Several young artists have revealed how a sudden rise in the market value of their works, followed by a dramatic fall, has led to financial setbacks.

The art market has experienced a slowdown in recent years, and this decline has particularly affected young artists.

During the pandemic, a boom fueled by a belief in quick returns led collectors to spend $712 million on works by artists born after 1974.

According to the New York Times, that represented a huge increase from the $259 million spent on the same type of artists the previous year.

With that sudden and dramatic increase, the price of these artists, now known in the industry as “ultra-contemporary,” plummeted by almost a third.

Amani Lewis put on shows in Paris and Miami, and used her newfound wealth to buy a Tesla and fund a new art studio.

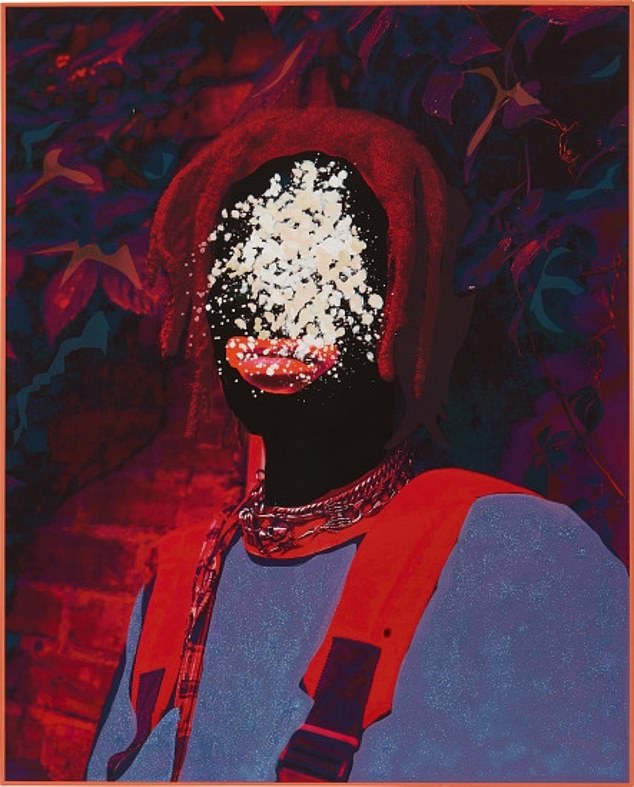

Seen here is Lewis’s ‘Into the Valley, the Boy Walks (Psalms 23:4)’. The painting sold for $107,100 in 2021 before resurfacing at auction in June and selling for $10,080.

One of those affected by this unfortunate fall was Amani Lewis, who rose to fame after selling her painting ‘Into the Valley, the Boy Walks (Psalms 23:4)’ for $107,100 in 2021.

The piece sold for more than double its estimated value, two other works tripled expectations and one collector paid $150,000 for pieces straight from his studio.

With her rise in popularity came exhibitions in Paris and Miami, which saw her move into a new art studio and purchase a Tesla.

Despite the sudden rise in market value, the painting reappeared at auction in June, selling for $10,080, 90 percent of its value.

The sale forced Lewis to give up renting a luxury apartment in Miami that cost $7,000 a month and move in temporarily with his brother.

Speaking to the Times, the 29-year-old said: “It was a really nice moment and then it went down. I felt like, “We’re done with Amani Lewis.”

He added: “There are things I should have done with the money I earned to protect myself from the current situation, but I didn’t.

‘I’ve lived in cars, I come from the neighbourhood’, before admitting that 2023, when the bubble burst, was ‘the hardest year of my life’

Isshaq Ismail had previously seen his cubist-style portraits sell for around $360,000, but amounts now being paid struggle to reach $20,000.

That same year, a collector sent him a message saying he was “distressed” about selling his paintings.

In a text seen by the outlet, he said: ‘I moved into a 120-year-old house that has some expensive issues and your painting is one of the few sellable things I have.’

Lewis replied, “If you want to renovate, take out a loan, brother,” and the work sold for $10,000 with fees, $2,500 more than the original payment.

While a painting by Ghanaian artist Emmanuel Taku, called ‘Sisters in Pink’, sold for $189,000 in 2021.

Like Lewis, Taku saw the price plummet after it went up for auction in March and sold for $10,160.

Meanwhile, several cubist-style portraits by Isshaq Ismail sold for around $367,000 two years ago, but have now gone for nowhere near $20,000.

Ismail said he regretted selling up to five works at a time to art consultants and collectors who would sell them quickly.

He told the outlet: “Everyone wants a piece of the pie,” adding that buyers contacted him via email or Instagram, making it difficult to differentiate.

Ghanaian artist Emmanuel Taku’s painting titled ‘Sisters in Pink’, seen here, sold for $189,000 in 2021

Emmanuel Taku, seen here, is reportedly planning a comeback and has clamped down on sales.

Brooklyn-based artist Allison Zuckerman has also felt the sharp decline in the market: Her painting “Woman with Her Pet” sold for $212,500 three years ago.

In June, the painting was put up for sale again and sold for just $20,160 at auction, once again demonstrating the volatility of the market.

Zuckerman was 27 and working out of his cramped apartment in the New York City borough when mega-collectors came knocking on his door.

Since 2021, his work has sold at auction 50 times, and Zuckerman told the Times: “It feels very out of body.”

He added: “‘Everything that was in that painting, the discoveries, the resolution of that corner, that brushstroke that really brought the whole thing together, is not what is being talked about.’

Despite the price drop for “Woman with Her Pet,” Zuckerman added that most of her paintings at a solo show in June sold for between $35,000 and $65,000.

Zuckerman said he wished he had been taught how to run a business, adding: “For me, graduate school was about finding my voice. I wish I had taken a business course.”

‘Woman with her Pet,’ seen here, sold for $212,500 three years ago before selling for just $20,160 in June.

Zuckerman, pictured here, was 27 and working out of his cramped apartment in the borough of New York when the mega-collectors came knocking.

Now, using his experience in the market, he said he is planning a series of paintings around the final check of his work.

Laurent Mercier, an art dealer who represents Emmanuel Taku, told the Times that what happened to Taku was “very sad and crazy.”

Mercier said his paintings had nearly 500 buyers on a waiting list and promised donations to the museum that would enhance Taku’s reputation.

In the following years, his works flooded the market and exceeded any type of demand, causing prices to collapse.

According to Mercier, he and Taku are now trying to slow sales to regain demand and “clean up the mess.”

He said: ‘People do not want to miss out on this opportunity and end up paying too much. Then the pendulum swings the other way and even at very low prices, few want to get in.

Experts believe the downward trend is continuing: sales of works by young artists have fallen by 39 percent in the past year.

Collectors had overestimated the strength of the market and, fearing that the work would become unsellable, sold it to at least recoup some of their money.

Record prices in 2021 triggered a surge in sellers who flooded an already fragile market.

Prices for artists’ works were subsequently raised, but in some cases they exceeded the limit, which discouraged buyers.

A dealer raised Lewis’s prices in 2022, but the artist’s exhibition failed to sell out, only adding to the tension.

Loring Randolph, director of the Nancy A. Nasher and David J. Haemisegger Art Collection in Dallas, told the outlet: “When prices get so inflated, everyone gets very excited and people tend to make a lot of mistakes.”

Randolph said buyers who felt they had paid too much are now “really pulling out.”

While Georgina Adam, author of two books on the contemporary art market, said that changes in taste previously dictated the rise of artists in the autumn, but now the cycles are shorter, which she believes is fuelled by speculation.

According to the Times, mMore than a third of Christie’s and Sotheby’s buyers in 2021 were new clients.

Adam added that they were perhaps more interested in making a profit than in becoming lifelong customers.