- The investigation reveals how much taxes weigh on residents in each state

- Unsurprisingly, New York came out on top with residents forced to pay 12.02%.

- Alaskans faced lowest tax burden of any U.S. state, data shows

As Americans suffer the highest costs of living in recent memory, rising taxes are only making the problem worse.

But residents face a ZIP code lottery over how much they are charged, with those in blue states faring worse than those in red states, new data shows.

A study conducted by a personal finance website WalletHub analyzed property, income, total sales and excise taxes in each US state to calculate which were the most “tax-burdened.”

Unsurprisingly, their findings showed that New Yorkers have the heaviest “tax burden,” as they are forced to shell out 12.02 percent of their income in taxes.

The Empire State was followed by Hawaii, where residents face a burden equal to 11.8 percent of their income.

Hover or hold your finger over the states below to see the income you need to live there comfortably.

The researchers defined “tax burden” as the proportion of total personal income that residents pay in state and local taxes.

Federal taxes were not included in the investigation, but instead focused only on state and local taxes. And it is not the actual tax rate set by states and cities.

Rather, tax burden measures the proportion of total personal income that residents pay in state and local taxes.

They found that Alaska had the lowest tax burden of all U.S. states, with citizens only paying 4.93 percent of their income in taxes.

New Hampshire, Wyoming and Florida followed, where residents face tax burdens of 5.63 percent, 5.7 percent and 6.05 percent respectively.

Property taxes were highest in Maine and lowest in Alabama, the report notes.

Meanwhile, if you look at just the individual income tax as a percentage of personal income, the highest percentage was recorded in California, at 4.9 percent, closely followed by New York. It was the lowest in Texas.

New York’s total of 12.02 percent is made up of 4.63 percent for income taxes, 4.36 percent for property taxes and 3.03 percent for sales taxes and consumption.

Commenting on the findings, WalletHub Analyst Cassandra Happe said: ‘It’s easy to feel dismayed at tax time when you see how much of your income you’re losing.

‘Living in a state with a low tax burden can alleviate some of that stress.

“Some states do not charge income or sales taxes, although all states have some type of property tax and excise taxes.”

The researchers ranked each state from one to 50, meaning New York came in at number one for having the highest burden.

The average ranking for a Democratic state was 20.08, but fell to 30.84 in Republican areas. WalletHub noted.

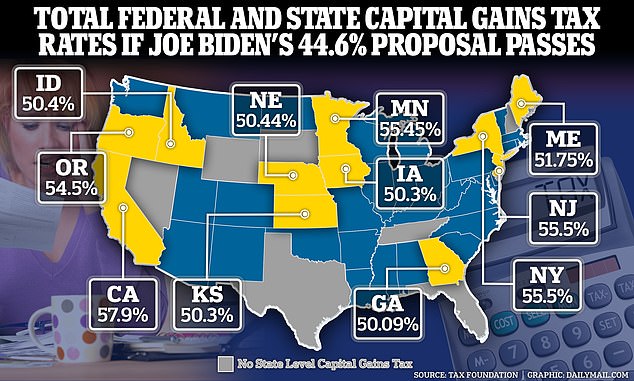

It comes after President Biden proposed raising the capital gains tax to 44.6 percent, the highest since the tax was implemented a century ago.

But the total owed when Americans sell assets, such as homes, will vary by state, because they all have rates in addition to federal ones.

It would mean Americans in 11 states next year will pay more than 50 percent of some of the profits when they sell their assets to the government.

If a 44.6% capital gains tax rate is included in the fiscal year 2025 budget, Americans in 11 states will be burdened by more than 50% when states and feds are combined when selling assets.

Biden proposed in his budget for next year the highest capital gains tax rate in history: 44.6%; the last highest was 40% during President Jimmy Carter’s administration in the late 1970s.

The current rate is below 25 percent.

Capital gains are gains made from the sale of assets such as stocks, businesses, homes, and other investments. The sale of these assets can typically trigger a taxable event.

Critics say the idea will “disincentivize investment” and could greatly harm American industries such as technology, while further shrinking the middle class.