Table of Contents

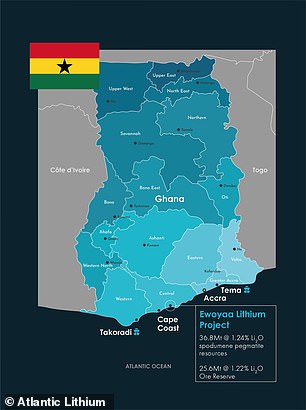

Atlantic’s Ewoyaa project will mark Ghana’s first lithium mine

Atlantic Lithium is tantalizingly close to starting construction on its flagship Ewoyaa lithium project in Ghana.

Mineral resource estimates at Ewoyaa received a boost in July and just this week, Atlantic secured an operating permit from the Ghana Minerals Commission.

This marks final regulatory approval before construction can begin at the Ewoyaa mine, paving the way towards a Final Investment Decision.

If all goes ahead, Ewoyaa will be Ghana’s first lithium project, complementing the West African nation’s thriving gold industry.

To be fair, this comes at a time of depressed lithium prices due to a global glut (which itself is due to reduced demand for EV batteries), but most analysts see a rebalancing by the supply side in the medium term.

If the reaction to the latest Atlantic Lithium developments is anything to go by, the market agrees: shares in the AIM-listed group are up 37 per cent this week.

The broader junior market was less optimistic, with the AIM All-Share index falling 0.7 per cent to 734 when it arrived on Friday.

Blue chips fared similarly, with the FTSE 100 index also down 0.7 per cent over the week.

The brunt of the losses were felt on Tuesday, when miners, Asia-focused stocks, homebuilders and oil companies weighed heavily due to the lack of expected new stimulus measures from the National Reform Commission and China Development Overnight.

Rosslyn Data Technologies It was one of the biggest failures of small cap companies. The data analytics group fell 50 percent on Wednesday in response to a cut-price stock offering and a potentially dilutive convertible debt deal.

The company also launched a retail offer aimed at raising an additional £250,000, which was successfully passed.

Inspirit Energy Holdings announced plans to become a cash cow and cease current operations following the departure of its design and development director.

“The board fully understands the employee’s personal position and is considering how best to support them during this time,” Inspirit said.

“This lead engineer is a key and critical member of the team, and the Board has concluded that leaving his employment at Inspirit will have a critical impact on the project.”

Shares duly fell 62 percent.

Centaur Media fell 24 percent after it sounded the earnings alarm citing current challenges in the marketing sector, driven by macroeconomic conditions for its woes.

These headwinds have led to reduced marketing budgets among blue-chip clients, impacting revenue and profits in the second half of 2024.

An interim business update from the cybersecurity software company Intercede Group plc failed to build trust. Even though the cash balance almost doubled compared to the first half of 2023 and revenue increased 22 percent, Intercede shares fell 20 percent.

Other weekly declines included CleanTech Lithium, which fell 20 percent, Blue Star Capital, which fell 27 percent, AFC Energy, which fell 17 percent and Conroy Gold and Natural Resources, which fell 27 percent after a raise of discounted funds.

Returning to the biggest promotions in the junior market, SEEN led the charge with a 54 percent rally following an interim trading update. The media and technology platform increased revenue by 19 percent and enjoyed a 60 percent improvement in gross profit.

Hercules Site Services rebounded 12 percent higher on Wednesday after announcing that its full-year profits will beat market expectations, thanks to strong growth in its core divisions in the UK infrastructure and construction sectors.

Hercules attributed its success to capitalizing on continued demand in its key markets, as well as securing £8 million in new investment, strengthening its financial position for future expansion.

digital box percent, the owner of Entertainment Daily, The Poke and TV Guide, added 21 percent compared to last Friday after revealing a potential sale of the business or other measures ‘with the objective of maximizing value for shareholders.’

The review process, led by the company’s independent non-executive directors, will conclude with an update at the end of November.

Finally, Zephyr energy saw an 8 percent rise Thursday after telling investors it decided to continue drilling an extended lateral on the State 36-2R well in Paradox Basin, Utah.

This was one of the anticipated possible courses of action and will see Zephyr significantly increase ultimate recoveries from the well.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.