A Kentucky widow has detailed how she was forced to file for bankruptcy to save her home after her husband’s death.

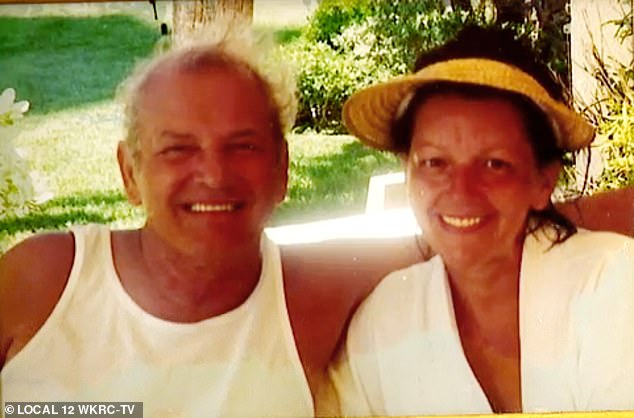

Carol Haynes, 80, offered the story to a local news station in Kentucky, as foreclosure rates across the country continue to rise following the pandemic.

The financial hole created by the crisis, she said, affected her and her husband for 25 years, after the killer virus claimed her life in 2022.

His death caused his bank accounts to be frozen and automatic mortgage payments on his two-bedroom home in Florence were suspended.

This occurred without her knowledge and led her to the bank to file for foreclosure, she said. Local 12 WKRC-TV. Haynes then received a letter stating that the house would be auctioned on May 23, prompting her to file for bankruptcy.

Carol Haynes, 80, offered the story to a local news station in Kentucky, as foreclosure rates across the country continue to rise following the pandemic.

She received a letter stating that the house would be auctioned on May 23, prompting her to file for bankruptcy.

This stopped the sale even though she had relatively healthy finances, she said, while she waits for evidence of a loan modification her daughter made to allow them to make payments to be presented in bankruptcy court.

“I want to be close to his stuff,” she said of the northern Kentucky home she once shared with her longtime love, Ed Haynes.

‘I can feel it here. “I think if I left here, I wouldn’t live long,” she added.

Now that she can pay the mortgage, she remembered the beginning of the crisis, when she was not only recovering from the loss of Ed, but also from a Covid attack.

Their bank accounts were then frozen and automatic mortgage payments to the bank were stopped, he said.

—Did you think they were already taking care of this matter? a Local 12 reporter asked, referencing how all of this happened without her realizing it.

Her stepdaughter Tiffany Tormey, who was able to successfully negotiate a loan modification, responded.

‘I did it, I did it!’ said Tormey, 42, adding, “I thought (my mom) was fine and she just didn’t want to bother me.”

“It was just a little miscommunication.”

It all started with the death of her husband of 25 years, after the killer virus claimed his life in 2022.

That lack of communication caused her late husband’s bank to begin a process to put the house into foreclosure, a process that typically results in a lender repossessing the property before attempting to sell it to recoup losses.

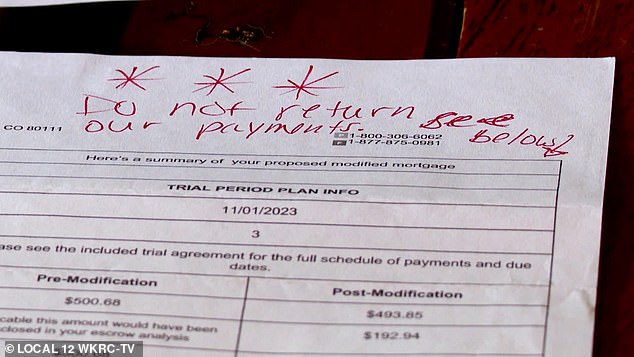

However, upon hearing the news months later, Tormey was able to successfully negotiate a loan modification that would “bring the loan current (and) put an end to the arrears,” he told Local 12.

“And we would just make the payments.”

But the bank was already in the process of selling the loan, both said, leaving them in a difficult position to rectify the situation.

Meanwhile, Tiffany helped her stepmother make payments while the bank transferred the deal to a new owner.

However, the new mortgage holder never received the amended agreement, so he filed for foreclosure again.

Tormey proceeded to send evidence of the modification to the mortgage holder, without any result.

Unable to bypass the bureaucratic red tape that big banks are famous for, her mother He received a letter indicating that his house would be auctioned on May 23.

Stepdaughter Tiffany Tormey (left) was able to negotiate a successful loan modification, but the bureaucratic red tape that big banks are famous for left them with no foundation to stand on.

His plan would have ‘(updated) the loan (and) put an end to the arrears,’ he told Local 12. ‘And we would just make the payments.’

But the bank was already in the process of selling the loan, his elderly stepmother said, leaving them in a difficult position to rectify the situation.

That prompted her smart older stepmother to declare bankruptcy, despite having the money to make the payments.

A day earlier, the man who would have carried out the sale, Boone County Chief Commissioner Larry Dillon, said the only thing that could save the couple was a court order from a local judge.

“If I have an order from the circuit judge ordering me to sell a property,” Dillon said in a video interview a day before the widow stopped the sale. “I have to sell it.”

‘Obviously, you don’t want to see a little old lady thrown out of her house… but I can’t take the unilateral step of canceling a sale.

“If I do that, I’m violating a court order,” Dillon said.

He added that Carol could declare bankruptcy, advice she apparently followed.

Now he hopes evidence of the loan modification will settle everything in bankruptcy court, even if the scenario is often intended for people who can no longer pay their debts.

By providing a fresh start by liquidating assets to pay off debts or creating a payment plan, the practice has, for now, saved Haynes.

That prompted his smart stepmother to declare bankruptcy, despite having the money to make the payments, he explained.

The loss of her husband, however, is still very important. “It was a wonderful marriage,” Haynes told the station from her home in Florence. ‘A happy one. I’ll see him again.’

A day earlier, the man who would have carried out the sale, Boone County Chief Commissioner Larry Dillon, said the only thing that could save the couple was a court order from a local judge.

Another foreclosed house, this one in Pleasant Hill, California. Foreclosures are currently affecting thousands of homeowners across the country.

A miscommunication caused her late husband’s bank to begin a process to put the house into foreclosure, a process that usually results in a lender repossessing the property before attempting to sell it to recoup losses. In the photo, another foreclosed house in Miami

However, the loss of her husband is still very important.

“It was a wonderful marriage,” Haynes told the station from her home in Florence. ‘A happy one. I’ll see him again.’

He added: “I lost it quickly, but I guess it was better than suffering for a long time.”

Foreclosures – which can take the form of default notices, auctions, or repossessions by the bank that approved the loan – are currently affecting thousands of Americans.

ATTOM’s latest February 2024 Foreclosure Activity Report showed a total of 32,938 U.S. properties with foreclosure filings, an increase of 8 percent from the previous year.

Rob Barber, chief executive of ATTOM, said at the time: ‘The annual uptick in foreclosure activity in the United States suggests a change in dynamics within the housing market.

‘These trends could mean evolving financial landscapes for homeowners, prompting adjustments to market strategies and lending practices.

“We continue to closely monitor these trends to understand their full effect on foreclosure activity.”