The Savings Guru: Sylvia Morris says notice accounts are a lesser-known way to get a top rate

For savers looking to squeeze every last drop of interest out of their savings, there’s a new place to look.

Typically, the best rates are found on easy-access or fixed-rate accounts. But for the first time I can remember, lesser-known ad accounts are topping the charts.

They are like easy access accounts in that they pay a variable interest rate.

But the key difference is that you must notify your provider if you intend to make a withdrawal.

They are considered a middle ground between easy access and fixed rate offers, as you can’t access your money whenever you want, but it’s not locked in for a full period of a year or more.

You have to be organized to use them, since they usually require a withdrawal notice between 30 and 90 days in advance.

Before using them, you should make sure there is enough in your easily accessible account to cover emergencies and planned expenses.

You can earn up to 5.4 per cent on Vanquis Bank’s highest-paying notice account, offered with deposits of a minimum of £1,000. You must give 90 days’ notice to get your money back.

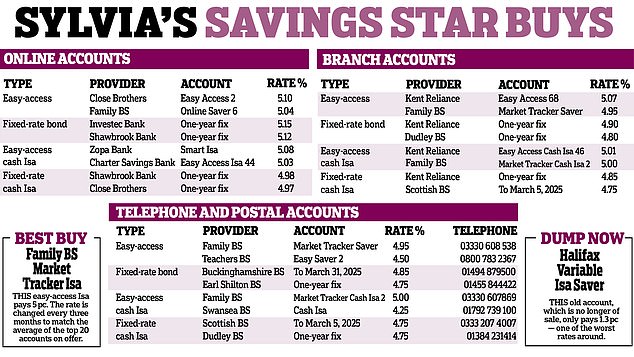

By contrast, the flagship one-year fixed rate bond pays 5.15 per cent on a minimum of £5,000 at Investec Bank. The most accessible account is the 5.1 per cent Close Brothers account, and you need at least £10,000 in your account to get it.

Notice accounts, once a mainstay of banks and building societies’ savings ranges, have been overtaken by easy access arrangements. They are now offered by some building societies and new banks.

Monument Bank and West Bromwich Building Society pay 5.25 per cent with 60 days notice. Investec Bank also pays 5.25 percent, but with a 90-day notice period.

Also worth a look are Shawbrook Bank at 5.14 per cent for 45 days, Charter Savings Bank at 5.15 per cent for 95 days and Kent Reliance at 5.13 per cent for 60 days.

Vendors warn that they can withdraw accounts from sale at any time, and will do so if they suddenly become popular.

Pay attention to the terms and conditions. You usually can’t get your money back right away, even if you’re willing to pay a fee; You must wait the notice period.

And with West Bromwich you have to be very organized. You can make as many withdrawals as you like, but you can only have one active notice period at a time. You must wait for the current notice period to end before the next one.

West Bromwich have launched a tax-free cash Isa version of their account at a lower rate of 5.06 per cent. Unlike its non-Isa version, you can get your account straight away; Isa rules say providers must allow this. But you will pay a charge equivalent to 60 days’ interest: £8.30 per £1,000.

You join a small group of providers offering cash Isas at a notice so you can enjoy the best rates and earn tax-free interest.

Furness BS is offering 5.01 per cent on 90 days’ notice. Chorley BS pays 5.05 per cent but with a 150-day notice to make a withdrawal. Aldermore Bank requires 30 days notice and pays a much lower 4.5 percent.

Variable rate accounts, including notice-type and easy-access accounts, pay more overall than fixed-rate bonds because of differences in how they are priced.

Fixed-rate bonds have plunged in recent months as providers have discounted the fact that interest rates are expected to fall from their current level of 5.25 percent.

Variable rate accounts tend to reflect what happens with interest rates in almost real time. So far they have not fallen as sharply as fixed rate accounts, but they are likely to do so as soon as the Bank of England cuts the base rate.

> Check the best savings rates in our tables prepared by Sylvia and This is Money

NS&I slashes ‘green’ bond rate once again

National Savings & Investments (NS&I) is reducing the rate on its Green Savings Bond.

The ecological bond now pays a fixed 2.95 percent for three years. It is the second cut in two months since last summer’s peak of 5.7 percent.

The new version will pay £911 interest over three years on £10,000, £321 less than the previous issue at 3.95 per cent and £898 less than last summer’s 5.7 per cent.

Worse still, it fails to overcome the current inflation rate of 4 percent.

National Savings & Investments reduces the rate of its Green Savings Bond

NS&I Green Savings Bond money funds “green” projects chosen by the Government, such as green transport and renewable energy projects. You can earn a better 4.6 per cent fixed for three years with Access Bank, DF Capital or Close Brothers Savings.

You should monitor your personal savings allowance if you have an NS&I bond. This gives basic rate taxpayers their first £1,000 of interest on ordinary savings accounts each year tax-free, while higher rate taxpayers get a £500 allowance and additional rate taxpayers get nothing.

All interest earned on your Green Savings Bond over the three years counts toward allocation in the year the bond matures rather than being spread out over the years.

Coventry’s new triple access account pays 5.15%

Coventry BS pays 5.15 per cent on its new Triple Access Saver account. But it only allows three free withdrawals a year, and then you will charge, which adds up to just over £7 to withdraw £1,000.

The maximum rate is only available if you open the account online. Savers who prefer to open an account in a branch have every right to feel upset. They will get a much lower rate: 4.65 percent instead of the 5.15 percent offered to those who want or can connect to the Internet.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.