stocks to outperform, with overseas investors attracted by “relative political stability”.

This week, the BlackRock Investment Institute moved to an “overweight” position on London-listed stocks, arguing that a new government with a sizeable majority will encourage investors to recognise “attractive valuations”.

But BII says a year packed with global elections will not be a tide that lifts all boats, with choppier waters forecast for stocks in the United States and France.

BII boosts City with forecasts for improved results for London-listed stocks

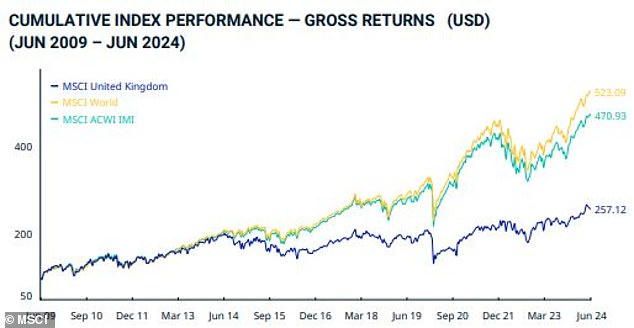

UK stocks have increasingly been seen as cheap in recent years as they continue to underperform their peers, with many international investors deterred by uncertainty over the future direction of policy in the wake of the Brexit referendum and various changes to the role of the prime minister.

The MSCI UK Index, which measures the performance of the large- and mid-cap segments of the UK market, has risen by 6.94, 5.74 and 2.7 percent over three, five and ten years respectively.

Meanwhile, the MSCI World has gained 7.38, 12.32 and 9.73 percent respectively over the same periods.

London-listed stocks have lagged behind their global peers

And the data shows the gap between the performance of smaller UK companies and their international peers is even wider.

The MSCI UK Small Cap Index is down 2.67 percent over three years, while up just 1.97 and 5.03 percent over three and ten years respectively.

International small-cap pairs have gained 2.15, 7.5 and 10.04 percent respectively over three, five and ten years.

But BlackRock II believes the outcome of last week’s general election could signal a shift in sentiment toward London-listed stocks.

He said: “Political stability and a recovery in growth could improve investor sentiment, lifting the UK’s low valuation relative to other (developed market) stock markets.”

The BII had previously said UK markets could benefit from a Labour leadership willing to “foster a more cooperative relationship with the EU, with a closer partnership on defence given the Ukraine war”.

“And targeted trade agreements could benefit key sectors such as energy and chemicals,” he added.

‘Better relations with the EU could reduce market uncertainty, support foreign investment and improve UK growth prospects.’

BII contrasted this with election years in the United States, where “no major candidate or party… has made debt and deficits a key campaign issue,” and in France.

Chairman Tom Donilon said: ‘We believe the unprecedented political stalemate in France following its parliamentary elections and weak fiscal outlook will attract increased scrutiny from investors.

“Global elections contribute to the geopolitical volatility we are seeing. This is a difficult time for those in power.”

John Ions, chief executive of London-listed fund manager Liontrust, also said this week that he expects greater political stability to benefit UK stocks, whose market aversion has hit the country’s asset management sector hard.

But Goldman Sachs Asset Management said Wednesday that the new administration is unlikely to be the key driver of stock market action for the foreseeable future.

He said: ‘Labour’s manifesto policies involve relatively limited changes to tax policy.

‘The new government is expected to set out more details of its policy agenda, including spending and taxes, in the coming weeks and months.

“We expect investors to remain focused on progress towards disinflation and a potential BoE rate cut.”

Funds to support UK recovery

FundCalibre Managing Director Darius McDermott’s top recommendations for a UK equity recovery:

‘While we still have a long way to go, business leaders and markets have largely embraced the new Labour government as a welcome change, providing a more stable political environment (particularly compared to other parts of the developed world).

‘This renewed stability, combined with attractive valuations, the reversal of negative macroeconomic headwinds and easing interest rates, positions the UK for a potential rebound.

‘Investors looking to capitalise on this rally may find value in UK-focused investment trusts.’

Schröder British Opportunities Trust (SBO)

After a long period in the eye of the storm, small caps have started to experience a small recovery and, coupled with increased M&A activity and attractive valuations, could be an incredibly attractive opportunity going forward.

SBO provides exposure to resilient small and medium-sized businesses in the UK, with a focus on undervalued companies with growth potential.

Schroders’ research expertise enables them to identify the best opportunities in both public and private markets, making it a truly unique proposition.

Fidelity Specialty Securities (FSV)

Another interesting option is FSV, a trust managed by Alex Wright, who has a proven track record of identifying undervalued UK mid- and large-cap companies.

While the trust does not prioritize income generation, it has seen its dividend rise steadily since Wright took over in 2012.

This trust is aimed at investors seeking a value investment in the UK market with a medium to long-term investment horizon.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.