Table of Contents

A stock we should keep an eye on now?

BAE, valued at £38.2bn, is the UK’s biggest defence player and Europe’s biggest contractor. Its products include nuclear submarines, combat vehicles and the Harrier, Hawk and Typhoon aircraft.

Stocks have been boosted by the war in Ukraine and are set to come even further into the spotlight. There is growing pressure on Keir Starmer to set out a timetable for increasing UK defence spending to 2.5 per cent of GDP to counter the rising threat level. Nato figures show the current outlay is 2.3 per cent.

Tell me about BAE

It was born from mergers that brought together illustrious companies such as the British Aircraft Corporation, Hawker Siddeley and Marconi. But BAE, which sells to the United Kingdom, the United States and the AUKUS alliance (Australia, the United States and the United Kingdom), continues to innovate.

This year it bought Malloy Aeronautics, a British start-up that makes unmanned drones for logistics missions.

How have stocks performed?

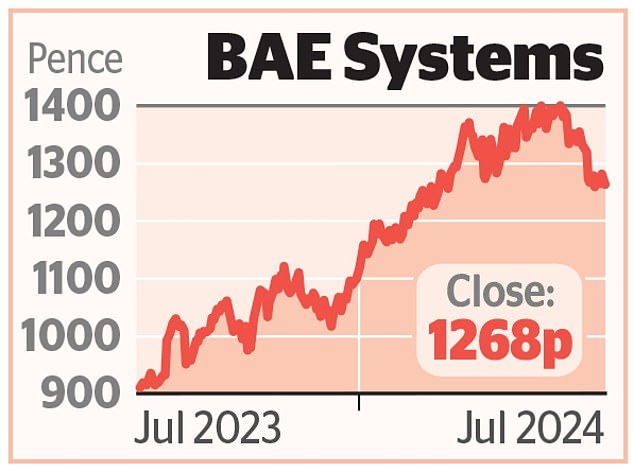

Before Russia invaded Ukraine in February 2022, they cost 599 pence. Now they are 1,268 pence, up 112 percent. Hamas’s attack on Israel last year contributed to that boost.

There has been a shift in the perception of advocacy actions. From being considered unethical, they are now seen as a means of defending democracy.

The Investment Association states: “Investing in defence companies contributes to our national security, upholds the civil liberties we enjoy, and at the same time generates long-term returns for pension funds and retail investors.”

So why did they dive?

There has been some weakness over the last four weeks.

This appears to be due to fears that populist policies in Europe could reduce defence budgets, on the basis that far-right politicians tend to be pro-Putin.

Another reason was the belief that ending the war in Ukraine (whenever that happens) would reduce spending in the United States, the United Kingdom and elsewhere, regardless of the politics of those nations’ leaders.

As a result, BAE and other European defence stocks are seen by some as overvalued. At the start of the war in Ukraine in 2022, BAE was trading at 13 times earnings. It now trades at a premium of 21 times.

Are these fears of overvaluation justified?

It is always reasonable to question the valuation of a stock whose price has soared 41% in the past year. However, the war in Ukraine has changed the way governments think about the long term.

Given the tensions in the Middle East and the increased potential for conflict elsewhere, budget cuts would be unlikely.

Saima Hussain of Alpha Value research group comments: “Geopolitical tensions continue to underpin the momentum of defence stocks.”

Most analysts agree and rate BAE as a “hold” or “buy.”

The average target price is 1,460p, but JP Morgan’s is 1,500p.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.