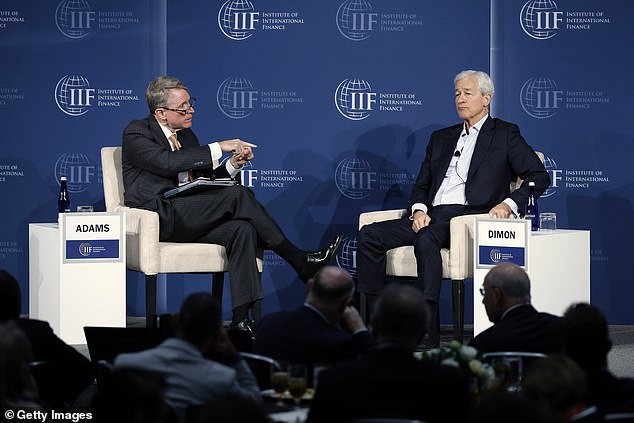

Jamie Dimon told a bankers conference Monday that he’s “tired of this bullshit” when it comes to the Biden-Harris administration’s regulation of banks.

The CEO of JPMorgan Chase – who has Reportedly Eyed Treasury Secretary Job Under Harris – He said this even though an investigation revealed that endorses privately Kamala Harris for president.

Dimon, 68, on Monday criticized several major U.S. financial regulatory initiatives and vowed to oppose those he believes would hurt banks.

“It’s time to fight back,” he said at the American Bankers Association, pointing to the “onslaught” of bureaucracy, before exclaiming, “I’m tired of this shit.”

Dimon, a registered Democrat, has been unusually quiet about his political leanings in recent months.

JPMorgan Chase CEO Jamie Dimon said at a bankers’ conference Monday that he is “tired of this bullshit” when it comes to the Biden-Harris administration’s regulation of banks.

The outspoken executive, 68, who runs America’s largest lender, said this despite an investigation revealing he is privately backing Kamala Harris for president.

This had led some observers to speculate whether he had switched allegiance to the Republican candidate.

Both the Trump and Harris campaigns have reportedly sought Dimon’s public support.

Dimon was then forced to publicly deny endorsing Trump earlier this month after the presidential candidate made a false claim on his social media site Truth Social.

Privately, however, the 68-year-old made it clear that he supports Vice President Harris.

He would also reportedly consider a role, perhaps Treasury secretary, in his administration.

The banker, who has an estimated net worth of around $2.4 billion, has reportedly told associates that he considers Trump’s 2020 election denialism almost a disqualifying factor.

However, at the New York conference he criticized what he called overlapping or poorly conceived rules on capital requirements, card payments and open banking.

“It’s time to fight back,” he said. Many banks are afraid to “fight with their regulators, because they would just come and punish more,” he added.

Both the Trump and Harris campaigns have reportedly sought Dimon’s public support.

Dimon was forced to publicly deny endorsing Trump earlier this month.

“People at the Federal Reserve have told me that from what you’ve said and what you’ve written, you know they’re going to come after you.”

The Federal Reserve declined to comment.

“We’re suing our regulators over and over again because things are getting unfair and unfair, and they’re hurting businesses, a lot of these rules are hurting lower-paid people,” he said.

As banks await new proposals under what is known as the end of Basel III, “the devil is in the details,” Dimon said.

He was referring to a proposal by US regulators in July 2023 to align their standards with those of the Basel Committee on Banking Supervision to help the industry better absorb economic shocks.

Federal Reserve chief regulator Michael Barr last month outlined a plan to increase big banks’ capital by 9%, easing the previous proposal to increase capital by 19%. It was a major concession to Wall Street banks that had pushed to water down the draft.

Despite the industry’s apparent victory, the plan was still mired in uncertainty, with key details unclear and the Nov. 5 US presidential election casting doubt on whether it would survive a new administration.

It will be difficult to achieve anything if the proposals do not emerge before the elections, Dimon said.

The capital surcharge for systemically important global banks was among the “stupidest” elements of the Basel framework, its operational risk calculations were “ridiculous” and there were “inconsistencies” in the liquidity coverage ratio, he said.

“The biggest problem I have with all these overlapping rules is that we don’t step back and say what we could do better to make the system work better,” he added.

The bank’s chief has been among the most strident critics of the regulations and has warned that the bank is willing to challenge some rules in court when it sees no other option.

“It’s time to fight back,” Dimon told the American Bankers Association, drawing applause and laughter. “We don’t want to get into litigation just to make a point, but if you’re in a knife fight, you better bring a knife and that’s where we are.”

The CEO also said regulators should not allow card-issuing financial services companies, such as American Express, Capital One and Discover Financial Services, to charge more for debit card transactions.

This is because banks are limited in how much they can charge for debit cards, while card issuers have no such limits.

“It’s grossly unfair to allow them to do more,” he said.

Dimon, the longest-serving bank chief at a major Wall Street bank, also criticized rules from the top U.S. consumer finance watchdog unveiled last week that would make it easier for consumers to switch between financial services providers. .

The Consumer Financial Protection Bureau’s “open banking” rule governs data sharing between fintech companies and traditional banks, allowing consumers to easily transfer their personal data between providers for free.

Dimon said he was not against open banking, but noted that it could compromise consumer data and lead to fraudulent money transfers and that he was willing to fight it.