Charles White-Thomson, former chief executive of Saxo UK, says British citizens are bolder than our politicians when it comes to wanting a plan to get the UK back to growth; Here are your ideas to achieve it.

Charles White-Thomson says Britain must be bolder to get back on track

‘If you owe the bank $100, that’s your problem. “If you owe the bank $100 million, that’s the bank’s problem.”

Interesting advice from J. Paul Getty and a quote that UK leaders, regardless of tribe, should keep in mind.

As a reminder, the UK has borrowed £2.6 trillion, 98 per cent of annual GDP or £38,000 for each citizen, or as I like to call us, the shareholders.

In this line from Getty there is a glimpse of the approach or attitude we should learn from. There is a smell of independence, confidence and intention.

This confidence must be channeled into executing a bold growth plan that goes above and beyond and embraces risk.

Not the prevailing tug-of-war, born of fear that the all-seeing bond market, or the UK’s lenders, might become displeased and punish us, if we put forward a direct growth plan, rather than prioritizing the status quo.

The specter or memory of Truss and Kwarteng’s mini-Budget, and the subsequent collapse in bond yields, should not be used as the main reason to continue down the current and uninspiring path of simply “getting by”.

The uncomfortable truth is that many of the UK’s citizens have a greater ambition for the UK than debt holders or lenders.

In general, the bond market wants stability with regular and timely payments. They have less interest in growth plans that they perceive as higher risk.

On the contrary, many of the citizens want to see a plan for growth so that we can break the cycle of excessive debt, high taxes and lack of income or slow growth.

The UK finds itself in a financial straitjacket, which becomes tighter as the population ages and the longer we go without addressing imbalances.

It’s about unlocking the shackles of economics and all the benefits this offers, rather than prioritizing the uninspiring and uninspiring “very sensible” praise.

A bold, over-the-top plan could well cause some friction with bondholders and entities like the IMF. If this is the price of progress and achieving economic advances, so be it.

The goal is not to overemphasize these relationships, as we should support a “win, win” approach. The focus will be on keeping this friction in a manageable category, and this will require a careful combination of details, good communication and articulation of benefits.

This task has become more difficult after the Truss era, but not impossible.

As a precursor, it was interesting to hear the IMF’s chief economist, Pierre-Olivier Gourinchas, support the argument for status quo or no change, with a list of the UK’s commitments when answering a recent question about the viability of cuts in UK taxes.

Addressing groupthink will be part of this plan.

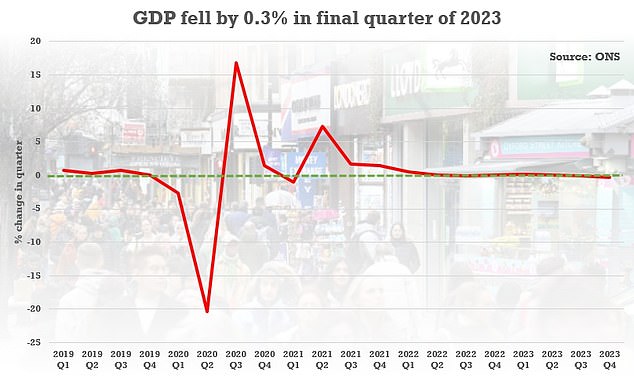

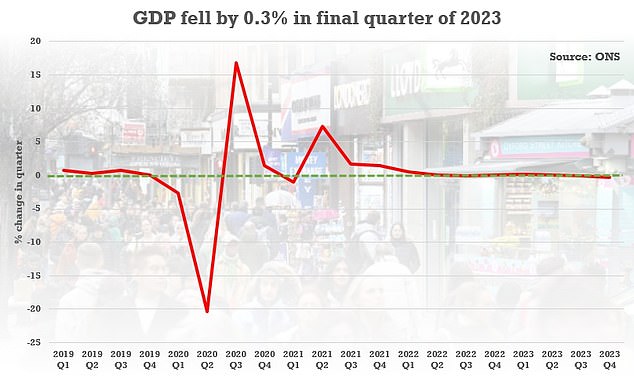

The economy fell a worse-than-expected 0.3 percent in the October-December quarter.

There is a risk, but if done right it is absolutely the right thing to do and the implications of not doing it are much worse. The disappointing negative fourth quarter GDP growth figure that saw Britain fall into a technical recession should focus even more attention.

This plan should deliver strong growth and include some spending cuts. We should not shy away from improving efficiency or how money is spent and this includes the benefits system.

The detail would include, among others:

- Take advantage of the economic benefits of being outside the European Union

- A gradual review of tax incentives and rates at corporate and personal level with the aim of making the UK a very attractive place to do business and live.

- A removal of specific bottlenecks or bureaucracy and the benefits of doing so: detailed measures to boost hard-to-explain productivity, including leveling up and improving access to finance outside London.

- Importantly, there will be a clear review of key areas of spending with planned cuts and, in some cases, increases.

This plan must then be shaped by focusing on the positive, knowing that it will be more aggressive, firmly presented, and rationally carefully articulated.

It will be important to ride out any short-term turbulence and keep an eye on the prize or benefits of growth.

My urgency is due to the fear that, in the absence of a meaningful growth plan, which breaks the cycle of slow growth, high taxes and excessive debt, we will continue to be good customers of the bond market and waste the advantages and benefits that come with a significant growth. and, worst of all, we betray the next generation, who will have to deal with this mess and ultimately pay for it.

It is also about the unwritten pact between one generation and the next: we strive to leave a place better than we found it and with greater opportunities. This will not be easy and will require courage.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.