The average downsizer could unlock more than £300,000 by moving from a four-bedroom home to a two-bedroom home, new analysis from property firm Savills shows.

It said there are 1.29 million owner occupiers aged 65 and over in England and Wales living in four-bedroom homes.

If they were to sell and buy a two-bedroom property, they could expect to be left with £305,090 after moving.

Based on an average life expectancy of around 20 years, for those aged 65, Savills estimates that the average downsizer could earn a tax-free income of £1,218 a month for the rest of their life.

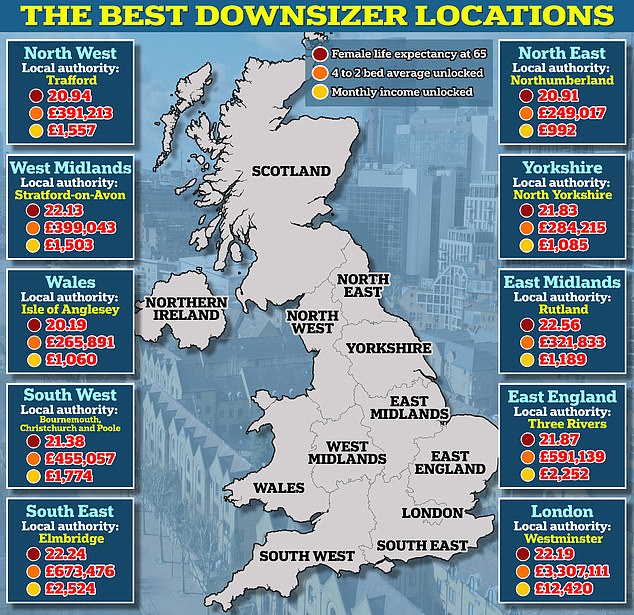

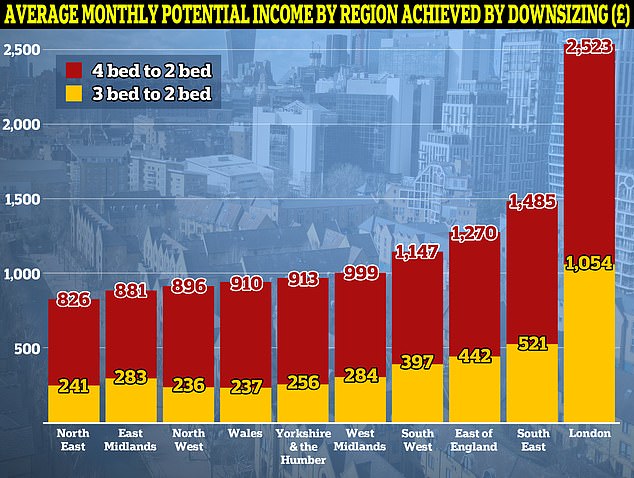

Where it’s best to downsize: The average Londoner can unlock £2,500 a month by downsizing versus £826 in the North East.

Lucian Cook, head of residential research at Savills, said: “It is understandable that homeowners have traditionally been reluctant to downsize due to their attachment to the old family home, but it is increasingly common for people to view their home as a way to supplement their pension provision. .

‘Those approaching or have already reached retirement age have been some of the biggest beneficiaries of the growth in house prices.

“By moving to a property that better suits their needs, movers, particularly those in high-value locations, can give themselves a significant boost to their retirement funding, particularly vital in the face of rising costs of living.”

Of course, the main caveat with Savills’ average income assessment is location, although there is a strong correlation between longer life expectancy and higher value property markets.

According to Savills, a 65-year-old downsizer in London can expect to unlock the most capital through downsizing.

On average, a 65-year-old Londoner moving from a four-bedroom home to a two-bedroom can unlock £2,523 a month, followed by those in the south-east with £1,485 a month.

Those in the North East can unlock the least by downsizing, averaging £826 per month.

Income source: Downsizing from a 4-bedroom home to a 2-bedroom home in England and Wales could unlock over £300,000 on average, equating to an income of over £1,200 per month on average

“This analysis exposes the north-south divide when it comes to downsizing,” says Lucian Cook.

‘Those living in typically more affluent areas of London and the South East have the option of using home equity to make a significant contribution to retirement income, even though they typically have a slightly longer life expectancy.

“For those living in the Midlands and North, there is much less to gain from downsizing and they are therefore likely to leave downsizing until later in life, if they actually do so.”

At a more local level, the 10 local authorities where the most capital can be unlocked are all in London, according to Savills.

This despite the fact that these places have one of the highest life expectancies in the country.

| Region | Area name | 4 bed | 2 bed | 4 to 2 difference |

|---|---|---|---|---|

| East Midlands | Rutland | £551,065 | £229,232 | £321,833 |

| East of England | Three Rivers | £993,415 | £402,276 | £591,139 |

| London | westminster | £4,893,835 | £1,586,724 | £3,307,111 |

| Northeast | Northumberland | £385,081 | £136,064 | £249,017 |

| northwest | TraffordEdit | £665,646 | £274,433 | £391,213 |

| Southeast | Elmbridge | £1,142,019 | £468,543 | £673,476 |

| South west | Bournemouth, Christchurch and Poole | £753,568 | £298,512 | £455,057 |

| Welsh | Isle of Anglesey | £459,810 | £193,920 | £265,891 |

| West Midlands | Stratford-on-Avon | £640,614 | £241,571 | £399,043 |

| Yorkshire and the Humber | North Yorkshire | £480,207 | £195,991 | £284,215 |

This is led by Westminster, where an average of £3.3 million in total could be unlocked if the average owner of a four-bedroom home downsized to a two-bedroom property, leaving them with an income of £12,420 a month.

Businesses downsizing in Kensington and Chelsea could unlock an average of £2.9 million by selling and moving to an average two-bedroom home. That would leave them with an income of £10,483 each month until his death.

An average person moving into a four-bedroom in Camden could free up £1.5 million in total and live on £5,688 a month for the rest of their lives.

Outside London, staff reductions in Elmbridge, in the south-east, have the potential to generate the most tax-free income.

Moving from a four-bedroom to a two-bedroom can unlock a total of 673,476 on average, resulting in £2,524 of monthly income.

So what stops people?

With a financial incentive this big, you’d think seniors living in four-bedroom homes would be crazy not to take advantage of it.

What is holding you back financially? Most likely it will be stamp duty followed by all the other costs associated with moving.

Savills says that while its calculations exclude any savings interest or gains from investing sales proceeds, they also do not take into account taxes such as stamp duty in England and Northern Ireland or legal fees.

Stamp duty currently applies to removal companies making property purchases over £250,000, although it is expected to drop to £125,000 from April 2025.

While someone moving into the average two-bedroom house costing £257,260 will only face a stamp duty bill of £363, in many areas of England it will amount to much more.

This will also apply to removal companies in Scotland and Wales, which have their own separate transaction taxes when purchasing property or land.

In England, for example, the average two-bedroom in Westminster costs £1,586,725, according to Savills. Therefore, someone downsizing would face on average a stamp duty bill of £101,656.

Someone downsizing to an average two-bedroom apartment in Elmbridge, southeast England, where prices are £468,543, will still face a stamp duty bill of almost £11,000.

Savills’ analysis also does not take into account estate agent fees associated with selling a property.

The average fee for high street estate agents is around 1.5 per cent of the final sale price. Although they can typically range between 1 and 3 percent, not including the additional 20 percent VAT they may be required to pay on top of it.

Someone selling the average 4-bedroom house, valued at £562,350 according to Savills, paying the average estate agent 1.5 per cent plus VAT (for a total of 1.8 per cent) can expect to pay more than £10,000 for the privilege to do so.

However, there is more to it than just cash.

Many people over 65 will have lived at home for much of their adult lives, and moving somewhere else would require a huge upheaval, both in terms of physical and emotional toll.

According to recent analysis by Zoopla, the average homeowner aged 65 and over has lived in their property for 26 years.

It found that a quarter of older people feel that moving home would be “too stressful”, while emotional attachments are also a barrier preventing more than one in five from moving.

There are also many who will try to keep their house to pass it on to their relatives.

Zoopla found that a quarter of people plan to stay in their home so their family can inherit it, meaning their own children or grandchildren are less likely to have trouble finding a family-sized home in the future.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.