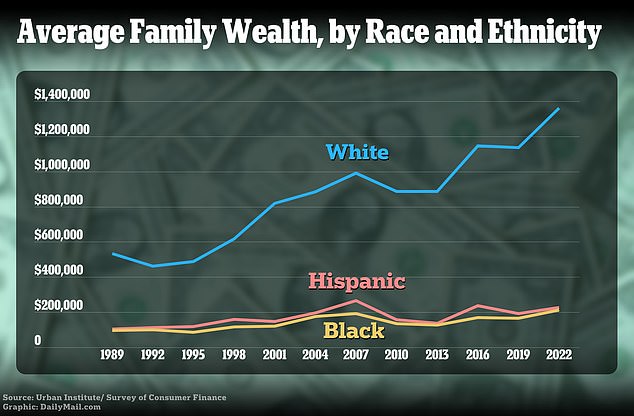

The wealth gap between white families and households of other races has widened by more than a million dollars, startling new statistics show.

The data comes directly from the Federal Reserve and its Survey of Consumer Finances.

The in-depth study is conducted every three years and tracks the difference in wealth among white, black and Hispanic families.

The results published this week belong to the period between 2019 and 2022, during which the average wealth of white families reached $1.4 million. That was more than $1 million more than the average of $211,596 attributed to black families and the $227,544 attributed to Hispanics.

Put another way, white families had three times the average wealth of their black and Hispanic counterparts combined, a cause for concern as the racial wealth gap continues to widen.

The wealth gap between white families and households of other races has widened by more than $1 million, startling new statistics released by the federal government this week show.

It showed that white families, on average, have three times more wealth than their black and Hispanic counterparts, combined.

“Wealth translates into opportunity,” said Signe-Mary McKernan, vice president of labor, human services and population at a think tank that analyzed the resultssaying.

‘It translates into mobility. [Wealth] allows people to reach their full potential”, s

Inequalities, he said, “are in the policies,” noting that structural racism is a major contributor.

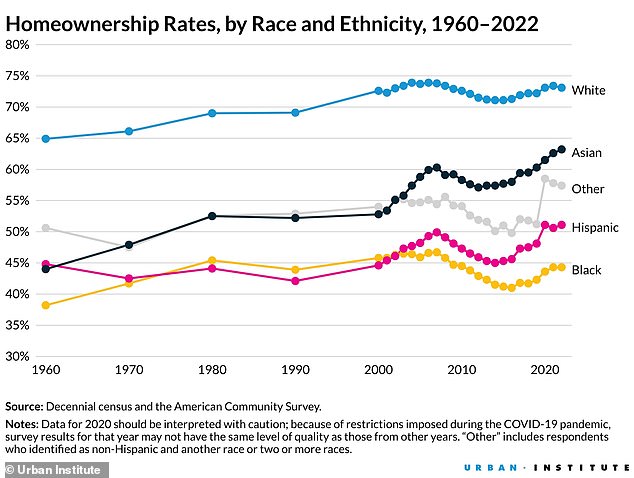

Highlighting exclusionary homeownership policies, such as redlining, that have largely affected blacks and Hispanics, he said these practices have “created pathways to building wealth for white families while also creating barriers for other families.” color”.

Redlining refers to the denial of a loan or insurance to someone because they live in an area considered low financial risk, a practice that fuels financial disparities.

Education also plays an important role, McKernan said, mentioning how some equate it with a silver bullet that could stop inequality in its tracks.

However, staff at the D.C.-based Urban Institute said it’s not the solution everyone is looking for, citing how Hispanics have had the fastest growth in advanced degrees of any ethnic group over the past 20 years, but are still far behind. behind their white counterparts.

“Education is seen as a silver bullet and will make a huge difference in income, but what education doesn’t do is close wealth gaps,” he explained.

The inequalities, one expert said, “are in the policies,” noting that structural racism is a major contributor.

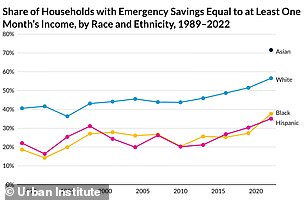

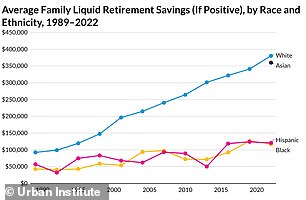

The Federal Reserve also found that black and Hispanic families have far fewer retirement (right) and emergency (left) savings than white families.

“In a society that professes that those who work hard and play by the rules should be rewarded with upward social and economic mobility, this is a stark reminder that we still have work to do.”

And he’s right: Other figures show how pronounced the wealth gap is.

White families have a median wealth of $284,310, according to the Fed, a figure more than four times higher than that of Latinos, set at $62,120.

Additionally, the analysis found that the wealth gap also widens as families age, with whites, on average, accumulating more wealth over their lifetimes than Latino families in the same age group.

It also found that black and Hispanic families have far fewer retirement and emergency savings than white families, as well as drastically lower homeownership rates.

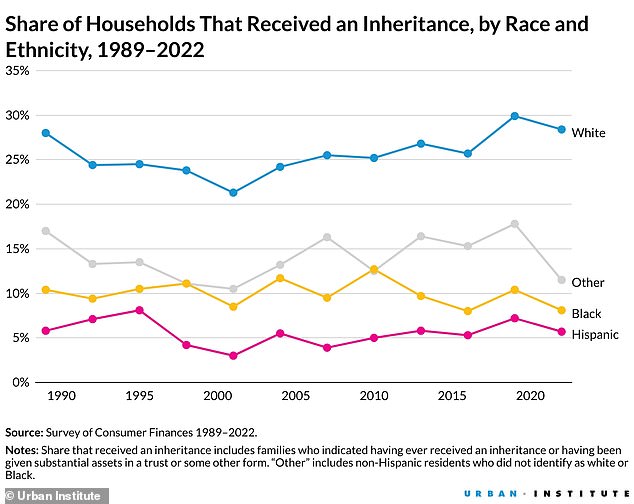

Things like inheritances were also notably less common in black and Hispanic families, the Fed discerned, a reality that, like the other trends, has been present for decades.

McKernan’s think tank examined the results through a lens based on economic and social policy research, and laid out some potential solutions to address the widening racial gap, such as starting wealth-building accounts from scratch.

A group of experts examined the results through a lens based on economic and social policy research, and laid out some possible solutions to address the widening racial gap, such as starting wealth-building accounts from scratch.

Things like inheritances were also notably less common in black and Hispanic families, the Fed discerned, a reality that, like the other trends, has been present for decades.

“In a society that professes that those who work hard and play by the rules should be rewarded with upward social and economic mobility, this is a stark reminder that we still have work to do,” a researcher who examined the results.

“Wealth is not only for the rich. Wealth is insurance against difficult times. It’s tuition to get a better education and a better job,’ she said, citing initiatives like Oakland-Alameda County’s Brilliant Baby program, which establishes college savings accounts during childhood.

‘It’s the capital to build a small business. “It’s retirement savings and a stepping stone to the middle class,” McKernan continued.

She also highlighted other programs available in California, such as the Hope, Opportunity, Perseverance and Empowerment Trust Account Program for Children that aims to close the racial wealth gap for children who have lost a parent to COVID-19 , and the San Francisco Kindergarten for College Program, the nation’s first universal children’s savings account program.

Taking advantage of these programs is the best course of action for comparatively disenfranchised families to eventually build wealth, he said, but of course, that takes time.

Incorporating emergency savings accounts into retirement accounts could be another option, he said, allowing employees to weather unexpected financial crises without committing their retirement funds to emergency withdrawals.

Additionally, automatic enrollment in emergency savings accounts nearly doubles the likelihood that people will save, he said.

Automatic stabilizers the government should offer, such as expanded refundable tax credits and enhanced unemployment benefits, would also help these families, the expert concluded.