A young woman was left devastated after losing $50,000 she had been saving for a deposit on a new house in a bank scam.

Julie Khoo, a Melbourne woman, responded to a call at work that she believed was from HSBC in October 2023.

Minutes later, two transactions drained a total of $50,000 from his account.

Mrs Khoo has been a loyal HSBC customer for more than 10 years and the heartbreaking scam occurred shortly after her father’s death just three months earlier.

In October 2023, Julie Khoo responded to a call at work that she believed was from HSBC’s fraud department.

Two transactions drained a total of $50,000, his daily transfer limit from his account.

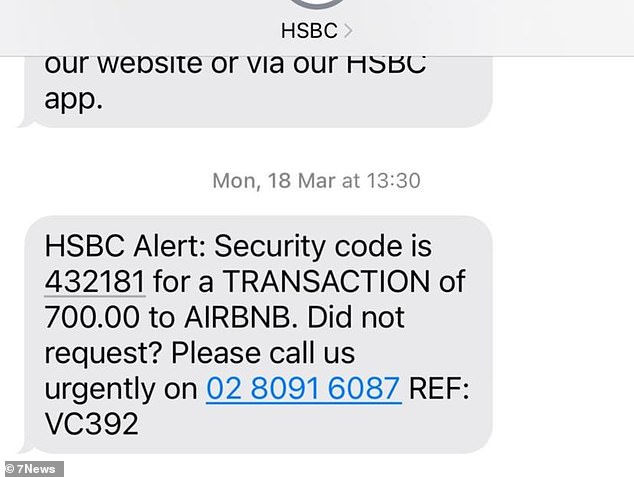

She said the “well-spoken” caller claimed he was from HSBC’s fraud team and was alerting her to suspicious activity on her account.

The scammer on the other end of the phone spent 30 minutes convincing her that the call was legitimate and providing details that only her bank would know.

Ms Khoo was asked for her password to prevent a fraudulent transaction, and the caller insisted they needed the information “right now”.

His daily transfer limit of $50,000 was then stolen from his account.

Khoo realized something was wrong when the caller asked for his credit card details.

He contacted HSBC in the hope that they would stop the transactions and provide him with some guidance.

“I knew the money was coming out of my account, but I didn’t know it was gone,” Khoo said. 7news.

“I really believed they could recover the funds.”

“They told me they would look into it, go to the branch the next day and report to the police.”

Khoo said the bank’s branch manager told her there was no need to file a police report, but she did so anyway.

She lashed out at the bank, saying she was disappointed by HSBC’s response.

Khoo said that six months after the scam, she has only been updated twice by email and is still waiting to get her money back.

After migrating to Australia from Malaysia in 2017 and now losing her deposit on a new house, Khoo said the scam left her shaken.

‘I couldn’t look at myself. I felt ashamed and ashamed,” she said.

“Now I review all my calls; My confidence is shattered.

A Facebook page has been created for victims of HSBC Australia scams where customers post their experiences and offer advice.

“We understand that being a victim of a scam is a stressful and distressing situation and we remain focused on doing everything we can to protect our customers,” HSBC said.

Unfortunately, Ms Khoo is one of many HSBC customers who fall victim to scammers.

A Facebook page has been created for victims of HSBC Australia scams where customers post their experiences and offer advice.

The Australian Competition and Consumer Commission (ACCC) has revealed that HSBC customers lost more than $6.3 million in a “phishing” text message scam in the eight months to March 2024.

WhatsNew2Day Australia has contacted HSBC for comment on Ms Khoo’s case.

In response, the bank said that due to For privacy reasons, they cannot discuss specific client situations.

“We understand that being a victim of a scam is a stressful and distressing situation and we remain focused on doing everything we can to protect our customers,” they said.

“Protecting our customers is our priority and we continue to improve existing initiatives and implement new ones, while playing our part in supporting the broader financial services industry on this issue.”

HSBC said it continues to educate its customers and will never ask them to provide PINs, passwords or verification codes in a phone call, in response to a text message or email.

Khoo says the bank is not doing enough to protect customers.

“Fraudsters targeted HSBC customers for a year because they could get away with it, and it is HSBC’s inaction that allowed this to continue,” he said.

‘This is not good enough.’