Table of Contents

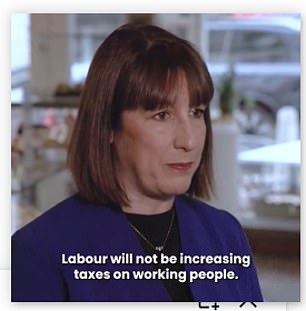

Taxes have become a hot issue in the election and the Conservatives want us to believe that Labor will increase your taxes by £2,000 a year.

The Conservatives, on the other hand, position themselves as the party of tax cuts.

The problem is that not only have the Conservatives been busy raising our taxes for some years now – even taking into account national insurance cuts – but after 14 years in power they have left Britain with an incoherent tax system .

Rishi Sunak, Jeremy Hunt, Keir Starmer and Rachel Reeves know this, but prefer to ignore it and score cheap points over who is going to cut or raise taxes.

Oh yes they will, oh no we won’t: the debate between Keir Starmer and Rishi Sunak descended into a Punch and Judy-style row over whether Labor would raise people’s taxes by £2,000.

This is nonsense because this General Election is the ideal time for both parties to promise to clean up the mess and start moving back on a better footing.

My fiscal manifesto would include ending the stealth tax raid, scrapping the 60 per cent income tax rate, reversing the tax raid on investors and savers and making some firm long-term pensions commitments.

Stealth tax

The freezing of income tax thresholds has combined with high inflation to create a major tax dragnet.

It is considered a stealth tax, but it has been done blatantly. People realized a long time ago and are angry, but we have the thresholds frozen until 2028.

Keeping the basic income tax threshold frozen drags more of people’s income into a 20 percent tax.

At the same time, stopping the point at which people pay 40 percent taxes has created a record number of higher-rate taxpayers.

The Institute for Fiscal Studies says this ‘colossal’ stealth tax raid will mean 8.9 million will pay 40 per cent tax by 2028. That compares with 3.2 million in 2010, when the Labor Party left power.

Tax thresholds should at least increase with inflation. This is essential for people to feel that the tax system is fair.

60% tax trap

We have a top marginal income tax rate of 60 percent, and it’s not for the highest earners.

This is due to the removal of personal allowance above £100.00: for every extra £1 earned, 50p is removed from the tax-free personal allowance. That turns the 40 percent income tax rate into 60 percent.

This is not collateral damage due to the interaction of two things, like eliminating child benefit or student loan payments. It is an integral part of the tax system and means that effective income tax rates rise to 20 per cent, 40 per cent and then 60 per cent between £100,000 and £125,140, before falling to 45 per cent above of that figure.

Clearly, this is a crazy way to structure a tax system. Meanwhile, the £100,000 threshold has not moved in the 15 years since it was introduced. If it had increased with inflation, it would be £153,000.

Those earning more than £100,000 earn a lot, but there is no reason to treat them unfairly. The removal of the personal allowance should be removed completely.

Hero or villain? Jeremy Hunt warns about tax rises on workers but conveniently ignores how, as Chancellor, he has been organizing tax raids.

Savings tax

The personal savings allowance was a welcome introduction which generated a tax-free amount of £1,000 towards savings interest. However, this was unnecessarily complicated by reducing it to just £500 for higher rate taxpayers and giving nothing to 45p taxpayers.

But again, this is an allocation that hasn’t changed in years. Meanwhile, inflation has soared and interest rates have risen, meaning many more savers have seen their interest caught in the tax net.

Through the rising cost of living, this meant not only that people saw their savings eroded by high inflation that savings rates couldn’t match, but things were made worse by taxes.

This is a clever tax raid on the returns on saved money that, in most cases, was probably taxed as income in the first place.

The personal savings allowance should increase substantially for everyone. I would win at least £5,000.

Reverse the tax raid on investors

If you thought Rishi Sunak and Jeremy Hunt’s tax threshold freeze was bad, wait until you see what they’ve done with the two key reliefs for investors.

Hunt has reduced capital gains tax relief from £12,300 to £6,000 and then to £3,000.

It has also reduced the dividend allocation from £2,000 to £1,000 and now just £500.

This is a direct attack on small investors. For the really rich, the additional tax on your capital gains or dividends is a drop in the ocean; For small investors and pensioners it is really important.

The Chancellor had the nerve to stand up and announce in his March budget the Tell Sid-style sale of shares in British Isa and NatWest, claiming he wanted to give investors a boost, while he got on with it.

It is time to reverse this fiscal incursion and increase allocations along with inflation.

Pensions: long-term clarity

“Pension policy is about long-term decisions…stability is desirable.”

These are the words of the Institute of Fiscal Studies, when discussing the possible return of the lifetime pension.

Mixed messages: Shadow chancellor Rache Reeves dismissed tax rise allegations but says she will bring back lifetime pension allowance

Jeremy Hunt removed this cap on the total value people’s pensions could reach before Jeremy Hunt removed high taxes in March 2023.

The lifetime allowance was introduced by Gordon Brown and was always problematic as it included both pension contributions and investment growth.

It was introduced by Brown in April 2006 for £1.5m and when Labor left power it was £1.8m.

The Conservatives managed to greatly aggravate the problem by cutting the lifetime allowance and it was left at just £1,073,000 when Hunt removed it.

That sounds like a lot, but at a standard withdrawal rate of 4 per cent on an invested pension, it’s £40,000 a year, less than the annual cost of a comfortable after-tax retirement of £43,100 from the PLSA.

After Hunt removed it, Rachel Reeves immediately said Labor would bring back the lifetime allowance, but has since refused to give any further details.

Will it go back to £1.07 million, the level Labor left it at, £1.8 million, or some other higher or lower figure?

This type of meddling and lack of clarity damages confidence in the pension system and raises fears of further tax raids. It’s depressing to read the comments on our articles encouraging pension saving, where so many readers say it’s pointless, that the government will only try to take it away.

We need the parties to give us a clear path forward for pensions – from tax relief to the lifetime allowance – and then commit to leaving everything as it is.

Restore faith in the tax system

These are just some of the many problems with our tax system and the problem in solving them is that there is no longer enough money coming in to cover the UK’s bills.

The UK has been borrowing to plug the cracks, but with interest payments on public debt considerably higher, this is not the cheap and easy option it once was.

Therefore we need to get more money from taxes, stop making costly promises like the triple lock on state pensions or boost growth. Obviously, the latter would be preferable for most of us, who already feel that our taxes are too high.

All parties must be honest with us about Britain’s finances and admit that without a major pick-up in growth, we should not cut major rates of income tax, national insurance or other major taxes.

But that doesn’t mean we can’t try to restore faith by fixing the underlying problem. We should start the next five years with a clean slate of simplified tax and relief.

We need to treat people fairly in tax matters as they will be happier to pay their fair share.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.