Experts warn of a growing group of financially vulnerable Americans known as ‘ALICE’s.

An ALICE (or Asset Limited, Income Constrained, Emploeded) is someone who makes enough money at their job to disqualify them from government assistance, but struggles to cover living expenses.

The term was coined by the nonprofit United Way in its United by ALICE program. It classifies ALICEs as Americans who earn more than the federal poverty level of $15,060 for an individual or $31,200 for a family of four, but who cannot make ends meet.

About 29 percent of American households are ALICE, according to the latest data from United for ALICE, while 13 percent are below the federal poverty level.

Many ALICEs are workers whose salaries are not enough to cover basic needs, meaning they may be forced to sacrifice healthcare in order to cover rent payments, for example.

The share of people in this vulnerable financial group has increased over the past decade, with pandemic-era boom states like Montana and Idaho seeing the biggest jumps. Business Insider reported.

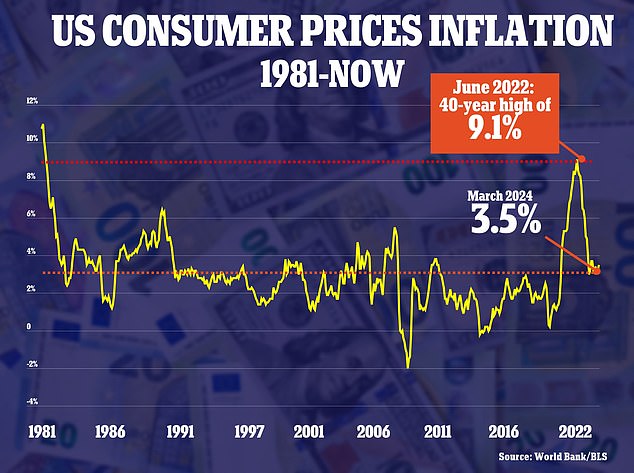

That’s because Americans’ incomes may have increased, but they may not have kept pace with rampant inflation, rising borrowing costs, and rising property prices.

According to the latest 2021 data, the three US states with the highest percentage of ALICE households are all in the Southeast: Georgia, Mississippi, and Florida. About 18 states have rates above 30 percent.

In Alaska and Wyoming, the share of ALICE households is lower than anywhere else: 22 percent.

In an attempt to curb persistent inflation, the Federal Reserve has raised interest rates to a 23-year high of 5.25 to 5.5 percent, increasing pressure on household budgets.

While expectations of an interest rate cut in the first half of this year were high, a higher-than-expected inflation report earlier this month has dashed hopes of a rate cut as soon as in May.

Speaking last week in Washington, D.C., Federal Reserve Chairman Jerome Powell said it will take “longer than expected” to bring inflation down to the central bank’s 2 percent target, noting that it will likely also take longer to bring inflation down. rates.

While poverty rates in the United States have been falling for the most part, the halt in government assistance means many Americans are being left on the sidelines.

Inflation rose slightly to 3.5 percent in March as prices were pushed up by housing and gas costs.

For example, to be eligible for SNAP benefits or food stamps, Americans must apply for them in their state and meet certain requirements. requirementsincluding income limits.

Families must have an income less than approximately 138 percent of the federal poverty level, meaning a family of four must have a gross income of less than $39,000.

Meanwhile, for Supplemental Security Income, which provides benefits to Americans with disabilities, the limit for individuals is generally $1,971 a month.

Stephanie Hoopes, national director of United for ALICE, told Business Insider: “It’s hard to reflect in the data the frustration, the stress, the day-to-day, having to make some really bad decisions.”

‘Are you going to get medicine for your son or are you going to have dinner tonight? Are you going to keep the electricity on? Are you going to daycare?

Hoopes said the Federal Poverty Level is outdated in many ways because it doesn’t take into account regional differences and the changing proportion of people’s budgets that go toward food.

He added that less attention is paid to helping those who are better off financially but cannot yet invest in their future.

It comes as separate research shows that more than half of Americans who earn more than $100,000 a year live paycheck to paycheck.

a survey by Barron found that 51 percent of people with an annual salary of more than $100,000 run out of money month after month.