Table of Contents

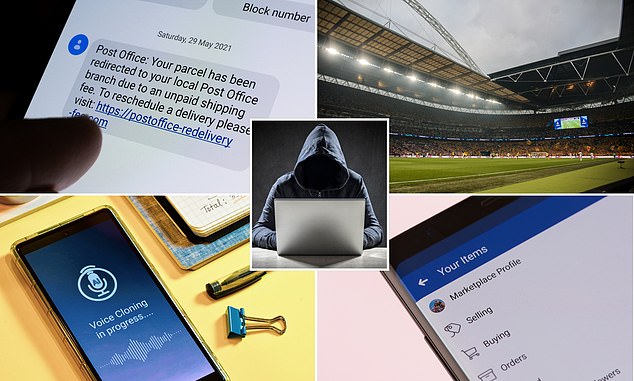

Fake package delivery text messages are the fastest growing scam of the year, a new study says. One in four adults were targeted by this type of scam in 2024.

Social media marketplace scams and AI-powered voice cloning scams were the other fastest-growing scams suffered by Brits this year, with 30 per cent of people reporting these types of scams.

Around 42 per cent of people have been targeted by a scam in the last 12 months, the NatWest study shows.

Criminals stole £570 million in the first half of 2024 through scams, with fraudsters targeting adults on average four and a half times a month.

Scam Watch: Fastest Growing Scams of 2024 Revealed. Fake Package Delivery Text Scams Growing Fastest

What are the fastest growing scams?

1. Fake Package Delivery Texts

Fake package delivery text messages were the fastest growing scam in 2024, affecting 30 per cent of people in the last 12 months, according to NatWest.

Fake package delivery text message scams involve scammers sending fake package delivery notifications, asking the recipient to click a link to reschedule delivery or pay a fee.

The link usually leads to a phishing site designed to steal personal information or install malware on the victim’s device.

2. Social media markets

Around 30 per cent of Britons were targeted by this type of scam over the past 12 months. They occur when criminals use social media platforms such as Facebook Marketplace, Instagram or TikTok to advertise and sell products that do not exist.

They create fake profiles to advertise popular and in-demand products (often using stolen photographs of real sellers) and list attractive offers to entice victims to make purchases.

Once payment is made, the promised goods never arrive and the fake account disappears.

3. AI voice cloning

This was the third fastest growing scam in 2024 and affected one in three people in the last year.

An AI voice cloning scam is a sophisticated type of scam in which scammers use voice cloning technology to replicate a person’s voice from a short snippet of audio.

Scammers can easily and cheaply capture and create deepfake audio online in just a few minutes.

Deepfakes are audio clips, videos and photographs that imitate a real person.

4. Request for money from a friend or family member

With this type of scam, scammers will pose as someone you know to urgently request money from you, often by phone, email or social media, to exploit your trust knowing that you will be more likely to send the money if you do. It’s for someone you know.

This type of scam was reported by 29 percent of people over the past 12 months.

5. Fake entries

Scammers sell fake or nonexistent tickets to popular events, such as concerts or sports games; Victims purchase tickets online or through social media, only to discover that the tickets are invalid or never arrive.

AI is helping scammers produce convincing music and sports ticket scams like never before. This is because scammers can now automate and streamline their processes, creating more convincing scams and a higher volume of them.

In the last 12 months, 28 per cent of Britons reported being targeted by fraudsters through ticket scams, according to NatWest.

6. The Cost of Living Assistance Ruse

Scammers exploit people’s financial vulnerabilities with this type of scam by offering bogus assistance programs, grants, or loans to help with living expenses, only to steal the money or use the information for identity theft.

7. Tax refund

Criminals will send fraudulent emails, make phone calls, or send text messages offering false tax refunds, either claiming that people are owed a refund or asking them to apply for one, with the goal of stealing personal information or money.

8. Refund scam

This type of scam occurs when scammers claim you are owed a refund in order to steal your personal or financial information.

They may contact you by phone, email, or text message, posing as a legitimate entity in order to trick you into revealing sensitive details or sending you money.

9. Celebrity deepfakes

Criminals create fake videos using artificial intelligence from celebrities or trusted brands, such as media outlets, to promote fraudulent schemes, such as investment opportunities.

NatWest found that 86 per cent of people are concerned that rapid advances in AI will give fraudsters new ways to scam people; and 59 percent of adults also say they believe identifying AI-based scams is becoming more difficult.

10. Get rich with quick investments

Get-rich-quick investment scams are fraudulent schemes that promise high returns with little risk or effort over a short period.

Scammers often use persuasive tactics and make up success stories to entice people to invest their money.

Stuart Skinner, fraud expert at NatWest, said: “Be wary of urgent messages or those requesting payments or to download an app – these will often contain spyware.” Or it could be the first step for criminals to contact you later to continue the scam in another way.

‘Are you looking at offers on social media? Do you really know who you are giving your payment details to when you click on an ad on a social media platform? Check back with friends or family for a second opinion.

‘If you receive a call that appears to be from a friend or family member asking for money or personal information, pause. Hang up and call them again at a number you know is legitimate. And remember, don’t trust the number that appears on your caller ID; scammers can fake that too.’

SAVE MONEY, MAKE MONEY

1% refund

1% refund

About debit card expenses. Maximum £15 per month*

4.05% 6 month solution

4.05% 6 month solution

Increase in interest rates at GB Bank

free share offer

free share offer

No account fee and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible Isa now accepting transfers

Sipp transfer offer

Sipp transfer offer

Get £100 to £2000 in cashback

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence. *Chase: Refund available during the first year. Exceptions apply. Over 18 years of age, resident in the United Kingdom.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.