Table of Contents

- Investors weigh economic data to judge timing of interest rate cuts

The FTSE 100 has fallen from record highs reached in early May as investors have pushed back expectations about when central banks will start cutting interest rates.

Britain’s blue-chip index hit record highs several times in the space of a short period, hitting an intraday high of 8,474.71 on May 15, marking a 9.4 percent rise since the start of the year.

The index has fallen about 3 percent since then, derailing a rally fueled by a globally buoyant stock market amid the prospect of looming interest rate cuts.

Investors now expect the Bank of England to delay cutting rates until August, while the Federal Reserve is expected to begin cutting rates in September.

Why has the FTSE 100’s momentum faltered?

While stocks have performed reasonably well globally this year, a key driver of the UK market’s momentum heading into May was positive domestic economic data.

But a higher-than-expected inflation figure for April pushed back market expectations for the Bank of England’s first interest rate cut from June to the end of the summer.

The impending general election, although largely ignored by investors following its announcement, is also putting a lid on risk appetite in the UK.

However, the FTSE 100 is not alone among its global stock market peers in seeing its recent gains capped.

The main driver of this has been the focus on the Federal Reserve’s fight against US inflation, which continues to prove much tougher than expected, pushing back expectations about when the world’s most influential central bank will start cutting. rates to much later in the year.

The FTSE 100 hit record highs in mid-May but has fallen again since then.

Markets now expect the European Central Bank, followed by the Bank of England, to overtake the Federal Reserve in the race to cut rates first.

The US market’s exposure to investor enthusiasm for artificial intelligence is helping to maintain momentum in domestic stocks, but is having an impact on US Treasury yields, which is weighing on sentiment in others. places.

Sophie Lund-Yates, senior equity analyst at Hargreaves Lansdown, said: “Treasury yields have risen to four-week highs, following relatively cautious comments from the Federal Reserve on the interest rate cut cycle, that has affected market confidence.”

What could reignite the FTSE 100’s momentum?

All eyes will be on the Federal Reserve on Friday when it releases its preferred inflation gauge, the Personal Consumption Expenditures (PCE) Price Index.

Economists forecast headline and core PCE will remain at 2.7 and 2.8 percent, respectively, for April.

Anything below that figure would likely be welcomed by markets as it suggests inflation is returning to target levels and therefore the Federal Reserve may consider cutting interest rates.

But any figure much higher than expected would solidify the view that inflation could be accelerating, further delaying the Fed’s first rate cut (and potentially putting another rate hike back on the table).

This would likely be poorly received by investors, potentially driving up Treasury yields and further denting stock market sentiment.

Mark Haefele, chief investment officer at UBS Global Wealth Management, expects US inflation to continue to fall and Treasury yields to fall in turn.

He said: ‘We continue to believe US sovereign yields should end the year lower as inflation and economic growth slow and the Federal Reserve cuts rates in the final months of the year.

‘The Federal Reserve remains on track to ease its monetary policy later this year.

“With a weakening labor market and slower economic growth, we continue to expect the Federal Reserve to begin easing policy in September, with a total of 50 basis points of rate cuts this year.”

Hargreaves Lansdown’s Lund-Yates added: “The reality is that there is no immediate catalyst for the UK market to take heart and it will remain firmly in the hands of better macroeconomic news.”

“Rishi Sunak’s promise to cut interest rates if he wins the next election will not be a powerful enough prospect to lift spirits just yet.”

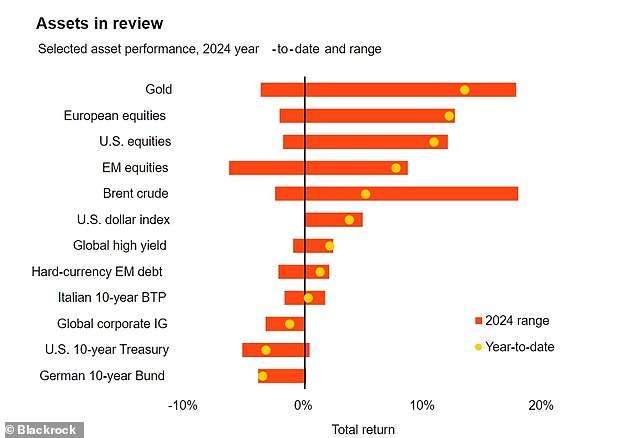

How have the different assets performed so far this year?