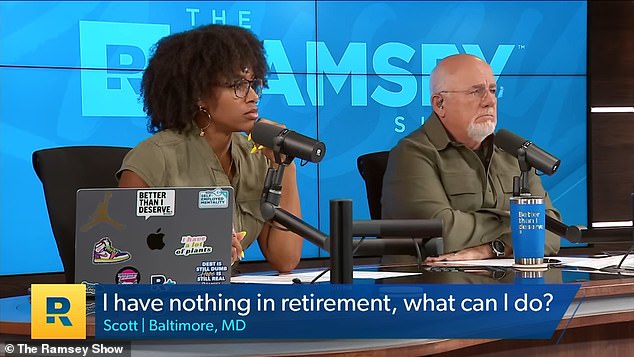

A financial expert delivered a harsh dose of reality to a caller who hoped to retire at age 58 despite having no savings and a costly car loan that was draining his wallet.

Scott from Baltimore, Maryland, learned the hard way that one bad purchasing decision can ruin years of financial discipline when he treated himself to the vehicle of his dreams: a Harley Davidson motorcycle.

On a recent episode of The Ramsey Show, Scott confessed to Dave Ramsey that he’s struggling with a $20,000 loan for his motorcycle, almost as much as his $25,000 mortgage on his home.

“It’s strange,” Ramsey said. “You did so well at home and so poorly on the bike. That was a moment of weakness.”

While many Americans are struggling with loans for essential vehicles, Scott’s debt stems from a luxury purchase. Ramsay advised him to sell the bike.

“I’m sure it’s a great bike, but it’s gone now. It’s someone else’s great bike now,” he said.

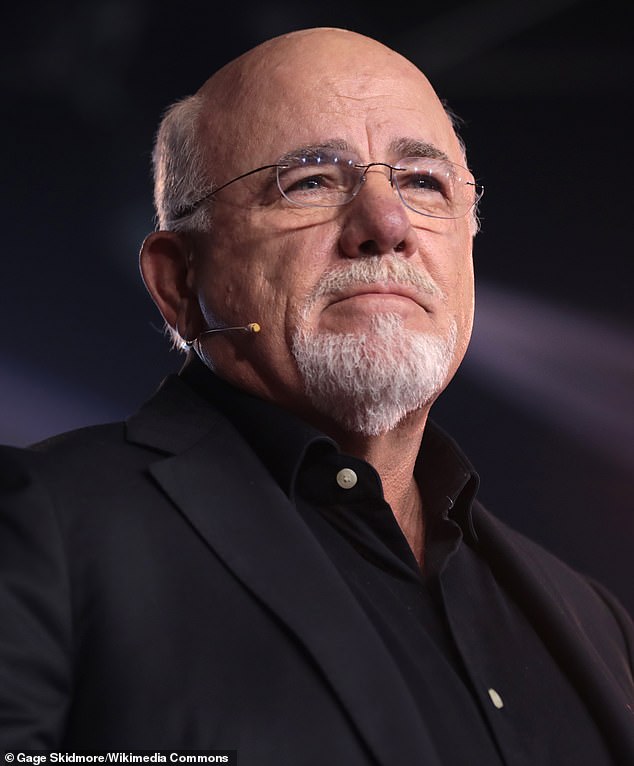

Financial expert Dave Ramsey delivered a harsh dose of reality to a caller who expected to retire at age 58 despite having no savings and a costly car loan that was draining his wallet.

Scott, who is recovering from a costly divorce eight years ago that wiped out his savings, faces a ticking clock to increase his savings.

He now has just $25,000 left on his mortgage, putting him close to joining the 40 percent of Americans who don’t have a mortgage, according to Bloomberg.

He also managed to save $23,000 in cash as an emergency fund.

But despite his age and lack of savings, Ramsey sees a ray of hope for Scott’s financial future.

Ramsey believes Scott’s greatest asset is his career as a carpenter in the luxury real estate market.

“The good news is that as a high-end carpenter, you’re in high demand. You’ve always had more work than you could handle,” Ramsey said.

Ramsey laid out a possible roadmap for Scott. He suggested increasing revenue through more contracts and higher rates as an independent contractor.

Ramsey estimated that if Scott could save an additional $2,000 a month, he could retire at age 67 with $500,000 in retirement assets and a paid-off home.

“Get a game plan, man,” Ramsey urged.

On a recent episode of The Ramsey Show, Scott confessed to Dave Ramsey that he’s struggling with a $20,000 loan for his motorcycle, almost as much as his $25,000 mortgage.

Scott’s situation reflects a broader problem facing Americans, many of whom are crushed under the weight of massive car loans.

This comes at a time when the US auto loan crisis has reached staggering levels.

A 2021 Consumer Reports study found that lenders are increasingly able to take advantage of the most vulnerable, especially those with lower credit scores. These loans allow them to earn more interest and, ultimately, they can repossess their cars.

Car loans are becoming a major source of stress for car-obsessed Americans and are leaving an increasing number of them with out-of-control debt.

Total auto loan debt hit a whopping $1.63 trillion during the second quarter of 2024, according to Federal Reserve report on household debt and credit.

This makes it the largest source of non-mortgage debt, surpassing both credit cards and student loans, it reports. Wise money.

Ramsey suggested selling the bike and taking on additional jobs. If Scott could save an additional $2,000 a month, Ramsey calculated he could retire at age 67 with $500,000 in retirement assets and a paid-off home.

Last year, auto debt in the United States hit a record $1.6 trillion, equivalent to an average of more than $13,000 per household.

In February, the Federal Reserve released data showing that Americans were falling behind on their car payments at the fastest rate since 2010.

In recent years, the cost of owning a car has skyrocketed. Not only are car manufacturers charging more for new cars, but used cars are becoming more expensive as well.

In the two years since January 2020, prices for used cars and trucks have risen more than 50 percent, according to figures from the U.S. Bureau of Labor Statistics.

Meanwhile, the cost of insurance is also rising. In March it was one of the main drivers of inflation as measured by the Consumer Price Index (CPI), having increased by 2.6 percent month on month.