Taxpayer-funded ‘guaranteed income’ programs are being rolled out across the country, giving struggling families up to $36,000 with no strings attached, a DailyMail.com analysis reveals.

The plans, whose total value exceeds $125 million, have grown in popularity since the pandemic. as progressive leaders accept cash donations to support Americans below the poverty line.

But the radical projects have come under fire after it emerged that a mother of three in Washington, DC, spent more than half of a $10,800 lump sum on a luxury vacation to Miami, along with a new wardrobe for her children and a ‘brightness’. For herself.

Canethia Miller, 27, spent $6,000 on vacation for herself, her partner and their three children, bought 15 new outfits for the children and spent $180 on a haircut. She was given the money through the country’s first project to offer money as a lump sum instead of monthly payments.

Similar programs in cities from Los Angeles to New York offer payments of up to $1,000 a month for three years with no conditions on how the cash is spent.

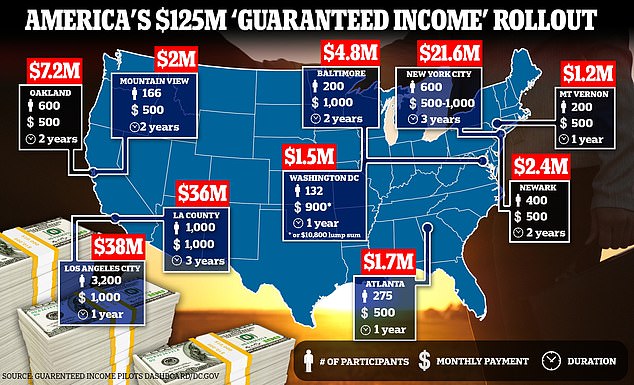

A map of some of the largest guaranteed income projects in the country shows that participants receive up to $1,000 a month for three years.

Canethia Miller, 27, spent more than half of a $10,800 lump sum on a luxury vacation to Miami, along with a new wardrobe for her children and a ‘shine’ for herself.

Erika James, 34, who also participated in the D.C. plan, opted for monthly payments of $900 and said she put the money in a savings account for her oldest son, De’Vire.

Eligibility criteria for many of the programs are based on the federal poverty level, a sliding scale based on income. For a single person, the poverty line is $15,060 or less, while for a family of four it is $31,200 or less.

Advocates and program leaders say guaranteed income projects have been shown to lift people out of poverty by helping them achieve financial stability and goals that include getting out of federally subsidized housing. Recipients have said the money has transformed their lives and has even taken some out of homelessness.

But critics say the plans “destroy fundamental elements of the social contract and create the wrong incentives for people.” They claim that cases like Miller’s show that offering money without conditions on how it is spent is not a solution to inequality.

Ongoing projects will deliver more than $125 million to nearly 10,000 Americans nationwide through more than 30 programs lasting up to three years, according to data published on the Guaranteed Income Pilots Dashboard.

Separate data from Stanford University’s Basic Income Lab revealed that at least 153 projects have taken place in the United States, including 68 that are “active.” But the data doesn’t include plans like DC’s, which cost about $1.5 million.

Most guaranteed income plans are funded with taxpayer money.

The largest and most expensive guaranteed income plan is the Big Leap program in Los Angeles, which provides 3,200 participants with $1,000 a month for a year.

The $36 million project was announced in October 2021 and is open to adult city residents who have at least one child, or are pregnant, and have incomes below the federal poverty level.

Like most other projects across the country, Big Leap is billed as a “pilot” that aims to study the impact of guaranteed, no-strings-attached income and qualified applicants are selected at random.

Los Angeles is also the location of the second largest plan, which pays $1,000 per month to 1,000 eligible Los Angeles County residents for three years. This is funded with about $36 million of taxpayer money.

The third largest, in New York City, provides 600 participants with between $500 and $1,000 a month for three years.

The Washington DC project is run by Martha’s Table, which delivers the booklets through its Strong Families, Strong Futures initiative. D.C. Mayor Muriel Bowser’s office recently committed another $1 million to execute the plan for a second year.

The DC program was funded by Democratic Mayor Muriel Bowser and is the only one in the U.S. to offer lump-sum cash.

Miller was one of 132 low-income new or pregnant mothers who could choose between 12 monthly payments of $900 or a one-time payment of $10,800.

She opted for the lump sum. After the year-long programme, she said: ‘I wanted to ruin it. “I wanted to have fun.”

The five-day Miami vacation included a boat tour that Miller said was a chance to show his children the city’s multimillion-dollar waterfront properties. The family also visited museums, took a swamp wildlife tour, and ate together during the trip.

“(My children) experienced something that I would never have been able to do if I didn’t have that money,” he told the Washington Post, which spoke with several participants in the program.

Miller said he spent $4,000 on bills and a used car, and opened a bank account in which he intends to keep at least $50.

The plan, like others across the country, also offered financial education courses, although they were not mandatory.

Miller acknowledged that many communities in his area ‘don’t know the financial benefit of credit, saving for children; That’s why we are ruined, that’s why we have nothing to inherit nor a house to give up.’

Other mothers who participated also spoke about the importance of financial education.

Stacie Adams, a mother of four who also received the lump sum, said: “(The courses were) not mandatory, but maybe they should have been.” Many people have not seen $10,000 and could have spent it immediately; Even me, who also has problems with finances.’

Los Angeles County’s BREATHE program, which provides $1,000 per month for three years, has shared promotional material from participants who spoke about the positive impact it had on their lives.

Darien, a single mother of five from Long Beach, said through tears, ‘Over the next few years I will understand.’ I can save and hopefully do the things with my kids that I always wanted to do.’

“I don’t get much help,” added Darién, whose last name was not provided. She said she was separated from her ex-husband and that she had been single for about three years.

‘When they chose me, you don’t know how happy I was. I was shocked. And then (my kids asked) ‘why are you crying?’ I thought, I believe that from this day on our life is going to change. It’s going to be different, you know?

“I told them that God answered our prayers and that we are going to get the help we need.”

Another mother, Jacqueline, also from Long Beach, said she was living with her 10-year-old daughter in her car when she was accepted into the BREATHE program.

‘We lived or slept in my car. There was no hope for us and I was just trying to survive,” she said.

Jacqueline, a participant in Los Angeles County’s BREATHE program, which provides $1,000 a month for three years, said the plan lifted her and her daughter out of homelessness.

Darien, a single mother of five from Long Beach who also participates in the BREATHE program, said through tears, “I can save and hopefully do the things with my kids that I always wanted to do.”

‘When I got that call, it was literally a month after I became homeless and we were already on the streets. “It gave me hope and it gave me something to look forward to.”

Jacqueline said the money was an “opportunity” and she plans to go back to school and then find work in the medical field, as well as making sure her daughter stays at her current school.

‘This program has given me the opportunity to live again. Be a mom and get back to normal, little by little.”

Many of the programs have shared the uplifting stories of families whose lives have been changed by the projects. Programs are often aimed specifically at mothers and young families, while others are open to any adult living below the poverty line.

But critics say cash handouts are a blunt tool that doesn’t address the underlying causes of poverty.

Oren Cass, executive director of the conservative think tank American Compass, said: “A permanent, society-wide system of providing for everyone would destroy fundamental elements of the social contract and create the wrong incentives for people when they make decisions about the course of life. his life”. ‘

Joel Griffith, economic researcher at The Heritage Foundation, added: “Too often, these donations actually trap people in a cycle of poverty. This doesn’t help people build long-term wealth or long-term economic prosperity.” term”.