Americans are likely to see a drastic drop in the cost of selling their homes after a landmark legal settlement will end the infamous commission system used by real estate agents.

The National Association of Realtors (NAR) agreed Friday morning to pay $418 million in damages and to change its controversial rules to settle a wave of lawsuits.

Experts say the change could cut costs by 30 percent, or about $20,000, on the sale of a $1 million home.

As it stands, agents in the United States make between 5 and 6 percent of the sale price of a house—far more than almost anywhere else in the world.

This is because for decades they have relied on a controversial mechanism to keep their prices high and extract as much commission as possible from sellers.

Americans are likely to see a drastic drop in the cost of selling their homes following a landmark legal settlement

Previously, the buyer’s agent could see which properties had the highest sales commission and ‘steer’ buyers to them

The settlement, agreed to on Friday, will still require approval from a federal court.

In a press release announcing it Friday morning, the association denied any wrongdoing.

“NAR has worked hard for years to resolve this lawsuit in a way that benefits our members and American consumers,” said Nykia Wright, interim executive director of NAR.

‘It has always been our goal to preserve consumer choice and protect our members to the greatest extent possible. This settlement achieves both of these goals,” she added.

Last year, NAR and a number of brokerages were found by a federal jury in Missouri to have conspired to force home sellers to pay higher fees.

In the US, rules set by the NAR mean that sellers pay between 5 and 6 percent commission – which is split equally between the buyer’s and seller’s agents.

Michael Ketchmark (pictured) was the lead attorney in the class action lawsuit filed against NAR in Missouri

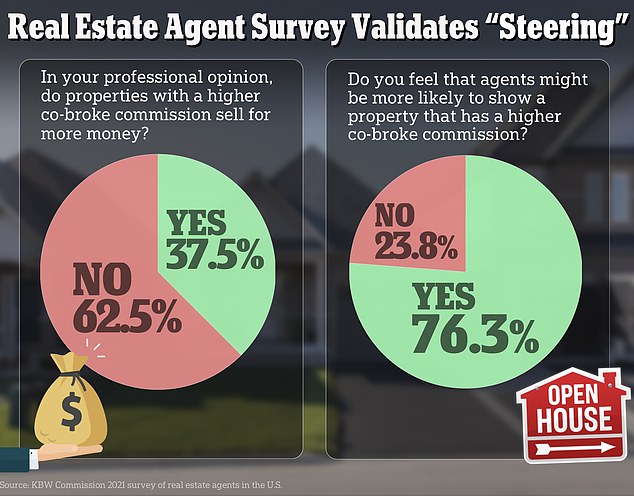

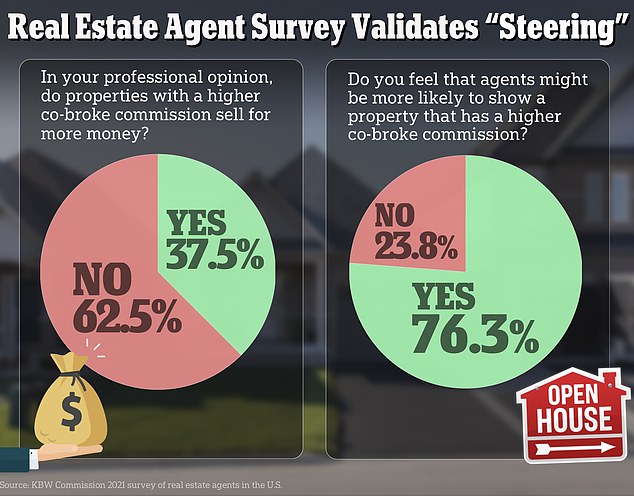

Plaintiffs argued that buyer’s agents were incentivized to steer their clients toward homes whose owners paid higher brokerage fees because they would then make more themselves.

Sellers were therefore incentivized to pay higher fees if they wanted their homes to be shown to potential buyers, the jury found.

In the wake of the Missouri ruling, a wave of ‘copycat’ lawsuits came across the country.

“The filing of copycat lawsuits across the country made it painfully clear that litigation would be enormously expensive,” Marty Green, principal of the law firm Polunsky Beitel Green, said in a statement about the settlement.

He suggested that changes thanks to the settlement would take time to take effect and that the mortgage guarantee could also be affected.

“I think we’re going to start seeing some creative buyer agent arrangements that may have been harder to get a hold of before,” he added. “However, these changes will not happen overnight, and I expect a certain amount of uncertainty in the coming months.”

NAR is the largest trade association in the United States, and only its dues-paying members may call themselves “brokers.” They are also the only ones with access to their proprietary databases of properties available for sale.

It is through these databases that agents indicate the amount of commission paid for the sale of a home.

While the changes will benefit sellers, they could also cause significant disruption to the livelihoods of NAR’s 1.6 million members.

Desirae Wykoff, 36, got her real estate license in 2015 and earned between $15,000 and $25,000 a year to supplement income from her full-time job

In recent years, obtaining a real estate license has become a popular sideline for Americans. In 2020 and 2021 — when the pandemic forced many out of work — a record 156,000 people became real estate agents, according to NAR.

“I feel real estate agents are getting an unfair reputation from this,” agent Desirae Wykoff, 36, told DailyMail.com after the Missouri ruling. ‘I could see a lot of these people hanging up their licences.’

Wykoff got her license in 2015 when her husband quit his job to start a new business, but it was slow to get off the ground.

When they divorced five years later, she became a single mother of three. She worked full-time at a local car dealership in Tulsa, Oklahoma, and brokered real estate deals on the side to supplement her income—usually an extra $15,000 to $25,000 a year.

‘When you are from the outside and look into this profession, it looks like easy money. It looks like you’re doing a little bit of work for a lot of money, but that’s not what it is at all,’ she told DailyMail.com.