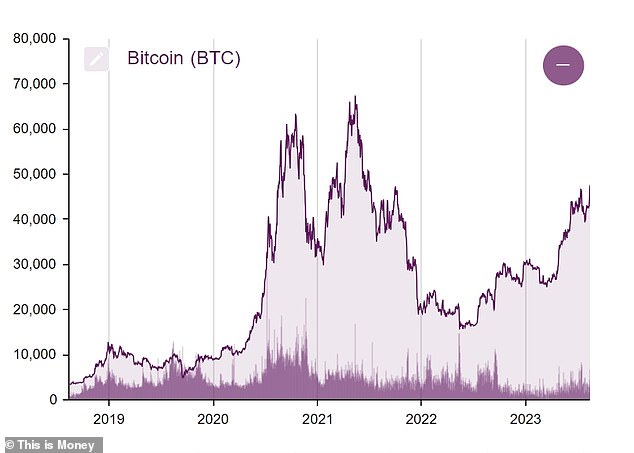

- Bitcoin Price Drops to $16,000 in 2022 Due to FTX Collapse

- Reached $43,000 at the end of the year

- Price is bolstered by recent spot ETF approval

The price of bitcoin soared past $50,000 today as investors continue to pile into new spot ETFs that received approval last month.

It marks a significant turnaround for the cryptocurrency, which fell to a low of $16,000 following the FTX collapse in 2022.

In 2023, it languished between $20,000 and $30,000 for much of the year before hitting $43,000 in December in anticipation of the US regulator’s approval of bitcoin spot ETFs, which track the price of the cryptocurrency.

The approval of bitcoin ETFs in the US has driven up the price of the cryptocurrency

It approached the $48,000 mark for the first time in a year before the decision before falling to $38,000 following the decision.

But in the last seven days, bitcoin has gained 16.7 percent.

Early last week, bitcoin made moderate gains, pushing the price above $43,000 before showing signs of further momentum to close above $47,000 on Friday.

Bitcoin is now trading at $50,066 at 5:30 pm UK time.

Matteo Greco, research analyst at Fineqia International, said: “The main driver of this price appreciation can be attributed to the increase in inflows into BTC spot ETFs.

‘As anticipated in previous weeks, output from the Grayscale Bitcoin ETF (GBTC) was expected to decline after the first two weeks of trading.

“This expectation materialized, with GBTC outflows showing a significant decline in the final days of January and continuing to decline into February.”

On the rise: Bitcoin price is at its highest level since the end of 2021

In late January, the Securities and Exchange Commission approved the launch of 11 bitcoin ETFs, including funds from Wall Street giants BlackRock and Fidelity.

The SEC’s decision marks an important milestone for cryptocurrencies to gain widespread acceptance.

Previously, the only way to buy bitcoins was through an exchange, which can be an intimidating process and involves confusing technicalities like wallets and keys.

Among the recently launched Bitcoin ETFS, Blackrock holds about $4.2 billion in assets under management (AUM), according to Fineqia, followed by Fidelity with about $3.5 billion in AUM.

Greco added: ‘Trading volumes remain exceptionally high, with cumulative volume of around $5.5 billion recorded last week, equivalent to a daily trading volume of approximately $1.1 billion.

“Since its inception, cumulative trading volumes have reached $35.6 billion, with an average daily trading volume of around $1.7 billion.”

Ethereum, the second leading cryptocurrency, has also benefited from Bitcoin’s rebound and is up 11.3 percent in the last week to trade at $2,551.