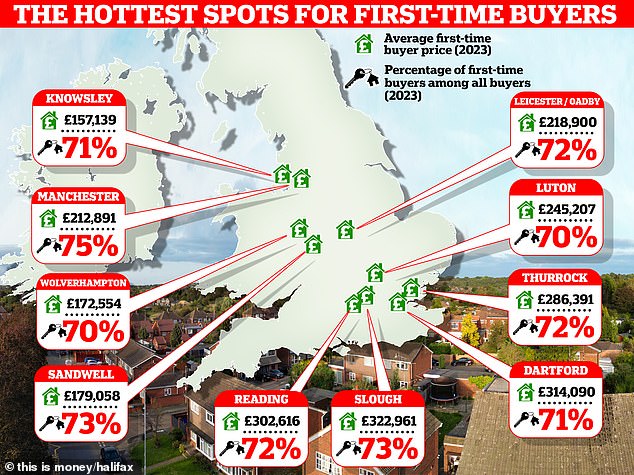

Manchester is now the most popular location for first-time home buyers outside London, research from Halifax has revealed.

The mortgage lender looked at areas of the country outside London where first-time buyers account for the largest proportion of home sales.

Nationally, first-time buyers accounted for 49 percent of all homes purchased with a mortgage last year, according to Halifax.

But in Manchester, Halifax found that first-time buyers accounted for three-quarters of all home purchases made with a mortgage.

>When will interest rates fall?

Point of interest: Manchester is now the most popular location in the country for first-time home buyers, outside of London

The city is known for its young and vibrant population, trendy bars, cafes and restaurants.

It has a student population of more than 100,000 people, of whom around half choose to stay in the city after graduating, according to one study – only London has a higher retention rate.

A strong job market, good transport links, a rich cultural scene and ongoing urban regeneration make it an attractive location for many first-time buyers.

The city has undergone something of a transformation over the past two decades, with large numbers of gleaming 30- to 60-storey apartment blocks now dominating the skyline, often equipped with swimming pools, gyms and underground parking.

But in addition to its appeal as a fun, trendy place to live, it also offers plenty of affordable housing, according to Halifax.

The average property price for first-time buyers in Manchester is £212,891, which is around £35,000 below the UK average.

The city also offers a choice between modern apartments in the city centre and traditional townhouses in suburban neighbourhoods, to suit different tastes and budgets.

Top 10: These are the places across the country with the highest proportion of first-time buyers

Manchester: The city has undergone a transformation over the past two decades, with a large number of gleaming 30- to 60-storey apartment blocks now dominating the skyline.

Nick Stanton, area support manager at Bridgfords estate agency in Manchester, said: ‘We’ve seen around a fifth more first-time buyers registering compared to last year, which is positive and it seems that any property coming onto the market ’empty’ is being occupied by a new owner.

‘Manchester has everything a first-time buyer could need. There are plenty of affordable apartments and houses readily available, and access to the city has never been easier and will continue to improve.

‘Manchester is a shining example of a vibrant, ambitious, multicultural and exciting city, and demand has never been greater.’

Manchester has also experienced significant economic growth and business investment in recent years, opening up new employment opportunities.

Andrew White, of commercial property firm Colliers, said: “We have seen many large corporations and government bodies move their headquarters to the city[Manchester]over the past five years, such as JP Morgan, Octopus Energy and Rolls Royce, which has naturally resulted in increased demand for housing and spurred significant house price growth in the city.”

Other hot spots for first-time buyers

Despite a housing market characterised in recent years by high property prices and higher borrowing costs, Halifax says first-time buyer hotspots are proving resilient, with a number of factors driving their popularity.

Slough is the second most popular location outside London for first-time buyers, accounting for 73 per cent of all properties purchased there.

In recent years there has been significant investment in city regeneration projects, including new residential, commercial and leisure developments.

Halifax says the combination of affordable prices, good transport links and employment makes Slough so popular.

The average property price in the city for first-time buyers is £322,961, around £75,000 above the UK average but still well below the average in nearby London (£490,235).

It has excellent rail links to London, including the Elizabeth Line, and is just 10 miles from Heathrow.

It is therefore an attractive option for professionals looking to commute and for growing families looking for more space outside the capital.

The city also has a strong jobs market. It is part of what is sometimes referred to as the “UK’s Silicon Valley” along the M4 corridor and is fast becoming a hub for large data centres attracting high-tech jobs to the area.

The third most popular location is Sandwell in the West Midlands, where first-time buyers also accounted for 73 per cent of all properties purchased with a mortgage last year.

Properties in Sandwell are significantly cheaper than the UK average, at £179,058, and also around £40,000 below the West Midlands average (£221,307).

This part of the Black Country is well connected by major road networks including the M5 and M6 motorways and with good rail links to Birmingham and Wolverhampton, making it an ideal location for commuters.

Sandwell is also another area that has seen significant economic regeneration and business investment in recent years.

The district also boasts 1,200 hectares of parks and green spaces, making it especially popular with young families.

Amanda Bryden, Head of Mortgages at Halifax, said: ‘First-time buyers are often more willing to move to new areas in search of finding the ideal home within their financial reach.

‘This flexibility opens up a wider range of possibilities and can lead to more affordable housing options.

‘Buying your own home remains one of the best long-term financial decisions you can make, and across the UK there are several locations that stand out for their appeal to first-time homebuyers.

‘Manchester in particular, with its diverse property styles and vibrant cultural scene, has become a magnet for those taking their first steps towards home ownership.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.